The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Employment: “I love the people I work with.”

Employment in Central Oregon

Part 3 of our series highlighting the newest and best features of our recently upgraded website, Employment, is our “Website Wednesday” post this week. Read about our previously highlighted features.

Mid Oregon Credit Union has long been a highly sought-after employer in Central Oregon. Having branch offices from Madras in Jefferson County, to Prineville in Crook County, to Redmond, Bend (2) and our soon to open La Pine branches in Deschutes County, we provide employment opportunities covering most of the region. Being headquartered in Bend brings additional jobs of all kinds not common in the area. Our strong community involvement also allows our staff to give back through our efforts locally, which is important to many in Central Oregon today.

Information About Employment Online

Our recently upgraded website has a great resource for those interested in working at Mid Oregon. You can catch some of the spirit of the credit union in our staff’s brief testimonials. We place a strong emphasis on how well a person fits in our organization so we live up to our longtime emphasis on job and self-satisfaction, honesty and integrity and concern for people.

A list of benefits for employees working at Mid Oregon is shown as well. Medical, dental and vision insurance, and paid sick leave are some available for full time employees. For all employees we have a 401K plan, paid vacation and many other benefits.

Interested in Working for Mid Oregon?

Available positions are shown on the page. Corporate as well as branch positions are listed when there are openings. As we have been growing steadily over the past few years, checking back periodically is a good strategy for staying abreast of the latest opportunities. Currently we have two positions open, one for a part-time Contact Center member service representative and the other for a part-time teller at our Bend Olney Street branch.

If one is interested in applying, instructions are given on the page on how to do so. A downloadable and printable employment application is available, and along with a resume and a cover letter can be mailed, faxed or hand delivered to one of our branch locations.

Would you like to become a member of the Mid Oregon team, or know someone who would? If this sounds like a good fit, go to or share this page. We are interested in hearing from you!

Website Wednesday- Ten Mid Oregon Website Features:

-

- TBD

- TBD

- Employment: “I love the people I work with.”

- Preventing Fraud: CardNav by CO-OP

- Convenience and Accessibility: ATM Locations

- Protect Yourself: Security and Fraud Center

- Tools to Help You Manage Your Finances

- Helping you find the right car at the right price-AutoSmart

- Community Involvement- It’s Who We Are

- Financial Calculators

Mid Oregon Anniversary-58 Years

58 Years of People Helping People

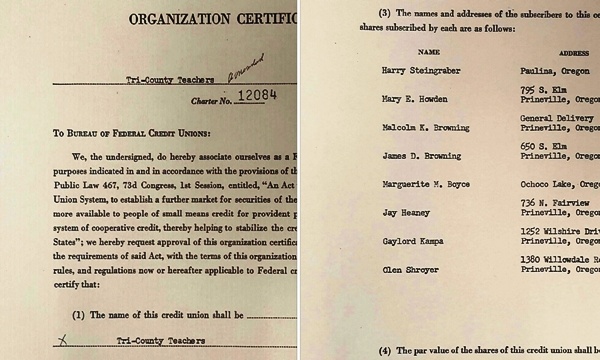

On November 22 of this year, Mid Oregon Credit Union will mark 58 years of helping people in Central Oregon meet their needs and achieve their dreams. Since eight Crook County school district employees signed the charter organization certificate on November 8, 1957 which was approved two weeks later, the credit union has grown from the original 8 members to almost 25,000 today. We are celebrating our Mid Oregon anniversary!

From the original credit union “office” in a home in Prineville, we have grown to six offices across Central Oregon, and are headquartered in Bend. Mid Oregon continues to expand and provide exceptional service, growing to assets worth over $215 million, while developing new and innovative product offerings that provides our members with financial tools necessary for their success.

An Exciting Year in 2015

In the past year we passed a few milestones and celebrated our Mid Oregon Anniversary. During the year, several exciting things happened to better serve our members and the community:

- We introduced CardNav almost a year ago, a new app for mobile devices by CO-OP, which adds another level of security to Mid Oregon debit cards by letting our members decide how and when they can be used. CardNav also provides alerts when any types of transactions you specify take place to help identify and stop potential fraud from happening.

- In March Mid Oregon received the national Dora Maxwell Social Responsibility Community Service Award Honorable Mention for our Pay it Forward initiative. In partnership with CoEnergy Propane and News Channel 21, Pay it Forward supports local people and projects that deserve recognition for doing good things in the community.

- Mid Oregon Credit Union and KTVZ kicked off a new community investment program called “One Class at a Time” in April, awarding $500 as the first of monthly classroom grants to help fulfill needs of area schools across Central Oregon.

- In May, Bill Anderson, President/CEO of Mid Oregon, announced assets exceeded $200 million for the first time since our establishment in 1957.

- In June, William R. Anderson celebrated 25 years of dedication and service as President and CEO of Mid Oregon Credit Union. When he came to the Credit Union in 1990, there were 10 employees, 5,975 members, one Bend location, and $19 million in assets.

- In August we unveiled a new website at www.MidOregon.com. A new and updated look, new features and a more user friendly site was launched to provide our members and those seeking financial information and about the credit union.

- We recognized two Mid Oregon staff members and longtime Central Oregon residents with well-deserved promotions. In the late summer & early fall, Tammy Gregory in Madras and Amanda Haessler in Prineville became branch managers, acknowledge their efforts in building community relations and growing branch and staff operations in their areas.

- On Thursday October 15th, we broke ground on a new Mid Oregon Credit Union branch in La Pine. Local officials, Mid Oregon’s Board of Director members, staff and invited community members gathered in the lot next to St. Vincent’s on Huntington Road in La Pine to break ground, and the branch is slated to open in the Spring of 2016.

Spirit of Original Credit Union Still Alive Today

Originally chartered in 1957 as “Tri-County Teachers Federal Credit Union”, the first field of membership included “Employees of the Public Schools who work in Crook, Deschutes and Jefferson Counties, Oregon; Employees of this credit union; members of their immediate families; and organizations of such persons.” Today, as Mid Oregon Credit Union, our field of membership includes more Central Oregon residents, but serves the same purpose. Bill Anderson, our President and CEO, said it well at the time of our 50th Anniversary in 2007:

“Mid Oregon was formed as a cooperative in 1957 to provide financial services for teachers who were underserved by mainstream financial institutions. As a result of a few teachers who banded together to help each other, today the Credit Union is available for all those who live, work, worship or go to school in Deschutes, Jefferson or Crook counties. The vision and spirit of that small group is still alive today.”

Thank you for helping us celebrate our Mid Oregon Anniversary!

Convenience and Accessibility: Mid Oregon ATM Locations

Mid Oregon’s ATM locations Web Page

Part 5 of our series highlighting the newest and best features of our recently upgraded website, Convenience and Accessibility: Mid Oregon ATM Locations, is our “Website Wednesday” post this week. Read about our previously highlighted features.

Did you know Mid Oregon Credit Union debit card holders have access to 38 ATMs (Automated Teller Machines) surcharge free in Central Oregon, and over 30,000 around the United States? Did you know that 9,000 of those ATMs accept deposits? If you didn’t, then www.MidOregon.com‘s webpage on ATM Locations will provide you with what you need to know.

The ATM Network

Mid Oregon is a participant in the CO-OP ATM network, which opens up tens of thousands of ATMs nationwide…all surcharge free for our members with debit cards. CO-OP is an organization that works behind the scenes to support credit unions by bringing them the latest financial services technology. Even though most will not have the name “Mid Oregon Credit Union”, these ATMs can be used to get cash in almost any city in the U.S. Most credit unions are participants in this network, including all those with offices in Central Oregon.

You might be surprised which other ATMs are part of the network. Some, like 7-Eleven stores, can be found across the country. Other locations may be in all retail locations in one area but not another. For example, ATMs in Rite Aid stores in Central Oregon are all part of the CO-OP network, but may not be in other places. That is why our web page offers convenient ways to find out, no matter where you are.

Using the Web Page

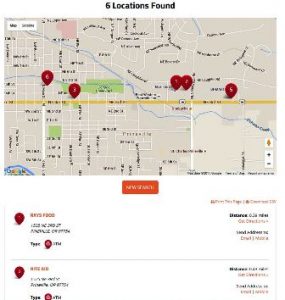

Mid Oregon’s ATM Locations page is simple and easy to navigate. Along with some general information about the ATM network, it offers two ways to find an ATM near where you are or will be going:

- Find an ATM. Simply enter the zip code where you hope to find an ATM and click find, and you will be directed to a page which shows ATM locations within a 25 mile radius of the zip code. It will show location name, address and a map of the area, including a satellite view if desired. By using the available generated links you can use Google Maps to easily obtain directions, or send the information to an email address or to your phone via text. Once on the ATM locator page, you have additional search options: by street address, city and state, find using advanced details, and more. You can also widen your search radius criteria, or search for an entire state. For example, an Oregon search returns 658 available network ATMs.

- Smartphone ATM Locator Apps. You can download the CO-OP Network ATM Locator to your smart phone. By clicking on the appropriate button, you can access Android or Apple Apps. You can also download directly on your phone by searching for CO-OP ATM in the Google Play Store or the Apple App store. These apps come in very handy during vacations, business travel or visiting family during the holiday season.

Central Oregon CO-OP ATMs

To give you an idea of the breadth of the locally available ATMs for Mid Oregon members, here is what a search revealed for local communities:

- Bend: 18 locations, including 7-Eleven stores, Rite Aid, and Costco.

- La Pine: 2 locations, including Shop Smart and Rays Food Place

- Madras: 3 ATMs, including Warm Springs Tribal Credit

- Prineville: 6 ATMs, including 7-Eleven, Rite Aid and Ray’s Food Place

- Redmond: 10 locations, including Rite Aid and 7-Eleven.

- Sisters: One ATM at Ray’s Food Place