The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

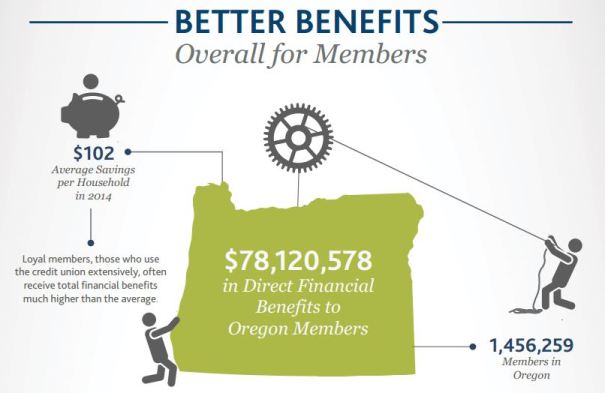

Benefits of Credit Union Membership

“Consumer Reports is out with the best and worst industries and companies for customer service”, reports CNBC in an article entitled “The best companies for customer service”. The results are based on surveys collected over three years. Industries are scored on a scale from zero to 100, with 100 being perfect customer service. According to the report gathered from all industries, “Credit unions ranked first scoring 90.”

A relationship with a credit union is all about membership, service, and loyalty. It’s about belonging to a not-for-profit financial service cooperative, with people helping people. It’s about creating value. As a member/owner, you enjoy unique benefits not available to customers of other financial institutions.

Learn how a credit union places the consumer’s interests above all else, particularly in returning financial benefits to their members. Attend a Free Workshop, “A Credit Union Can Make a Difference for You”, on Tuesday, February 23, 2016 at 6:00 p.m. The class will be held at Mid Oregon Credit Union’s East Bend branch, 1386 NE Cushing Drive, Bend. Presenting the class will be Wayne Hanson, Membership Development Manager at Mid Oregon Credit Union. Reserve your seat at beheard@midoregon.com, or call 541-382-1795. Refreshments will be served.

This introductory look inside the credit union is perfect for new members or anyone who just wants to know more about how they can effectively manage their finances.

2016 – Growing and Challenging our Team!

By Bill Anderson, Mid Oregon President/CEO

New Opportunities

We are excited to see the progress on our La Pine branch, the foundation is set and now the walls and roof are taking shape. We are planning to open in mid 2016 (Hopefully by June as weather and construction permits). In anticipation of the new location, we have been working on a charter expansion to provide access to our neighbors in North Klamath and Lake Counties. On January 7, 2016 we received approval from the National Credit Union Administration to expand the Mid Oregon charter to include Lake, Wheeler and North Klamath Counties.

This recent approval opens up new areas of opportunity and restores a historical relationship with Wheeler County, which was part of the charter from 1961 to 1998. We look forward to introducing ourselves in the new area and re-establishing our connections in Wheeler County.

Growing to Serve

Additionally, we are continuing to grow and add new staff, systems, technology and resources to serve our members efficiently and effectively. We are creating space for our growing commercial services and strategic partners as well as a potential new branch (To be announced at the Annual Meeting).

Accountability Leadership Training

Through all of this we continue to invest in our staff. We have implemented accountability leadership training and I am happy to report that nearly half of our team members have completed the certification training. The rest of our team is not far behind. You might even hear our staff speaking the new accountability language; seeing opportunities to improve member service, owning it, solving it, and doing it.

We are also implementing internal reporting to provide complete organizational visibility to keep us focused on our key growth metrics; making sure your credit union is performing well and providing us with the data we need to make adjustments along the way. The point of our efforts is to ensure that we continue to provide a safe and secure financial institution that is here to help meet your needs and achieve your dreams.

Thanks for your support!

Cash Still Popular?

Study Finds Cash Still Popular, But Differences In How It’s Used By Generation, Gender

From Credit Union Today, 2/1/2016

HOUSTON–Despite consumer access to a wide variety of payments methods, cash retains a prominent place in the consumer payments landscape.

But there are differences in how different generations use cash, a new survey has found—including a surprising finding about Millennials.

The survey from Cardtronics, Inc. has found that from paying people back to convenience store purchases to tipping, cash retains a prominent place in the consumer payments landscape. The Cardtronics survey included 1,000 U.S. adults in 2015.

“Cash is king for many consumers, even in today’s expanding universe of digital payment options,” said Tom Pierce, chief marketing officer, Cardtronics. “Our survey data clearly shows that in a competitive payments environment, cash is a predominant payment form and sits atop multiple spending categories.”

The survey asked, “What type of payment have you used in the past year for the following situations?” And the answers revealed that while consumers are using a mix of payment methods, time and again, cash is number one in a variety of scenarios, including:

Paying someone back – cash: 78%; runner-up, check at 18%

Convenience store purchases – cash: 63%; runner-up, debit at 41%

Snacks away from home – cash: 67%; runner-up, debit at 37%

Grocery Store – cash: 52%; runner-up, debit at 51%

Small business – cash: 49%; runner-up, credit at 43%

Restaurant – cash: 53%; runner-up, credit at 48%

Tipping – cash: 78%; runner-up, credit at 27%

In addition to identifying where and when cash continues to play a prominent role in consumer spending, the Cardtronics survey findings also provided insights into how different demographic groups use cash.

“There is a myth in the marketplace that Millennials have abandoned cash in favor of mobile and other digital payments. It’s simply not true. What we found exposed the myth, with Millennials embracing cash usage along with new payment methods. Millennials take an open-minded view of payments and cash plays a pivotal role in their payment choice mix,” added Pierce.

While more than half (57%) of Millennials reported using a greater variety of payment methods than before, nearly half (45%) of that group also said that they’re more likely to pay more with cash now than they did a few years ago. In fact, Millennials report increased cash usage at the greatest clip compared with all other survey respondents. Among all adults, 37% said their use of cash had increased. The survey also found that women are more likely than men (39% vs. 29%) to use cash to help stay on budget.