The Duck Race Goes On!

COVID-19 and State of Oregon distancing rules have limited or postponed many worthy fundraisers this year. With limits to large crowds, it may have meant there would be no Great Drake Park Duck Race this year. But thanks to the perseverance and ingenuity of local...

We’re All In! Virtual Big Day at Mid Oregon

To celebrate the re-activation of our checking promotion, our Mid Oregon branch teams created some fun pictures and videos! Under the theme of "We're All In! Our Virtual Big Day at Mid Oregon", they show their enthusiasm and excitement for serving our members....

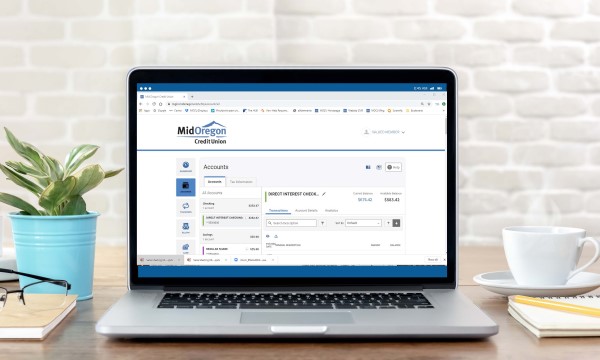

Our New Digital Banking Platform!

It has been a long time coming. The wheels have been in motion for over a year! But it is now here. We are excited to announce the launch of our new digital banking platform. Improved Member Service Experience The change to our new system was done for many reasons...