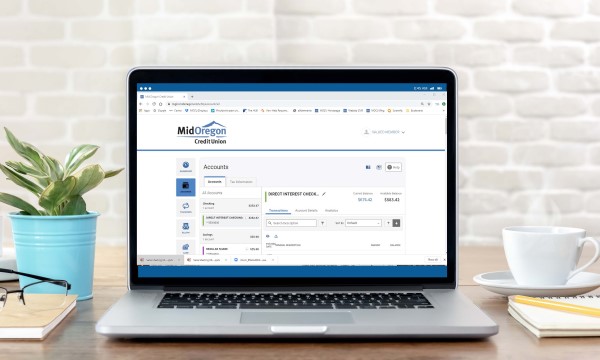

It has been a long time coming. The wheels have been in motion for over a year! But it is now here. We are excited to announce the launch of our new digital banking platform.

Improved Member Service Experience

The change to our new system was done for many reasons members will never see. Key factors were integration with other systems, security and more “behind the scenes” reasons. What seems to be please members the most, however, is the experience inside online banking.

“The new mobile/online banking system will vastly improve our member service experience,” says Kevin Cole, Executive VP/CFO. “In its first week of adoption, more than 75 percent of our online banking users logged in to the new system, which indicates how much our members are choosing to manage their money remotely. We are pleased to provide our members with the highest level of digital personal and business account management capability available in the market today to meet their increased need for remote services.”

Robust Features And More Control

The new system is seamlessly integrated, providing exceptional account management flexibility in desktop and mobile banking. Our new technology includes features such as:

• View all your accounts in one location, including external accounts

• Savings goals – set goals, track progress and set alerts

• Card management – block, unblock card access and alerts

• PayTo – send and receive funds to anyone with a phone number or email, with no fees

• Mobile deposit – deposit checks into your account right from your smartphone

• Credit Savvy – see, track and monitor your credit score, get tips on how to improve it, and receive offers based on qualifications

• Track your spending by category—even on non-Mid Oregon accounts!

• Personalized logins for multiple account users

• Full suite of enhanced features just for business users

The new digital banking system also includes all the current mobile/online conveniences of paying and tracking bills online, account transfers, alerts, and electronic statements, plus enhanced security to protect members from fraud.

Patience During The Transition

The transition was relatively easy for most of our members, and some experienced challenges. In spite of generally tripling our Contact Center team, and re-purposing other staff during the transition, factors led to long wait times for help for come. We apologize for their frustration, and thank them for their patience. The few days notice we had for stimulus check distribution and the Payment Protection Program loans didn’t allow time to make any changes and added to member inquiries. We are happy that members, when engaged in the new system, have been enjoyed the expanded capabilities they now have.

We hope they continue to explore the tools at their disposal, and improve their financial well being as a result.