How do you continue to maintain good credit? Your credit report acts as your financial references when you apply for any new credit. The only way to maintain a good credit history is to use credit wisely.

Tips for Building Credit

Following are 10 tried and true tips for building credit:

1. Create a spending plan and live within it. Credit should not be used to live beyond your means. Borrowing now means paying back from future earnings in that future budget.

2. Provide complete, accurate, and consistent identification on your credit applications. This information helps set up your credit history correctly from the beginning, ensures that your new accounts will be matched to the correct report, and minimizes the chance that your credit file will be incomplete.

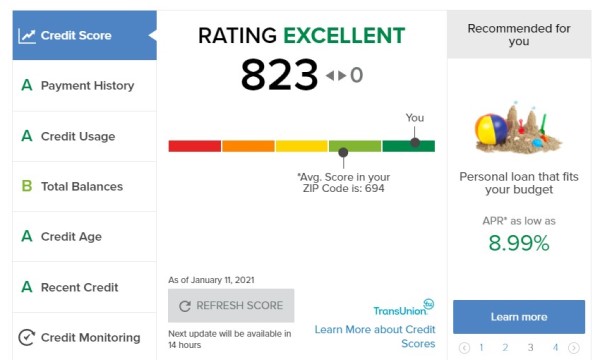

3. Pay your bills on time, all of the time. Late payments, called delinquencies, negatively affect your ability to get credit since they indicate a stronger likelihood that you will make late payments again or will be unable to pay your debts in the future. 35% of your credit score is determined by your payment history.

It Pays to Have Some Credit

4. Have some credit, but not too much. Having no credit history is almost as bad as having a negative credit history, and you only need a few accounts reported to the credit reporting companies to demonstrate credit management.

5. Have a mixture of credit types. It is good to have a history of repaying an installment loan, but a revolving account demonstrates more clearly that you can responsibly manage credit. 10% of your credit score is built on the types of credit you currently have in use.

6. Keep credit card balances low. Keeping your balances low compared with credit limits shows that you aren’t tempted to charge more than you can pay. By charging a small amount on at least one card and paying the balance on time, you will show that you can handle larger amounts of available credit.

Closing Credit Accounts Isn’t Always Good

7. Use caution when closing accounts. Closing an account isn’t always a good thing. It can result in an increase to your balance-to-limit ratio, making you appear to be an increased credit risk. Another key factor of your credit score is how much of your capacity are you using? Closing accounts will reduce your capacity by the amount of the credit limit closed. 30% of your score is dependent upon using a little, but not all of your potential borrowing capacity.

8. Be aware of your debt-to-income ratio. Mortgage lenders consider your monthly payments compared with your monthly income. As a practical matter, higher levels of debt compared to income increases stress.

9. Demonstrate stability. Some creditors consider your length of employment, length of residence, whether you own or rent, and if you have any savings in making credit decisions.

10. Contact your lenders if you fall behind on your payments. Many lenders will work with you to set up a different payment schedule or interest rate. Whatever you do, keep the channels of communication open.

How To Get Your Credit Report

You can order your credit report free. Each year, you can request one credit report from each of the major credit bureaus without charge. In some situations you can request them more frequently. To learn more, and order, visit www.annualcreditreport.com.

Getting and maintaining a good credit score takes consistent effort. It’s well worth it, and will pay benefits for a lifetime.