Your credit score is a significant gauge to your financial wellbeing. Understanding why your credit score is important will help you use your credit wisely, and as a helpful financial tool (Read Why Your Credit Score is Important article). Knowing what makes up your credit score is the key to improving a poor score, or to start out using credit better.

What Makes Up Your Credit Score?

FICO® credit scores are calculated from many different pieces of data in your credit report. This data is grouped into five categories shown below. The percentages reflect how important each of the categories is in determining how your FICO® Score is calculated. The number generated is how your credit situation is in relation to these factors, and that number will be between 350 and 850.

Payment history- 35%: “Do you pay your bills on time?”. On time payments will raise this factor, while missed payments and defaults will lower your score. This is the most important contributor, and one you can best control.

Amounts owed to creditors-30%: “Do you owe a lot of money to a lot of people?” Owing money on credit accounts doesn’t necessarily mean a problem, but using most or all of your credit limits could be a sign of problems, and the formula treats it accordingly.

Length of credit history-15%: “How established is your credit history?” In general, a longer credit history will increase your score. The age of your oldest open account, the average age of all accounts, and how long it has been since you’ve used your accounts are factors.

New credit-10%: Are you increasing your debt obligations? Borrowers opening several new accounts in a short period of time has shown to be a bigger risk to lenders.

Types of credit currently in use-10%: “Do you have a ‘healthy mix’?” Your balance of credit cards, installment loans, retail accounts, and mortgage loans are considered by the formula. It’s not necessary to have all types of credit, but a healthy mix is good (For example, only having credit cards is not a good balance).

FICO Scores Are Unique to You

The importance of credit categories varies by person. Your FICO® Scores are unique, like people are unique. They are calculated based on the five categories referenced above, but according to FICO®: “…for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.”

Over time, the information in your credit report will change. As they do, so does the evaluation of these factors in determining your FICO® Score.

According to FICO®, “Your credit report and FICO® Scores will evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO® Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO® Scores chart are for the general population and may be different for different credit profiles.”

How To Find Out Your Score

So how do you know what is going on with your score? You can order your credit report at AnnualCreditReport.com. That will show the factors which go into your score. You can get your score from FICO® (myfico.com), for a price. There are some websites which can give you a credit score based on your FICO score, like Credit Karma.

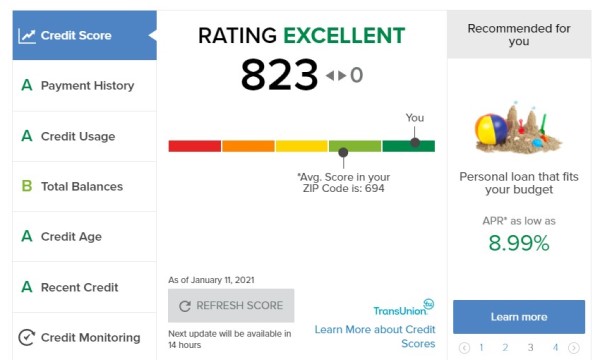

But your best and easiest access to your credit score might be Mid Oregon Credit Union. Our members can check their credit score for free with Credit Savvy, inside our easy-to-access Digital Banking platform.

In addition to your score, Credit Savvy will provide the individual breakdown of the 5 categories. Included is how well you are doing in that category, what is impacting that category, and suggestions to improve. You can also see information which makes up your credit report, access offers from the credit union, and see articles in “Your Money Blog”.

Let us help you manage or improve your credit score. Visit MidOregon.com, or visit one of our Central Oregon branches to get started.