Your Credit Report Matters

Credit reports contain your personal financial information. Incorrect information can affect your ability to get a loan, rent housing, or get a job because businesses often make their decisions based on that data.

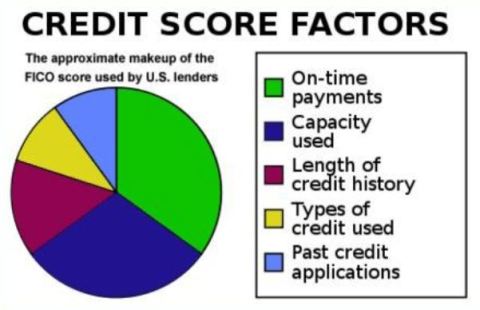

Lenders use credit reports to determine the interest rates on loans; the more creditworthy you appear on paper, the lower the rate you pay. Errors may cause you to pay more.

Many people are surprised to learn that a potential employer turned them down for a job because of negative information on their credit report. Federal law, however, requires that the employer get your permission before pulling your report.

To keep your reports accurate:

Order Your Credit Report

* The Fair Credit Reporting Act requires each of the “big three” credit reporting agencies—Experian, Equifax, and TransUnion—to provide you with one free copy of your credit report, at your request, once every 12 months. Visit annualcreditreport.com to order yours. Watch out for so-called deals that you may not need.

* Check the basics first. Check variations in name, Social Security number, and address. Experian lists all variations reported to it to ensure the consumer has a full account of the identifying information reported and can act on it. Often, variations are simply the use of a nickname or a transposed address digit.

* Verify data. Some can get complicated. If a loan is sold, the lender listed may not be the original.

Get Errors Corrected

* Look for errors. A study by the Federal Trade Commission and another by Policy and Economic Research Council (PERC) revealed similar results: one of five consumers reportedly found errors on their credit reports which could negatively impact their credit score.

When counselors at credit counseling agencies review reports with clients, they often find that the unfavorable information is valid. But when it is in error, it’s important to start the correction process right away.

* Dispute errors. Contact the company that has provided the incorrect information and the credit reporting agency in writing and keep copies. Work with both the source of the information and the credit reporting company to resolve the issue quickly.

We Can Help

Talk to your local Mid Oregon Credit Union Loan Officer, or call us at (541) 382-1795. We can provide some general information, and possibly discuss your report. We can only pull your credit report if you are a member, but if you are not a member, you can bring your own and we would be happy to discuss it with you.