For the first 4 of ten things you can do avoid the credit blues. To improve your credit score, read this prior post, Credit Blues? Things You Can Do To Improve! (Part 1).

What can you do to improve your score?

The Federal Trade Commission (FTC), on their Consumer Information webpage on “Credit Scores”, provides this informative recap:

Credit scoring systems are complex and vary among creditors or insurance companies and for different types of credit or insurance. If one factor changes, your score may change — but improvement generally depends on how that factor relates to others the system considers. Only the business using the system knows what might improve your score under the particular model they use to evaluate your application.

FTC Credit Report & Credit Score Information

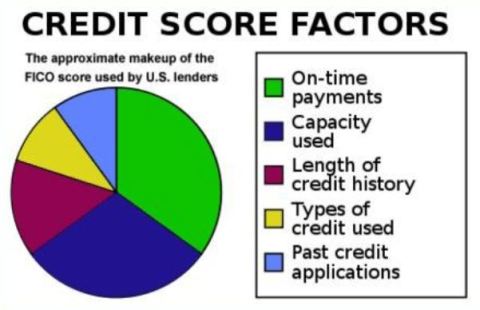

Nevertheless, scoring models usually consider the following types of information in your credit report to help compute your credit score:

-

- Have you paid your bills on time?You can count on payment history to be a significant factor. If your credit report indicates that you have paid bills late, had an account referred to collections, or declared bankruptcy, it is likely to affect your score negatively.

- Are you maxed out?Many scoring systems evaluate the amount of debt you have compared to your credit limits. If the amount you owe is close to your credit limit, it’s likely to have a negative effect on your score.

- How long have you had credit?Generally, scoring systems consider your credit track record. An insufficient credit history may affect your score negatively, but factors like timely payments and low balances can offset that.

- Have you applied for new credit lately?Many scoring systems consider whether you have applied for credit recently by looking at “inquiries” on your credit report. If you have applied for too many new accounts recently, it could have a negative effect on your score. Every inquiry isn’t counted: for example, inquiries by creditors who are monitoring your account or looking at credit reports to make “prescreened” credit offers are not considered liabilities.

- How many credit accounts do you have and what kinds of accounts are they?Although it is generally considered a plus to have established credit accounts, too many credit card accounts may have a negative effect on your score. In addition, many scoring systems consider the type of credit accounts you have. For example, under some scoring models, loans from finance companies may have a negative effect on your credit score.

Scoring models may be based on more than the information in your credit report. When you are applying for a mortgage loan, for example, the system may consider the amount of your down payment, your total debt, and your income, among other things.

-

Here are the last 6 of 10 things you can do to improve your credit score:

- 5. Use credit cards—but manage them responsibly. In general, having credit cards and installment loans that you pay on time will raise your score. Someone who has no credit cards tends to have a lower score than someone who has already proven that he can manage credit cards responsibly. Mid Oregon has low cost credit cards with no cash advance fees and no balance transfer fees.

- 6. Don’t open multiple accounts too quickly, especially if you have a short credit history. This can look risky because you are taking on a lot of possible debt. New accounts will also lower the average age of your existing accounts which is something that your credit score also considers.

- 7. Don’t close an account to remove it from your record. A closed account will still show up on your credit report. In fact, closing accounts can sometimes hurt your score unless you also pay down your debt at the same time.8. Shop for a loan within a focused period of time. Credit scores distinguish between a search for a single loan and a search for many new credit lines, based in part on the length of time over which recent requests for credit occur.

9. Don’t open new credit card accounts you don’t need. This approach could backfire and actually lower your score.

10. Contact your creditors or see a legitimate credit counselor if you’re having financial difficulties. This won’t improve your score immediately, but the sooner you begin managing your credit well and making timely payments, the sooner your score will get better.These ideas won’t create a dramatic improvement in your credit score overnight, but over time, they will. Remember, it takes time to develop a strong profile. Once you’ve done it, you’ll find it easier to apply for credit and favorable interest rates.Talk to us to find potential tips and solutions. We are only a short trip (visit one of our 7 Central Oregon branches), a quick email or a short phone call away.((541) 382-1795).