The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Don’t Get Schooled by Scammers.

There are so many scams out there preying on us these days, and many of them are targeting our online shopping. Now that it’s back to school time, if you’re shopping for supplies, returning items online, or just participating in some online retail therapy regardless of the time of year, here are a few tips to help identify fraudulent shopping websites and how to avoid giving up your personal information, whether it’s your payment card details, your address, or any other bit of PII that a cybercriminal may find useful.

- Check the URL of the website before doing anything. It’s best to do this before clicking any ads or links. Hover over it with your mouse or hold your finger down for a few seconds to reveal the link. If it’s really long, full of junk, or doesn’t make sense at all, don’t click it. It may be legit, but better to err on the side of caution.

- If a shop you’ve never heard of catches your eye, do some additional investigation. See if the goods are sold elsewhere and check reviews. If you can’t find much, that may be a clue to move on.

- If you’re already shopping on a site and popups keep appearing asking for payment details WHILE you’re shopping, that could be an indicator of a fake. Additionally, if it says your payment was declined when you don’t expect it to be, don’t re-enter another card. Contact your financial institution and make sure they didn’t block it. There is a scam that performs just this trick.

- Zoom in and check the images. If they’re blurry, you could be looking at a phony site.

- If the customer service link is a link to nowhere, don’t trust it.

Keep in mind that when you’re online shopping, criminals are shopping for your payment card and other information. Stay ahead of them by checking and rechecking the websites you’re shopping on and don’t let them start your school year off with a failing grade!

Want to know more? Read additional Mid Oregon blog articles about online security and fraud protection.

By: Jim Stickley and Tina Davis

August 3, 2025

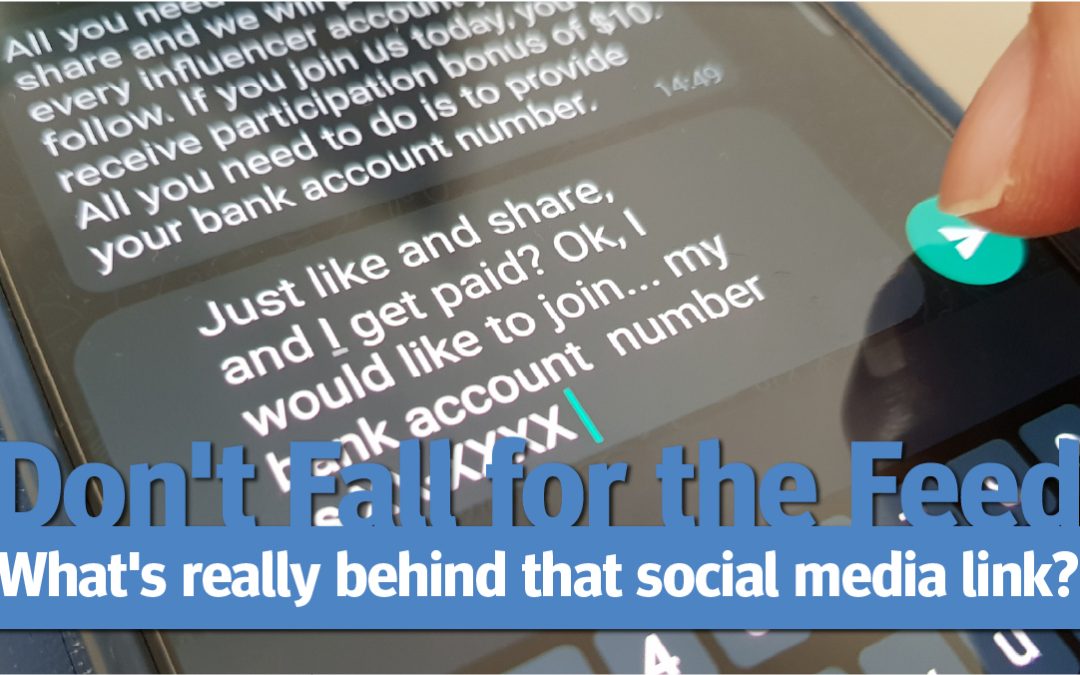

Don’t Fall for the Feed: What’s really behind that social media link?

Social media platforms are fantastic for connecting, sharing, and discovering. However, they’ve also become fertile ground for scammers. From tantalizing fake giveaways to alarming account takeovers, and even seemingly innocent clickbait, social media scams are designed to trick you. Staying informed is your best defense against these digital traps.

Five Key Points on Social Media Scams:

- Fake Giveaways & Contests: Scammers promote enticing “too good to be true” giveaways (e.g., free vacations, electronics, cash) from seemingly legitimate brands or influencers. They often ask for personal information, a small “fee,” or for you to share the scam to enter.

- Account Takeovers & Impersonation: A scammer gains control of a friend’s or family member’s account, then messages you asking for urgent financial help, gift cards, or personal information. They exploit your trust in the “friend.”

- Clickbait to Malicious Websites: Innocent-looking posts with sensational headlines (e.g., “You won’t believe what happened next!”) lead to websites riddled with malware, phishing forms, or unwanted subscriptions.

- Phishing Attempts: Direct messages or posts designed to trick you into revealing sensitive information like passwords, credit card numbers, or social security numbers by impersonating a legitimate service or offering a false sense of urgency.

- Romance Scams: Scammers create fake profiles to build emotional relationships with targets, eventually asking for money for fabricated emergencies, travel, or investments.

How to Protect Yourself:

- Verify Everything: Before clicking any link or responding to an offer, verify its legitimacy. Look for official company pages (blue checkmarks), check URLs carefully, and search for the offer on the company’s official website.

- Be Skeptical of “Too Good to Be True”: If an offer, prize, or request seems too good or too urgent, it’s likely a scam. Scammers thrive on excitement and fear.

- Secure Your Accounts: Use strong, unique passwords for all social media accounts, and enable two-factor authentication (2FA) whenever possible. This adds an extra layer of security.

- Guard Personal Information: Never share sensitive personal or financial information (passwords, bank details, SSN) via social media messages, even if the request seems to come from a friend. Call them directly to confirm.

- Think Before You Click: Hover over links before clicking to see the actual URL. If it looks suspicious or redirects multiple times, avoid it.

What to Do If You Fall Victim:

- Act Immediately: The sooner you act, the better your chances of mitigating damage.

- Change Passwords: Immediately change passwords for the compromised social media account and any other accounts that use the same password.

- Notify Your Bank/Credit Card Company: If you shared financial information or made unauthorized payments, contact your bank and credit card companies to report fraudulent activity.

- Report the Scam:

- To the Social Media Platform: Use the platform’s built-in reporting tools for fake accounts, suspicious posts, or scams.

- To Authorities: File a report with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. For internet crimes, report to the FBI’s Internet Crime Complaint Center (IC3) at IC3.gov.

- Warn Your Network: If your account was taken over, inform your friends and family through other channels (phone, email) so they don’t fall for messages sent from your compromised account.

By staying vigilant and informed, you can enjoy the benefits of social media while protecting yourself from the ever-evolving tactics of online scammers.

Want to know more? Read additional Mid Oregon blog articles about online security and fraud protection.

Reading, Writing & Money: how to save on back-to-school

Families are starting back-to-school shopping earlier this year. According to the National Retail Federation (NRF), about 70% of families have already started, up from 55% last year. Starting early can help avoid last-minute chaos, and gives you time for shopping around for the best deals and maximizing credit card rewards. Additionally, starting early can give you time to plan and keep your spending within budget.

Why Start So Early?

With tariffs and inflation are still on many people’s minds, most parents want to lock in prices before they rise. The NRF found that 51% of families stated that worries about rising costs were what motivated them to head out earlier for back-to-school supplies. Getting out early also gives you the opportunity to spread the cost of big dollar items over time and can help alleviate stress from crowds, and last-minute shopping.

Being cautious and strategic with your back-to-school spending can help you stay ahead of any surprises and avoid future higher prices.

How To Save

Back-to-school shopping can be a chore, especially when the kids start loading the cart with pens, backpacks, clothes and maybe even a new electronic device. Try these simple tips to stretch your dollar this season:

- Use your rewards. When checking out, use your Mid Oregon Everyday Rewards VISA® and take advantage of the cash-back that offers you extra points in categories like fuel and groceries. Don’t have a Mid Oregon Everyday Rewards VISA®? Apply today!

- Stack coupons, promo codes and sales. Combine manufacturer coupons with in-store discounts, online promo codes and cash-back platforms.

- Take advantage of loyalty programs. Stores often provide exclusive coupons, early access to sales or points that can be redeemed for future purchases. These perks can add up over time at places you frequently shop and help stretch your budget further.

- Use store apps. Many retailers have digital coupons and alerts for flash sales that you won’t find in flyers or emails. The Fred Meyer app offers digital coupons and flash sale alerts, and Walmart’s app also works the same way, helping you score exclusive coupons and early access to deals.

- Track your spending and budget. Loading up with “extra” items in your cart is easy to do during sales when heaps of items are sitting in front of you. Plan what your kids need, make a budget and stick to it by tracking expenses as you shop. Using Mid Oregon’s Digital Banking, Financial Wellness widget can help you easily track your spending and set goals.

Out of these tips, using the right credit card can be key in maximizing your back-to-school savings. Mid Oregon’s Everyday Rewards VISA® offers 2% to 3% back in rewards on everyday spending categories like groceries and gas. If you pay off your balance in full every month to avoid interest, these rewards can add up, especially with regular school drop-offs and bulk grocery runs to prep lunches for the week.

The Mid Oregon Platinum VISA®‘s lower APR is great for large purchases such as laptop computers, phones or other expensive school supplies.

Bottom Line

Don’t wait to do your back-to-school shopping. Tackling the shopping game early, looking for deals and sticking to necessities to avoid overspending will be the right plan.

Learn to adapt and thrive in this uncertain economy. Maximize rewards and using the right credit cards to score cash back or lower interest rates.