The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Family Finances: Keep Everyone Informed

The Importance of Keeping Everyone Informed

In your household, does one person handle all the finances? Who pays all the bills, files the joint taxes, deals with insurance matters, and knows where all the important papers are saved? Who deals with the family finances?

What happens if that person becomes ill and can’t take care of these tasks?

According to a study by UBS Global Wealth Management, more than half of married women leave all financial decisions to their husbands. This could be risky for a number of reasons. Three key reasons are:

- Women tend to outlive their husbands on average by five years.

- Women are earning more income than they have in the past, sometimes more than their husbands.

- About 36% of marriages end in divorce.

Chances are women will find themselves solely responsible for their family finances at some point in their life.

This situation is also applicable if you are a single parent with children. If one of your children is over 18, it may be a good time to go over important financial matters with them, should anything happen to you.

Here are a few steps to help get all the adults in the family up to speed and involved:

Step 1: Have a family budget meeting

Sit down with your spouse, partner, or adult children and talk about spending habits and savings. Go over your combined incomes and total expenses, including the amount spent on groceries, mortgage, insurances, entertainment, kids, etc. Review all your debts together, including credit cards, medical bills, and student loans. This will help you understand where you currently stand financially as a family. If you or your spouse have a written budget in place, make sure both of you agree with and follow it. If there isn’t a budget in place, this is an excellent opportunity to create one together.

Step 2: Review your retirement accounts

This is your financial future, too; it’s important that you know how much you both are contributing to your retirement accounts and what the current balances are. You should know where your accounts are held and how to access them. Make sure everyone knows where important financial documents are kept. If they are on a computer, make sure they are easily accessible without help. You should visit your financial planning advisor together so they can go over and explain your current accounts. It’s also a great time to review the beneficiaries on your accounts.

Step 3: Understand your insurance coverages

Know what is covered by all your insurance plans, including life, health, home, and auto. Make sure you know who to contact to file a claim and what your deductibles and co-pays are for each policy.

Tips for Staying Involved:

Once all the adults in your family understand your current finances, it’s important to continue staying involved. Start having monthly budget meetings with your spouse, partner, or adult child to review current spending and planned expenses for next month.

Getting involved in managing your family finances enables you to feel more empowered and ready to handle any unexpected life events that come your family’s way.

How Mid Oregon Can Help

Is this an opportunity for you? If so, Mid Oregon Credit Union has resources to help:

If you need to get set up on your Mid Oregon accounts with online banking, our staff can get you started. Inside online banking, you can even check your credit score and see the actions to take that can improve it.

Our financial advisor with Mid Oregon Wealth Management can review your retirement accounts with you, if you don’t have an advisor or want a second look.

Mid Oregon financial partner Cascade Insurance Center will review your insurance coverage to be sure you are well covered at the right costs.

Please check out our midoregon.com website to learn more.

We’re All In! Virtual Big Day at Mid Oregon

To celebrate the re-activation of our checking promotion, our Mid Oregon branch teams created some fun pictures and videos! Under the theme of “We’re All In! Our Virtual Big Day at Mid Oregon”, they show their enthusiasm and excitement for serving our members.

Starting on Monday, June 1, anyone who opens up a new checking account at Mid Oregon Credit Union will be automatically entered to win a $250 Visa gift card. One gift card per branch will be awarded to the randomly drawn winners, for seven $250 gift cards total. Checking accounts must be opened by 7/12/20 to be eligible.

Mid Oregon Checking Accounts

To learn more about Mid Oregon’s great checking account options, including our Simply Free Checking, visit on checking webpage.

To see details about the new checking account prize drawing and more, view the We’re All In Checking Promotion Drawing Flyer.

Your East Bend Branch Team |

|

Your Redmond Branch Team |

|

Your Olney Avenue Branch Team |

Your Prineville Branch Team |

|

|

Your Madras Team |

|

Your La Pine Branch Team |

Your Sisters Branch Team |

|

|

Your Administration Team |

|

|

Budgeting Basics- Introduction & Cash Flow

Introduction to Budgeting

One of the most important aspects of investing is cash-flow management, also known as budgeting. Not only is it necessary for successful investing, it is necessary for attaining most of the things you want in life. Here is an introduction about some budgeting basics.

A budget helps you focus on the important things in your life and how to pay for them. A good budget will help you economize and save for these things. It will also help you improve your risk tolerance.

What Is a Budget?

“You really need to make a budget and stick to it.” Hopefully, we haven’t lost you, because those 10 words have started more arguments and domestic disputes and have led to more divorces than any other words in the English language. There have been television sitcoms based on the premise that budgeting is just too funny and cannot be taken seriously. In fact, the financial planning community doesn’t like to use the term budget. Instead, they call it “cash-flow management.”

- If you handle money, you already have a budget.

- Budgets consist of cash coming in and cash going out.

Everyone Has A Budget

Everyone who handles money has a budget, whether they know it or not. It may not be written down, but it is there just the same. For example, mom gives her eight-year-old son a $10 allowance for the week. Does Sonny go out and spend it on a CD, candy, or school supplies, or does he save it to make a larger purchase in the future? It doesn’t matter how you answer the question. However Sonny “spends” the $10, he has made his decision based on his budget, although it wasn’t written down.

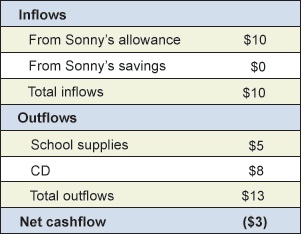

A budget has two main components: cash coming in (inflows) and cash going out (outflows). If you subtract the outflows from the inflows, the answer should always be zero. That’s called balancing the budget.

Budgets Compare Money Flowing In and Money Flowing Out

So why is budgeting subject to so much angst? Most persons don’t see the difference between income and inflows. Income is an inflow, but so is money taken from savings and money borrowed. Income is money earned from work, earned from investments, or received as a gift. Some people try to spend more income than they have, ultimately causing problems in the future, when the budget must be balanced with inflows from either savings or borrowing.

Here is a simple example:

Budget Example 1

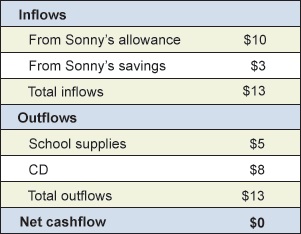

The negative $3 cash flow tells us that to balance this budget, Sonny needs an additional inflow of $3. If Sonny had previously saved some money, then he could easily take the $3 from savings and his budget would look like this:

Budget Example 2

If Sonny didn’t have any savings, one of two things would happen: He would either have to postpone one of his purchases or he would have to borrow the cash from his mother or another lender.

Budgets Are Also Called “Cash-flow Management”

A budget is merely a way to identify cash coming in and how we spend it. It can be a valuable tool for planning future spending and for making investment and borrowing decisions. When used to make decisions about future spending, saving, and investments, it is called cash-flow management, essential to budgeting basics.