Introduction to Budgeting

One of the most important aspects of investing is cash-flow management, also known as budgeting. Not only is it necessary for successful investing, it is necessary for attaining most of the things you want in life. Here is an introduction about some budgeting basics.

A budget helps you focus on the important things in your life and how to pay for them. A good budget will help you economize and save for these things. It will also help you improve your risk tolerance.

What Is a Budget?

“You really need to make a budget and stick to it.” Hopefully, we haven’t lost you, because those 10 words have started more arguments and domestic disputes and have led to more divorces than any other words in the English language. There have been television sitcoms based on the premise that budgeting is just too funny and cannot be taken seriously. In fact, the financial planning community doesn’t like to use the term budget. Instead, they call it “cash-flow management.”

- If you handle money, you already have a budget.

- Budgets consist of cash coming in and cash going out.

Everyone Has A Budget

Everyone who handles money has a budget, whether they know it or not. It may not be written down, but it is there just the same. For example, mom gives her eight-year-old son a $10 allowance for the week. Does Sonny go out and spend it on a CD, candy, or school supplies, or does he save it to make a larger purchase in the future? It doesn’t matter how you answer the question. However Sonny “spends” the $10, he has made his decision based on his budget, although it wasn’t written down.

A budget has two main components: cash coming in (inflows) and cash going out (outflows). If you subtract the outflows from the inflows, the answer should always be zero. That’s called balancing the budget.

Budgets Compare Money Flowing In and Money Flowing Out

So why is budgeting subject to so much angst? Most persons don’t see the difference between income and inflows. Income is an inflow, but so is money taken from savings and money borrowed. Income is money earned from work, earned from investments, or received as a gift. Some people try to spend more income than they have, ultimately causing problems in the future, when the budget must be balanced with inflows from either savings or borrowing.

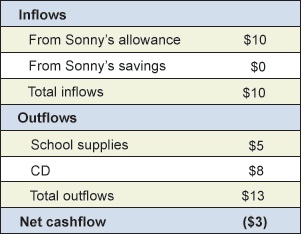

Here is a simple example:

Budget Example 1

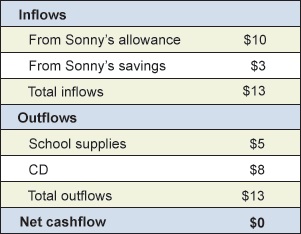

The negative $3 cash flow tells us that to balance this budget, Sonny needs an additional inflow of $3. If Sonny had previously saved some money, then he could easily take the $3 from savings and his budget would look like this:

Budget Example 2

If Sonny didn’t have any savings, one of two things would happen: He would either have to postpone one of his purchases or he would have to borrow the cash from his mother or another lender.

Budgets Are Also Called “Cash-flow Management”

A budget is merely a way to identify cash coming in and how we spend it. It can be a valuable tool for planning future spending and for making investment and borrowing decisions. When used to make decisions about future spending, saving, and investments, it is called cash-flow management, essential to budgeting basics.