The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Retirement Savings—Start Early

Start Early, Earn More

Retirement—it’s not a word you think much about when you’re young. After all, that’s something that happens when you get old. Don’t wait until you are older to think about it: when it comes to your retirement savings—start early!

But You Have Social Security!

You might think Social Security will be all you’ll need, but it was designed to supplement your retirement savings. You can’t rely on it entirely. You’ll need some other source of income to pay for your living expenses.

The younger you are when you start your retirement planning, the better off you’ll be financially when you retire.

So how should you start?

The first thing to do is see if your employer offers a 401(k) program. Basically, a 401(k) is a retirement plan your employer sponsors. Money is deducted from every paycheck, on a pre-tax basis, with the purpose of having it to use when you retire. If you’re lucky, your employer will also contribute and/or match your contributions up to a certain limit. The money is invested for you and earns compound interest, meaning you earn interest on the interest. The sooner you open a retirement account, the longer you have to make affordable contributions to it, and the more compound interest it earns.

Start an IRA

Whether or not your employer offers a 401(k) program, you might also consider starting an IRA, or an Individual Retirement Account. There different types of IRAs, but the most common are a Traditional and a Roth. The biggest difference between them is how each one gets taxed.

Traditional IRAs/401(k) are pre-tax contributions; you will be taxed when it is time to withdraw funds.

Roth IRAs/401(k) are post-tax contributions; since you already paid taxes on the contributions, you will receive tax-free withdrawals when you retire.

There isn’t any one right way to invest money for your retirement, so it’s worth looking into the different options to see which you like best. You don’t need a lot of money to make money. You just need a lot of time. Your youth gives you that advantage.

Give Yourself The Time

The earlier you start saving, the more time your money has to accumulate interest. The more time you have it invested, the more time you have to figure out what system works best for you. So it makes sense when it comes to retirement savings—start early!

If you have questions about retirement products, talk to Mid Oregon Wealth Management. They’ll be an excellent source for more detailed information.

Check In On Your Finances

By Jean Chatzky *

It’s time to check in on your finances, including emergency funds and budget plans.

This end-of-the-year financial assessment can help you get back on track in 2021

Budgets and cash reserves aren’t just for corporate America. As the COVID-19 global pandemic keeps going (and going) it’s time to figure out exactly where you are with your personal finances so you can create a plan for how to best move forward in 2021. Across the United States and the world, it’s been a challenging year on many fronts with millions of people facing a much different economic outlook than they did just 12 months ago.

“This year showed the exact reason why you need an emergency fund,” says Tanner Bortnem, CFP, JD, owner of Harmoney Wealth, PLLC. “I’ve had some clients who used almost all of theirs.”

If your budget took a hit, or you want to protect yourself from losses in the future, now is the time to get back on track or be more strategic with savings in the new year. Here are some areas to consider as you assess your finances.

Did you spend your savings?

If you depleted your emergency fund, building it back up is priority number one, Bortnem says. The goal is to have enough saved to live on for three to six months. Make sure the money is in a separate account from your regular checking, but still easy to access in a bank or credit union savings account.

If you took a financial hit and are unsure about how to start saving again, Bortnem suggests several strategies, including asking for more hours or overtime at work, taking an extra part time job and/or cutting back on some expenses, such as premium movie and streaming services, until your savings have been restored. If you are out of work, finding new employment is, of course, the most important goal to accomplish.

Do you have the right amount of life insurance?

When it comes to protection such as life insurance, Bortnem says, some people may have more than they need. It’s wise to review your policy and premiums to see if you can get by with less coverage, at least for a while. For example, someone who earns $100,000 a year may have been advised to be insured for 10 times that much, which is $1 million.

Whether you really need a million dollars in life insurance depends on what you want to achieve with those funds, Bortnem says. Many people want life insurance to pay off a mortgage, or pay for a college education, and to make sure a spouse has several years of income if the other spouse dies. When you consider what that will really cost, it could be much less than $1 million.

If you decide $500,000 in life insurance coverage is adequate for the near future, you can take the savings from what you would have paid in higher premiums and plug that money back in to your emergency fund or other savings.

Are you following a budget?

If you’ve never lived on a budget, or recently fell off the budget bus (it happens), there’s no better time to start following a spending plan than today. Being aware of where your money goes (restaurant take-out and Amazon?) can help you reign in your spending. There are plenty of apps and online websites such as Mint and YNAB (You Need A Budget) to help track where your hard-earned money goes. Your credit union or local bank may have resources as well.

Have you automated your savings?

Life is tough enough. Make saving for the future a little easier by automating the process. If you don’t already do online banking, work with your bank or credit union to set up an electronic transfer from your checking account the day after you typically get paid to streamline your savings plan. On a tight budget? Start with a small amount and gradually increase your transfers over time. You won’t regret it!

* This guest article, “It’s time to check in on your finances, including emergency funds and budget plans”, is from the “Your Money Blog” in Mid Oregon’s digital banking Credit Savvy resource. “It’s time to check in on your finances, including emergency funds and budget plans” is made possible by Savvy Money. The article first appeared in December, 2020.

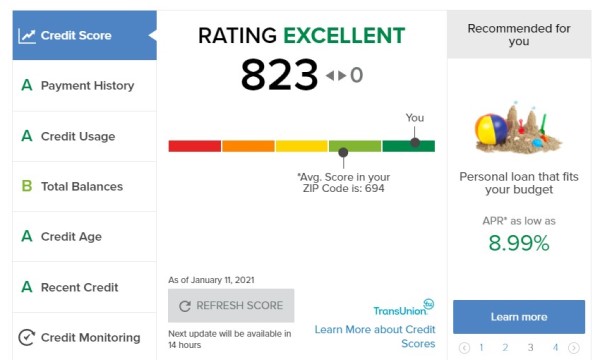

What Makes Up Your Credit Score?

Your credit score is a significant gauge to your financial wellbeing. Understanding why your credit score is important will help you use your credit wisely, and as a helpful financial tool (Read Why Your Credit Score is Important article). Knowing what makes up your credit score is the key to improving a poor score, or to start out using credit better.

What Makes Up Your Credit Score?

FICO® credit scores are calculated from many different pieces of data in your credit report. This data is grouped into five categories shown below. The percentages reflect how important each of the categories is in determining how your FICO® Score is calculated. The number generated is how your credit situation is in relation to these factors, and that number will be between 350 and 850.

Payment history- 35%: “Do you pay your bills on time?”. On time payments will raise this factor, while missed payments and defaults will lower your score. This is the most important contributor, and one you can best control.

Amounts owed to creditors-30%: “Do you owe a lot of money to a lot of people?” Owing money on credit accounts doesn’t necessarily mean a problem, but using most or all of your credit limits could be a sign of problems, and the formula treats it accordingly.

Length of credit history-15%: “How established is your credit history?” In general, a longer credit history will increase your score. The age of your oldest open account, the average age of all accounts, and how long it has been since you’ve used your accounts are factors.

New credit-10%: Are you increasing your debt obligations? Borrowers opening several new accounts in a short period of time has shown to be a bigger risk to lenders.

Types of credit currently in use-10%: “Do you have a ‘healthy mix’?” Your balance of credit cards, installment loans, retail accounts, and mortgage loans are considered by the formula. It’s not necessary to have all types of credit, but a healthy mix is good (For example, only having credit cards is not a good balance).

FICO Scores Are Unique to You

The importance of credit categories varies by person. Your FICO® Scores are unique, like people are unique. They are calculated based on the five categories referenced above, but according to FICO®: “…for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.”

Over time, the information in your credit report will change. As they do, so does the evaluation of these factors in determining your FICO® Score.

According to FICO®, “Your credit report and FICO® Scores will evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO® Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO® Scores chart are for the general population and may be different for different credit profiles.”

How To Find Out Your Score

So how do you know what is going on with your score? You can order your credit report at AnnualCreditReport.com. That will show the factors which go into your score. You can get your score from FICO® (myfico.com), for a price. There are some websites which can give you a credit score based on your FICO score, like Credit Karma.

But your best and easiest access to your credit score might be Mid Oregon Credit Union. Our members can check their credit score for free with Credit Savvy, inside our easy-to-access Digital Banking platform.

In addition to your score, Credit Savvy will provide the individual breakdown of the 5 categories. Included is how well you are doing in that category, what is impacting that category, and suggestions to improve. You can also see information which makes up your credit report, access offers from the credit union, and see articles in “Your Money Blog”.

Let us help you manage or improve your credit score. Visit MidOregon.com, or visit one of our Central Oregon branches to get started.