The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Community Involvement- It’s Who We Are!

Involvement in our community is more than something we do… it’s who we are.

As part of our series highlighting the newest and best features of our recently upgraded website, today on “Website Wednesday” our #9 feature is our Community Involvement page. We hope that through this page more people will see how important we believe it is to support and engage is in Central Oregon communities.

As a not-for-profit cooperative, our members should know that participation through their Credit Union membership, deposits and loans make it possible for us to give back on their behalf to many important efforts and organizations locally. Acknowledging that many of today’s Central Oregon residents use online sources for information, we’ve provided more a better resource about our involvement.

More than writing checks

As our page states, Community Involvement is “Who we are”, and a big part of that is our volunteer commitment to support local organizations. We know our members and the community at large believe in personal service, and so do we. Significant community involvement is more than just writing checks.

On the page is a “Learn More” button which will open a PDF with snapshots of many of the things Mid Oregon does in the community. For example, we recently completed the summer campaign for the Great Drake Park Duck Race, where over $90,000 were raised and as an organization we volunteered, promoted and sold tickets to raise money for 5 Central Oregon Charities…each of which help children.

Why we place such a strong emphasis on giving back is verbalized in parts of some of our organizational statements:

“We demonstrate through meaningful involvement, our commitment to the communities we serve. We both benefit from and have a responsibility to help grow a healthy community.” – from our Foundational Vision.

“As the only credit union headquartered and doing business solely in Central Oregon, we recognize and share in a corporate social responsibility to our communities and residents. Mid Oregon Credit union has been recognized as an exceptional credit union in the area of social responsibility evidenced by its winning of the statewide Dora Maxwell award since 1998. We have accomplished this through our actions and strong belief in contributing to the community with both time and financial resources.” – from our Social Responsibility Statement.

Understanding Mid Oregon and Credit Unions

Please take a moment to check out our page and involvement, and hopefully you will get a better understanding of how important supporting our community is to credit unions and Mid Oregon. We welcome you to join us!

10 Facts About Credit Unions

Being a member of a credit union is a coup for your finances for many reasons. Here are just a few facts that make credit unions a great option.

Fact #1: President Roosevelt signed the Federal Credit Union Act in 1934 to promote thriftiness and prevent usury during the Great Depression.

Fact #2: Credit unions are insured. Most credit unions are insured by the National Credit Union Administration (NCUA), which provides essentially the same coverage on funds as does the FDIC. If the word “federal” is in the name, they are insured. If not, check with your credit union. It may be state-chartered and/or have private deposit insurance. (Mid Oregon’s legal name is “Mid Oregon Federal Credit Union”, so we have NCUA Insurance!)

Fact #3: Eligibility is fairly flexible at most credit unions. Most require residency in a certain community, city, or state, or that you are employed by the credit union’s sponsor company, also known as a Select Employee Group (SEG). But requirements are pretty broad on most, making eligibility at a credit union a possibility for almost anyone.(Generally Mid Oregon’s eligibility is persons who live, work, worship or go to school in Deschutes, Jefferson or Crook Counties. For more details, visit www.midoregon.com)

Fact #4: Credit unions are not-for-profit institutions and are owned by the people they serve, not by a few shareholders.

Fact #5: Credit unions can offer better rates on savings accounts, lower interest rates on loans, and little or no fees on accounts because they are exempt from federal taxes. Credit unions still pay state taxes.

Fact #6: The credit union’s board of directors, which is elected by members, can set loan limits in an effort to help the credit union grow.

Fact #7: Credit union members have democratic control of the credit union and can attend and participate in regular and special membership meetings.

Fact #8: Nonmembers benefit from credit unions too. Competition for low rates keeps banks’ fees in check, thereby benefiting nonmembers.

Fact #9: With more than 5,000 credit unions across the globe and access to tens of thousands of ATMs, credit unions are increasingly convenient on a national scale. (Mid Oregon’s ATM Network includes 38 Central Oregon, 30,000 + Domestic and over 800,000 ATMs worldwide surcharge free!)

Fact #10: Once you are a member of a credit union, you stay a member for as long as you maintain your deposit account (share), regardless of whether or not you continue to meet the original eligibility requirements.

Questions? Email us to beheard@midoregon.com, call us at (541) 382-1795 or visit one of our Central Oregon branches!

Financial Calculators- Website Feature

In late summer Mid Oregon upgraded our website at www.midoregon.com to provide a better online experience for our members and the community. Starting with this post we would like to share some of the best improvements and point out ways these can benefit our members or those looking for information. Today’s post is featuring our new Financial Calculators.

Mid Oregon Credit Union members all benefit when more of our members make wise financial decisions. Central Oregon families, organizations and communities also benefit from overall better money management through increasing the tools available. The new financial calculators on midoregon.com are a great new resource!

Our calculators are available to aid in making decisions on loans and savings options. These provide estimates to empower you to make better choices, but you should always contact a Mid Oregon representative to get actual numbers for your situation. Here are the five and some information on their use:

Loan Calculator

This calculator will compute a loan’s monthly payment amount and the total interest paid. Examples for it’s use would be comparing different vehicle financing options of different loan terms, how a larger down payment might reduce your monthly payments and overall interest expense, or might help you decide if taking a zero percent interest auto maker financing option makes sense or should you take the alternative option of cash back with low interest Mid Oregon financing.

Mortgage Refinance Calculator

This calculator will help you to decide whether or not you should refinance your current mortgage at a lower interest rate. The most common questions regarding refinancing a mortgage is how long does it take the reduced payments to break even on the closing costs added by refinancing, and will you remain in your home long enough to make it worthwhile. This calculator will tell you how long it would take and the savings you would incur. You can also compare different options such as higher closing costs vs. a larger interest rate reduction.

Debt Consolidation Calculator

This calculator will show you how much you could save if you consolidate your debt. In our free community workshops on credit one of the most common questions we hear is “Should I consolidate my debt?” The answer is rarely obvious. Some of the big factors are will it actually reduce your payments, will you pay it off faster and will you pay less interest. Our calculator allows you to project monthly payments, interest paid and payoff time using different interest rates and lengths of loan, along with other information.

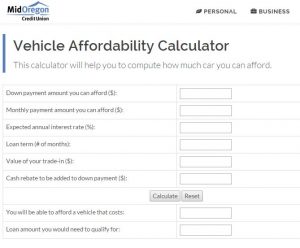

Vehicle Affordability Calculator

Vehicle Affordability Calculator

This calculator will help you to compute how much car you can afford. Determining how much of a vehicle you can afford to purchase should be based on how much will your budget handle, and how does it fit into your financial goals. Figuring that out is much easier with our Vehicle Affordability Calculator, which allows you to test different scenarios based on your available down payment, the monthly payment you can afford, your trade in value, and different loan factors. Speaking to a Mid Oregon loan officer will help you decide what to expect in qualifying for a loan.

Savings Calculator

This calculator will determine how much you can save over time if you make monthly contributions to your savings account. A component of any good spending plan is to pay yourself first, meaning setting up periodic savings deposits which are taken from your account before you determine your monthly budget. This becomes even more important when you want to save for a future purchase, like a car or home down payment. This calculator allows you to see what different deposit contribution amounts, frequencies,interest rates and timetables do for your savings goals.

Using these calculators can be simple, but determining some of the information to use may not be as easy. Contact us to learn more about how best to apply the calculators and how to determine which factors to use: Through email beheard@midoregon.com, by phone (541) 382-1795 or by visiting one of our offices in Bend, Redmond, Prineville, Madras or La Pine.