The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

What Is International Credit Union Day?

Mission of International Credit Union Day

Mission of International CU Day: To highlight and celebrate the qualities that make credit unions the best financial partners of people all over the world.

1. What is International Credit Union Day?

• International CU Day is a day when credit unions all over the world celebrate the qualities that make credit unions unique and show appreciation for their members.

• The celebration started in 1948, and occurs every year on the third Thursday of October.

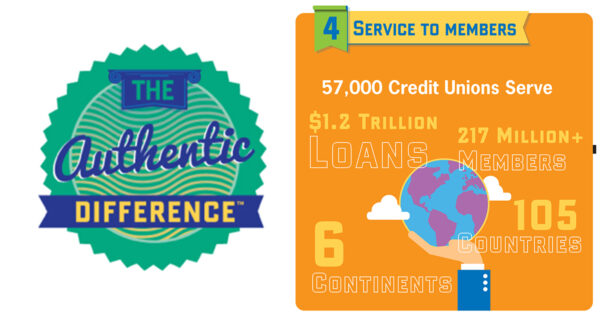

• There are 57,000 credit unions worldwide in 105 countries.

2. What makes a credit union different?

• Credit unions are not-for-profit financial cooperatives.

• We offer the same services as other financial institutions, but we return all our profits to members. That’s why we have better rates and fewer fees.

• We are owned by our members, not shareholders, so our money stays in the community.

3. What is a cooperative?

• A cooperative is an association of people who come together to meet a shared need.

• All co-ops are democratically controlled and share common principles, such as social responsibility and offering education to members. The 9 credit union principles come from the 7 cooperative principles that all co-ops follow.

• Credit unions are financial cooperatives, but there are all kinds of co-ops. From a neighborhood grocery co-op to national name-brand co-ops, like the outdoor retailer REI.

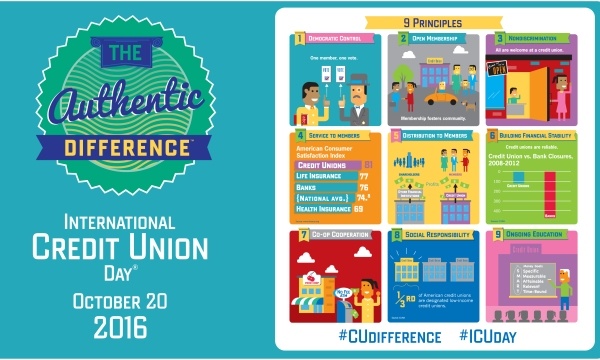

The Authentic Difference Is Our People-First Principles

On October 20, 2016, credit unions around the world will celebrate International Credit Union Day (ICU Day). We are proud that as credit unions, our authentic difference is our people-first principles.

Credit unions are not-for-profit financial cooperatives, offering the same services as other financial institutions, but with a people-first philosophy.

“The Authentic Difference,” this year’s ICU Day theme, zeroes in on what makes credit unions different from banks, fintech startups and other financial institutions—our principles.

Credit unions have operated according to the same core principles since the 1850s, when a group of weary German workers, tired of being exploited by loan sharks, formed the world’s first credit union by banding together to provide affordable credit to each other.

These principles are based on the 7 cooperative principles, shared by all cooperatives. They are:

1. Democratic Control

One member = One vote. Whether you have $5 or $5 million, your voice is equal.

2. Open and Voluntary Membership

Members are connected by a bond of association, fostering a sense of community.

3. Non-Discrimination

Credit unions are open to all without regard for race, orientation, nationality, sex, religion, gender, or politics.

4. Service to Members

Credit unions are ranked No. 1 in service in numerous surveys, because they exist to serve members, not profit.

5. Distribution to Members

Credit unions return all profits to their members through dividends, lower fees, better savings rates, and improved services.

6. Building Financial Stability

Credit unions are historically stable organizations. They’re owned by the people they serve, so they don’t take unnecessary risks.

7. Cooperation Among Cooperatives

Credit unions and cooperatives share the same principles. Together, they amplify each other’s good works.

8. Social Responsibility

Credit unions strive for social justice by committing to strengthening their communities and helping people of modest means.

9. Ongoing Education

Credit unions prioritize financial education for their members, employees, and communities as part of their pursuit of social justice.

This is why we celebrate ICU Day at Mid Oregon Credit Union. Because putting people before profit, prioritizing social responsibility, and offering financial education improves lives. These values are why cooperative banking is a key component of helping people in developing countries gain access to microloans, or a middle-class couple in Central Oregon receive an affordable mortgage for their first home.

So when we wish you a Happy ICU Day at Mid Oregon. Know that we’re thanking you for belonging to a movement that’s helping your neighbors—and people around the world—grow and thrive and follow their dreams. And contributing to credit union’s people-first principles.

If you have any questions about the credit union philosophy or how Mid Oregon Credit Union can help you, stop by or contact us at (541) 382-1795 or at beheard@midoregon.com.

Vote and Make a Difference for FAN!

Vote Love My Credit Union Campaign

As part of the “Love My Credit Union Campaign”, Mid Oregon Credit Union has created a video about our school community involvement which could win FAN (Family Access Network) up to $26,000 this Fall if we get the most votes. You can Make a Difference for FAN!

The Love My Credit Union® Campaign is a nationwide video contest that invites credit unions and credit union support organizations to create a short video showcasing their good deeds and charitable work. Now it’s up to those reading this, to vote for your favorite (hint: Mid Oregon CU’s video and FAN!) and help charities across the country receive donations of up to $122,500. Plus, you could win a $500 gift card and a $500 donation to the charity of your choice just for voting! Vote every day now – December 16, 2016.

Here’s how you can help:

VOTE- EVERY DAY!

- Visit http://www.votelovemycu.org/MidOregonCUForFAN, and watch the 90 second video. Vote every day through December 16th. You register just once (today) by clicking the “Vote” button, confirm your registration through your email, and every time after you just enter your email address to vote.

- Set up a reminder so you vote every day

- *** Each vote enters you into a sweepstakes for a $500 Visa Gift Card and a $500 donation to the charity of your choice!

SHARE WITH YOUR FRIENDS, FAMILY, ETC.

- On the web page is a button to easily share directly to Facebook or Twitter

- Share from your other social media platforms

- Email the link above to your contacts

Thank you for helping make an impact for our kids, families and schools!

Contest’s First Year in 2015

In 2015, $105,000 was donated to local charities on behalf of nine winning credit unions nationwide. This year, there will be more donations to charity and more ways to win. The Love My Credit Union® Campaign will award up to $122,500 to charities nationally on behalf of the winning videos submitted by credit unions and credit union support organizations!

Details about Awards

October Winners

Four $5,000 donations on behalf of winning credit unions with the top votes in each asset size category as of October 31, 2016

November Winners

Four $5,000 donations on behalf of winning credit unions with the top votes in each asset size category as of November 30, 2016

December Winners

One $15,000 donation on behalf of the grand prize winning credit union with the most overall votes as of December 16, 2016

One $15,000 donation on behalf of the grand prize winning credit union support organization with the most overall votes as of December 16, 2016

Up to 50 $1,000 state-level donations on behalf of the credit union in each state with the most overall votes as of December 16, 2016. * Minimum 5 Credit Unions participating in state to award.

Consumer Sweepstakes

The campaign will randomly selected five campaign voters when voting concludes on December 16, 2016 and award each with a $500 gift card plus a $500 donation to the charity of their choice*. Each time you vote you are entered into the sweepstakes to win the consumer prize!

Winners will be announced each month of the campaign from October 1 through December 16, 2016.

*Charity must be a 501c3