Mindfulness Key to Spending Control

Are you spending too much? For many Americans, the answer is, “Absolutely.”

The reasons are varied—lack of a budget or a desire to maintain appearances—but, to better manage your spending, many financial advisers recommend tracking your cash flow and monitoring your emotional state.

Here’s how:

Planning is Key

* Plan. It’s not only big expenses that put you in debt. More likely it’s “death by a thousand tiny cuts” eating up your income. Track your spending with a notebook or online app, shop with a list, consider using only cash for a couple of months, and set up monthly automatic deductions from your share draft/checking account into an emergency savings fund.

* Be mindful. Try to understand why you’re overspending. Maybe you’re trying to keep pace with high-rolling friends or spending makes you feel better—temporarily, anyway. Regardless, when you feel compelled to buy something you maybe don’t need, wait 24 hours and consider why you’re buying it. Ask yourself, “How will I feel when the credit card bill comes?”

Know Your Limits

* Set limits. Know what pleasures you can’t live without and decide in advance how much you’ll spend on them each month. Try to focus on the joys in your life that cost nothing—friends, family, a favorite public park—and for big-ticket items, set aside a little each paycheck until you can afford to buy it.

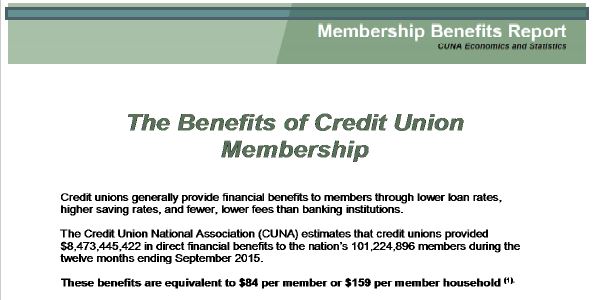

For help getting started to bring your finances under control call a Mid Oregon Credit Union Loan Officer at (541) 382-1795. You can also email info@midoregon.com, or visit one of our seven Central Oregon branches.