Can you believe it—we are already one month into 2024! It feels like we were ringing in the New Year just yesterday, full of hope and excitement for what the next 12 months had in store for us.

Now that you have jumped into the new year with both feet firmly planted, it’s time to check on the financial plan you (hopefully) started in January.

Why is a financial plan important

A financial plan is a way to improve your financial well-being, set goals, and create a road map for a better financial future. Whether it’s saving money, paying off debt, starting an emergency fund, or investing—having a clear financial plan can give you a sense of direction and purpose.

Review your 2024 goals

Take a moment to review your financial goals. Are they relevant and achievable? If not, don’t be afraid to make adjustments. Having realistic goals in your financial plan is better than setting yourself up for failure. Tips to reach your financial objectives:

Make a savings goal

If you see a tax refund or Oregon kicker in the future, use part of that money to give yourself a head start. You can also log into Digital Banking and use the Savings Goals tool to set a goal and track your progress.

Track your spending

This may seem obvious, but it’s amazing what you discover when you start writing down all your expenses. From major purchases to treats for your four-legged pal—it’s important to write it all down.

Get a free Financial Checkup.

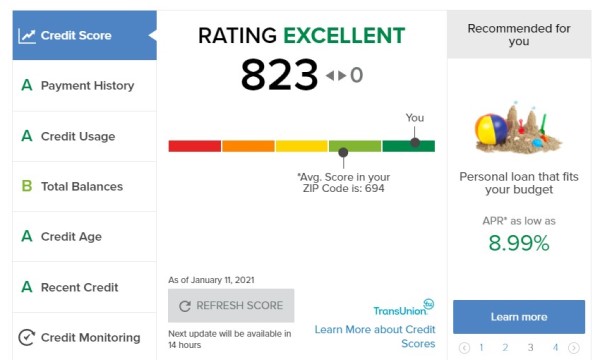

Mid Oregon recently introduced a powerful resource for getting a handle on your finances—Financial Checkup in Digital Banking—an empowering new addition to our My Credit Score family.

Expand your financial know-how

Take advantage of our upcoming free financial literacy workshops. We also have past workshops you can view on our YouTube channel. Additionally, our Financial Tips section on our homepage has a variety of articles on budgets, saving money, fraud prevention, and more.

Watch it grow, grow, grow

As your savings account balance grows, you’ll feel more motivated to take it even further. We have various savings products to fit your goals. Make your money work smarter, not harder.

Whatever your goals, Mid Oregon’s experienced team is here to help. 2024 is a great time to start taking control of your finances and getting fiscally fit. Stop by a branch or visit us online at midoregon.com and begin your journey to financial health.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.