Investing in our kids’ financial education is like giving them a key to a successful future. When children learn how to manage money from an early age, they become more prepared to handle their finances, avoid debt, and make smart choices as they grow up.

As parents, it’s up to us to start teaching them these valuable skills and values early on. If you’re wondering when to start talking to your kids about money, don’t worry! We’ve put together a helpful article with tips tailored for kids from preschool to high school to make it easy for you to get started.

Preschool through Kindergarten—starting the conversation

Conversations with your children about money can begin as young as three years old. Have fun with it by introducing basic concepts such as the difference between pennies, nickels, dimes and quarters. When shopping, opt to pay with real coins instead of plastic. Use the change and let your child pay for you, explaining that the money is earned through work and used to purchase things.

Piggy banks can also introduce the concept of savings. With one coin at a time, your kids can learn the difference between instant satisfaction and saving for a rainy day.

Takeaways: You need money to buy things, money is earned by working, you may have to wait to buy something you want.

Elementary school—demonstrate the value of money

Discuss the difference between things we need to buy (clothing, food, a home to live in) versus things we would like to have, but don’t necessarily need (toys, treats, video games). You can begin discussing financial goals. Encourage them to save the money they receive from Grandma or an allowance for something they really want, reinforcing the advantages of instant versus delayed purchases.

Compare prices and explain how different brands of the same product cost more or less. You can give them a few dollars to spend and let them see what they can get. Remind them that once they spend it, it is gone.

Takeaway: Teach them the difference between want and need, how to save and spend money wisely, compare prices.

Middle school—money management

These are the years to help children establish good saving and spending habits, and manage impulse-buying. Help them set up accounts—one for their savings and one for spending money. Encourage the habit of saving 10% of all money they receive.

This is also a good age to begin discussing the concept of debt. For example, they watch you use credit cards. Help them understand that these are loan transactions, which still need to be paid.

Takeaway: Save a percentage of every dollar, set up saving and spending accounts, understand credit cards are like a loan.

High School—money mindfulness

At this stage, young adults are usually ready for more sophisticated lessons in money management. This includes personal debt and credit cards. Teach them about interest rates and how it can work against them. Give an example of how much interest they will be charged if they do not pay the credit card balance in full a the end of the statement period.

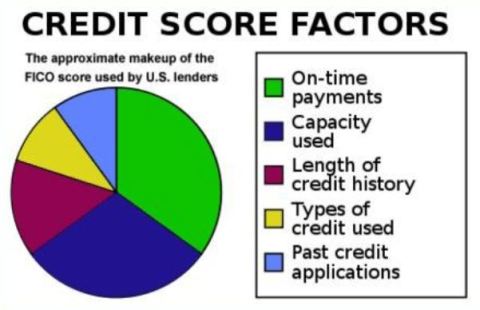

This is also the time to impress upon them the benefits of good financial choices and the cost of poor decision making. Explain what a credit score is and how financial institutions and other lenders use them to determine whether to issue them a credit card or loan, and at what interest rate.

Finally, stress the importance of having an emergency fund. Provide examples of why it is important to always keep some cash in savings. You can refer to examples of emergencies you’ve experienced such as the refrigerator breaking or being unexpectedly unemployed. Tell them how having a savings cushion helped you get through these situations. Conversely, you can discuss the consequences of not having an emergency fund.

Takeaways: Pay credit card balances in full each month, the importance of an emergency fund, credit score impact.

We all want the future generation to be successful. Let’s give our kids the tools they need to make wise financial decisions, save for the future, and become savvy consumers. By teaching them about earning, saving, and planning ahead, we’re giving them skills that will benefit them for life.