April is Financial Literacy Month, making it an ideal time to overcome financial anxiety and adopt a more positive outlook on our finances. Let’s be honest—money can be daunting. We pay bills and receive paychecks, but we rarely take the time to explore the bigger picture.

This month, let’s turn those financial anxieties into actionable steps toward a more secure and fulfilling financial life. Whether you’re a parent wanting to make discussions about money easier for your kids, or just an everyday person looking for some helpful tips, there’s always something new to learn.

Why Does Financial Literacy Matter?

Think of financial literacy as your personal financial GPS. Without it, you’re driving blind, susceptible to detours and costly mistakes. Did you know:

- Personal finance is the number one topic of argument within a marriage.

- Parents rank teaching financial responsibility to their children near the top of their parenting wish list.

- Only a handful of states require high school students to take a personal finance course before graduation—Oregon is not one of these states.

- Poor financial literacy leads to poor decision-making, which leads to poor behavior and therefore limits your and your family’s ability to reach its financial goals.

Arming yourself with financial literacy is a crucial part of responsible money management and a financially fit life. Below are a few tips to help you get started.

Schedule a “Financial Date Night” (Candles Optional 😊)

Many people tend to avoid discussing finances until a crisis arises. However, what if you could make it a regular—and even enjoyable—experience? Set aside a specific day each month to sit down with your bills, your paycheck, and anyone who is involved in your financial matters, and find out where you stand.

- Set the Mood: Light some candles, put on your favorite playlist, and pour a relaxing drink. Create an atmosphere that feels cozy and inviting—no distractions allowed.

- Review Your Finances: Gather your bills, pay stubs, and account statements. It’s time to face those numbers!

- Dream & Plan: What do you want to achieve financially? Do you dream of that exotic vacation, a cozy new home, or a sturdy emergency fund? Write down your financial aspirations, big or small—it’s all part of the journey!

- Create a Budget: Dive into your spending habits and see where your money is going. This is your chance to craft a financial plan that works for you.

Tip: Make it a monthly tradition—consistency is key. You’ll be amazed at how much clarity you gain!

Needs vs. Wants: The Ultimate Budgeting Hack

Ever found yourself at the end of the month wondering, “Where did all my money go?” If so, it’s time for a little financial self-reflection. Creating a “Needs vs. Wants” list is not just a budgeting tool—it’s your personal roadmap to financial freedom. Understanding the distinction between what you truly need and what you simply desire can make all the difference. Let’s dive into the three primary categories:

- Essential (Non-Negotiable): These are the pillars of your financial life: your rent or mortgage, utilities, auto loan payments, and taxes. Think of them as the essentials that keep your life running smoothly. You can’t live without them, so they take precedence in your budget.

- Next up are your credit card debts and student loans. While these are important to pay off, they offer a bit of breathing room. You can negotiate terms, defer payments, or even seek lower interest rates. You have some power here, so use it wisely.

- Non-Essential (Wants): Finally, we have the fun stuff: dining out, entertainment, and those little impulse buys. While they can add joy to your life, they’re the easiest areas to cut back on when your budget gets tight.

Pro Tip: Use the Financial Wellness widget provided by Mid Oregon. Categorize your expenses from the last month and identify the areas where you can trim the excess. This can empower you to take control of your finances and steer your budget toward your true priorities.

Take Control of Your Retirement: It’s Never Too Late!

If you’re counting on Social Security to provide for your entire retirement, you may be in for a rude awakening. Benefits are shrinking and the fiscal solvency of the program is always in danger. Taking an active role in your retirement planning is the best way to get some peace of mind about your future. It’s never too late to start, but beginning the conversation in your late sixties is probably not in your best interest.

- Maximize 401(k) Matching: If your employer offers a match, take full advantage! It’s free money.

- Contribute to an IRA: April 15th is the deadline for IRA contributions. Even after filing taxes, you can amend your return.

- Seek Professional Advice: A financial planner can help you navigate complex retirement laws and create a personalized plan.

Pro Tip: Don’t rely solely on Social Security. Take an active role in your retirement planning.

Get the Whole Family Involved—Empower Your Kids Towards Financial Independence!

Investing in our kids’ financial education is like giving them a key to a successful future. When kids learn to manage finances from a young age, they’re equipped to navigate life with confidence, make smart spending choices, and steer clear of debt.

As parents, we play a pivotal role in this journey. Here are some ways to make financial education a family affair:

- Join the Adventure. Start by opening a Mid Oregon savings account for each child in your family. As soon as they can write, let them take charge of their savings book; encourage them to jot down their deposits and withdrawals. And for the teenagers? Introduce them to the world of debit cards and help them track their spending—it’s an empowering experience!

- Share and Learn Together. Get everyone involved in family money discussions. Show your kids how budgeting works—reveal your income and expenses and let them see how you manage it all. As they grasp these concepts, add a dash of fun by setting challenges: Can they save up for a special toy or game? How about sticking to a budget for back-to-school shopping? These little projects make learning engaging and practical!

- Coach for Confidence. Remind your children that it’s perfectly okay to ask for help when they’re unsure. And don’t hesitate to reach out to your credit union for guidance! At Mid Oregon, our tradition of service and philosophy of self-help make us the perfect partner in unfolding your family’s journey to financial security.

Learn more about teaching your kids about finances in our blog post: “Are You Raising Financially Savvy Kids?”

Financial Literacy Month: Your Credit Union’s Role

Financial Literacy Month is more than just a calendar event. It’s a chance to build a foundation for lifelong financial well-being. By expanding your financial knowledge, you’ll be better equipped to make responsible money decisions throughout your life.

At Mid Oregon, we believe that everyone deserves access to the resources that can help achieve financial well-being. That’s why we offer a variety of tools, workshops, and personalized guidance tailored just for you (see below). Whether you’re looking to budget better, save for that dream vacation, or plan for retirement, we’ve got you covered!

Let’s make this Financial Literacy Month count! Your bright financial future starts today!

Resources:

- Mid Oregon hosts several financial wellness workshops throughout the year. Learn about upcoming events on our website

- Financial Blogs: blog.midoregon.com

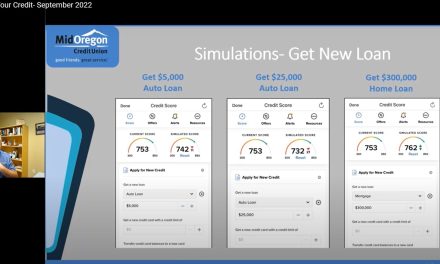

- My Savvy Money in Digital Banking

- Financial Wellness widget in Digital Banking

- Dave Ramsey Financial Planning