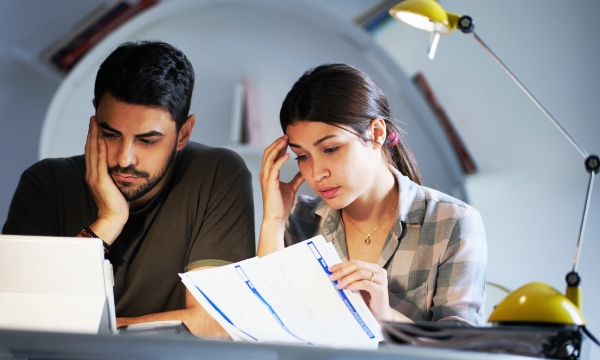

It’s good to know how lenders determine if you’ll be able to afford your monthly payments comfortably, based on your income and other debts. Remember: Many lenders exceed these guidelines, particularly if you have no debt, good credit, or a large down payment when applying for a mortgage. Your debt-to-income ratio is one key factor.

Use this guide to calculate your debt-to-income ratio:

Debt:

Calculate Your Debt-to-Income Ratio

Monthly mortgage or rent $________

Minimum monthly credit card payments ________

Monthly car loan payment ________

Other loan obligations ________

Total minimum monthly debt payments: $ ________

Income:

Monthly gross salary $________

Other monthly income (bonuses, overtime, and so on) ________

Monthly alimony received ________

Total gross monthly income: $ ________

Total debt divided by total gross monthly income = $ ________

Then, multiply the result by 100 to come up with a percent ________%

What does it mean?

36% or less: This is an ideal debt load to carry for most people. Showing that you can control your spending in relation to your income is what lenders are looking for when evaluating if you are credit-worthy.

37% to 42%: Your debts still may seem manageable, but start paying them down before they begin to spiral out of control. At this level, credit cards still may be easy to obtain, but acquiring loans may be more difficult.

43% to 49%: Your debt ratio is high and financial difficulties may be looming unless you take immediate action.

50% or more: Seek professional help to make plans for drastically reducing your debt before it becomes a real problem.

Want a closer look at your situation? Would you like to see how a new purchase and loan would look to a lender? Talk to the professionals at Mid Oregon Credit Union to learn about all the services available to help you meet your goals. Call us at (541) 382-1795, email to info@midoregon.com, or visit our website www.midoregon.com. We look forward to seeing you soon.