Credit Savvy, our free credit score and monitoring tool, is now even better! The updated feature includes some new and enhanced features, including some you just won’t see in other products of its kind. Here are some of the things that will look a little different when you open up the new and improved Credit Savvy tool:

- Score Analysis. Easily and quickly understand all of the factors that influence your credit score. You’ll see detailed explanations and some ideas for improving your score.

- Personalized Recommendations. We automatically look to see if we can lower your monthly payments on your current or future loans and credit cards.

- Credit Score Event Chart. Visualize the impact to your credit score over time and how key changes can impact it.

- Simulator—all new! Your choices can cause your score to move up or down. Simulate your credit score by selecting possible actions

and see how your score reacts. For instance, you can find out the potential impact to your credit score of such actions as paying off a debt, skipping a payment, increasing a credit limit, or applying for a new loan.

and see how your score reacts. For instance, you can find out the potential impact to your credit score of such actions as paying off a debt, skipping a payment, increasing a credit limit, or applying for a new loan.

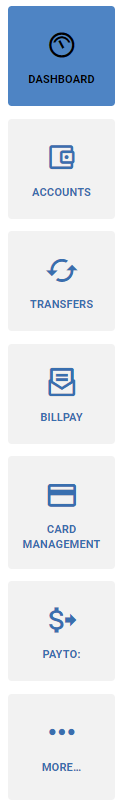

Easy access within Digital Banking

And the best thing about Credit Savvy is you don’t need to share your personal information or create a new login with another company—it’s all located securely inside Mid Oregon’s Digital Banking platform.

Just click the the More…. button on your Dashboard or Accounts view on your computer or mobile device to find the Credit Savvy widget. Answer a few questions to enroll, and you’re all set! You’ll have access to your updated credit score anytime, anyplace.

Take control of your credit score. Try Credit Savvy today!