The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

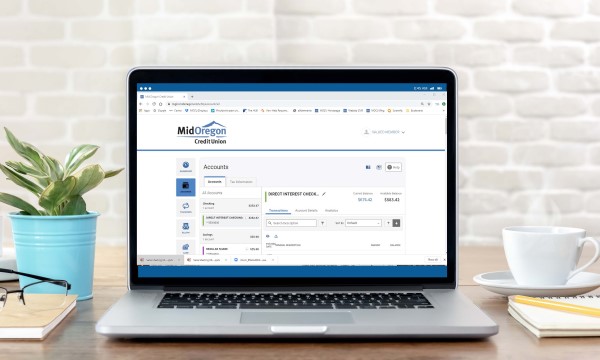

Our New Digital Banking Platform!

It has been a long time coming. The wheels have been in motion for over a year! But it is now here. We are excited to announce the launch of our new digital banking platform.

Improved Member Service Experience

The change to our new system was done for many reasons members will never see. Key factors were integration with other systems, security and more “behind the scenes” reasons. What seems to be please members the most, however, is the experience inside online banking.

“The new mobile/online banking system will vastly improve our member service experience,” says Kevin Cole, Executive VP/CFO. “In its first week of adoption, more than 75 percent of our online banking users logged in to the new system, which indicates how much our members are choosing to manage their money remotely. We are pleased to provide our members with the highest level of digital personal and business account management capability available in the market today to meet their increased need for remote services.”

Robust Features And More Control

The new system is seamlessly integrated, providing exceptional account management flexibility in desktop and mobile banking. Our new technology includes features such as:

• View all your accounts in one location, including external accounts

• Savings goals – set goals, track progress and set alerts

• Card management – block, unblock card access and alerts

• PayTo – send and receive funds to anyone with a phone number or email, with no fees

• Mobile deposit – deposit checks into your account right from your smartphone

• Credit Savvy – see, track and monitor your credit score, get tips on how to improve it, and receive offers based on qualifications

• Track your spending by category—even on non-Mid Oregon accounts!

• Personalized logins for multiple account users

• Full suite of enhanced features just for business users

The new digital banking system also includes all the current mobile/online conveniences of paying and tracking bills online, account transfers, alerts, and electronic statements, plus enhanced security to protect members from fraud.

Patience During The Transition

The transition was relatively easy for most of our members, and some experienced challenges. In spite of generally tripling our Contact Center team, and re-purposing other staff during the transition, factors led to long wait times for help for come. We apologize for their frustration, and thank them for their patience. The few days notice we had for stimulus check distribution and the Payment Protection Program loans didn’t allow time to make any changes and added to member inquiries. We are happy that members, when engaged in the new system, have been enjoyed the expanded capabilities they now have.

We hope they continue to explore the tools at their disposal, and improve their financial well being as a result.

COVID-19 Pandemic Financial Management

The COVID-19 pandemic is not only causing fear and uncertainty about our health, but our livelihood as well. Many wonder “What happens to me and my family if my employer has to lay off people or my hours are cut?” Perhaps you are already experiencing COVID-19 pandemic financial management challenges?

Track Your Expenses

Now more than ever, it’s important to keep track of your expenses to make sure you’re not spending more than you make or increasing your credit card debt. If you feel like you live paycheck to paycheck, then now is definitely time to take a hard look at your expenses, see where you can make adjustments, and take firm control.

Create a Budget

To get control, you need to know exactly what you’re dealing with – how much money is coming in each month and how much is going out. To get a clear picture, create a budget. There are many apps and online templates you can choose from. Many of them provide visual images, like pie charts, that help you see how big of a chunk each expense is taking from your take-home pay.

A budget will tell you if you’re setting aside enough money for the essentials (rent, utilities, food) and how much is being eaten up by non-essentials (like snacks, eating out, cable, or non-essential online purchasing). If money is tight, cancel non-essential subscription services temporarily. You can always restart them when things get better. The silver lining of this pandemic is that since most of us are practicing social distancing to minimize contagion, you may already be saving money by not going out.

Minimize Credit Card Impact

If your credit card debt is high, see if any of your existing cards are offering low interest rates on balance transfers. Transfer the balance from the highest card to a lower interest card and pay more than the minimum whenever possible. Mid Oregon’s VISA credit cards can cost you less, with no balance transfer fees. Also, until you have paid off the debt, only use your credit card for emergencies.

Emergency Savings

Another important task is to beef up your emergency savings or start an emergency savings account if you haven’t done so. Ideally, you want to save at least 3 months of your take-home pay. You can start with as little as $5 a week. Simply save $5 consistently each week and when you think you can add a little more, increase your deposit. To make this easier, set up an automatic transfer from your checking account.

Mid Oregon’s online banking provides a savings goal tool that makes it easy to set and track your emergency fund and other savings goals. New online banking users can easily register on our website.

Mid Oregon also has additional ways to support our members. At this time we are also offering our members CARE Loans, Refinance options, Skip-A-Payments and more. Know that Mid Oregon Credit Union is still here for you. Current information is available on our COVID-19 Update page.

Paycheck Protection Loans Approved

776 Jobs Protected

Mid Oregon Credit Union, as the only financial institution headquartered in Central Oregon, completed approval of 37 Paycheck Protection Program (PPP) loans during the past week. The total approved funding from SBA (Small Business Administration) was $9,309,789 that protected 776 jobs in Central Oregon. The average number of employees per per business borrower is 21, and the average loan amount was $251,615.

“Our Commercial Services team did a great job of working through the red tape to get this program funding secured for our business members.” says Kevin Cole, our Executive VP/CFO. “The demand and volume of interest for this program was overwhelming, and it was a fast and furious week to accomplish this level of loan funding in such a short time frame.”

Another Round of Funds Coming Available

The Paycheck Protection Program exhausted the $349 billion federal stimulus package last week, and Congress approved another $310 billion this week to support the businesses still in need of help who were not approved in the initial program funding. We have received an additional 90 applications in anticipation of the system coming back online for more lending to small businesses.

We understand many businesses which wanted the program didn’t get in on the first round, we hope many are able to get funding in round 2. Our Commercial Services team did it’s best to respond under very challenging circumstances, and we are thankful so many were approved.

Challenging Circumstances

In spite of staff working remotely, a rushed federal program roll out with little warning, stimulus checks going out at the same time (and all the calls to find out when they would arrive) and our long-scheduled online banking platform upgrade, much was accomplished. We appreciate the work done by our team.