The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Supplies 4 Schools Raised $2,725!

The credit union and community rally together to provide students with supplies.

Mid Oregon Credit Union and Supplies 4 Schools raised $2,725 during our annual Supplies 4 Schools drive. This year’s campaign included school supply donations as well as cash contributions to better support local students and families who are facing increased financial hardships due to COVID-19 and the shift to remote learning.

Mid Oregon Matched $1,000 of Donations

Throughout August, the credit union’s seven branch locations collected donations from members and the community. Mid Oregon pledged to match the first $1,000 donated in cash, which contributed to the overall total of $2,725.

The Supplies 4 Schools funds and supply donations will stay in the local community where they were collected. Mid Oregon partnered with Family Access Network (FAN) and school districts to distribute the supplies to students in Deschutes, Crook, and Jefferson Counties who lack the necessities to be successful at school.

“We are grateful for the generous support of our members and local communities during the Supplies 4 Schools drive,” says Kyle Frick, VP of Marketing for Mid Oregon Credit Union. “These donations are helping local families and their children in their preparations for this unique school year.”

FAN Advocates Work Directly With Students

Julie Lyche, Executive Director of Family Access Network, adds, “Last year, FAN connected 2,190 students to school supplies. Even though this year is different, kids still need the items they would use at school, and FAN advocates are making sure that they have access to these items. This year, we are seeing a greater need for over-the-ear headphones for elementary students and earbuds with microphones for older students. Mid Oregon Credit Union’s contribution makes a difference in helping source these items.”

Family Access Network offers assistance, possibility, and hope to Central Oregon families in need by connecting them with crucial resources that will help children flourish in school and life. FAN is unique to Central Oregon, located in all public schools in Deschutes County and Prineville. Dedicated FAN advocates work with families to connect students with essential services such as food, shelter, heating, health care, clothing, and more. To donate or learn more, visit http://familyaccessnetwork.org/.

Telling-A-Friend Is Win-Win!

We love rewarding our members when they spread the word about our great checking accounts—that’s why we introduced our Tell-A-Friend program. When your friend opens a Mid Oregon checking account, you’ll both get a reward! We’ll buy back their old debit cards and checks for up to $10, and enter them to win a prize! (Prize through October 9th is an Amazon Blink Two-Camera Package). But Telling-a-Friend is win-win!

What do you get when you refer someone? A $10 gift card! And there is no limit, so you can keep referring. As long as the person you refer provides us with your name and email address, your award will be automatic.

But for a limited time, you are also entered to win an Amazon Blink Two-Camera Security Package! Details are below.

Many Ways To Refer

There are three easy ways to refer your friends:

First, you can obtain a Mid Oregon Tell-A-Friend referral slip, complete your information on the back and give it to your friend. We will capture your information when they present the coupon as they open their checking account.

First, you can obtain a Mid Oregon Tell-A-Friend referral slip, complete your information on the back and give it to your friend. We will capture your information when they present the coupon as they open their checking account.

Second, you can email your friend automatically using our online referral page. Just visit the page, complete your information, and enter your friend’s name, email address, and a brief personal message before you send. When your friend opens their checking account, our new account representative will see you sent them an email, and complete the process.

Second, you can email your friend automatically using our online referral page. Just visit the page, complete your information, and enter your friend’s name, email address, and a brief personal message before you send. When your friend opens their checking account, our new account representative will see you sent them an email, and complete the process.

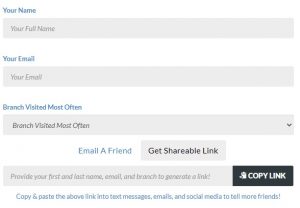

And now you can also share through your own email or social media with a shareable link. Visit the same web page at https://refer.midoregon.com/. Instead of clicking “Email A Friend”, click “Get Shareable Link”. That will produce your personalized URL you can copy and paste into any number of places. When the friend opens their new checking account, you will be credited with the referral. Telling-a-Friend is a win-win!

And now you can also share through your own email or social media with a shareable link. Visit the same web page at https://refer.midoregon.com/. Instead of clicking “Email A Friend”, click “Get Shareable Link”. That will produce your personalized URL you can copy and paste into any number of places. When the friend opens their new checking account, you will be credited with the referral. Telling-a-Friend is a win-win!

Win an Amazon Blink Two-Camera Package

And now through October 30, 2020, you’ll also be entered into a free drawing for an Amazon Blink Two-Camera Package.

The Blink XT2 Outdoor/Indoor Smart Security 2 camera kit comes with cloud storage included, 2-way audio, 2-year battery life. You’ll get Extended battery life, on two AA lithium batteries with a combination of two-way talk, live view, and motion recording. And it works with Alexa – View live streams, motion clips, arm and disarm your system, and set up smart reorders for batteries through select Alexa-enabled devices.

Just visit refer.midoregon.com to start referring. There’s no limit—you can refer as many friends as you like (and earn as many gift cards as you want). You don’t even need to have a Mid Oregon checking account to Tell-A-Friend and be entered to win. Although why would you miss out on all the savings and convenience by having your checking account anywhere else?

Amazon Blink Two-Camera Package Drawing Rules: No purchase necessary to enter or win a prize. Must be 18 years of age or older. Entries accepted through October 30, 2020. No cash equivalent, substitution or transfer of prize permitted. One entry per person. Other restrictions apply. See a Mid Oregon associate for details.

Say ‘I Do’ Without the Debt

Something old, something new, something borrowed, something blue —a sweet wedding tradition, unless the something borrowed is thousands of dollars to pay for the big day. Is it possible to say ‘I do’ without the Debt?

Money issues are the number 1 cause of marital conflict, so it doesn’t make sense to start married life with enormous debt. Sometimes a financial rough spot is unavoidable, such as when a spouse loses a job. But wedding-related debt is an entirely avoidable hurdle.

Know what you can afford and work with what you have

The average wedding these days costs between $25,000 and $35,000. However, you can make the big day memorable and special without breaking the budget. It just requires the right attitude, a willingness to be flexible, and creativity.

Starting out richer rather than poorer

Those in the wedding business agree that there are countless ways to cut costs without sacrificing the dream. The key is identifying what one or two things are most important to you and your future spouse so you can splurge in those areas and economize in others.

For example, one bride put together a wedding for 150 people at a cost of just $1,500. The trick was to splurge on fresh flowers (her “must have”) and good champagne (her fiancé’s indulgence) and keep everything else simple. They also asked friends and family for help, including borrowing a friend’s wedding dress.

You can achieve elegance and individuality with half the money. Here are other ways to cut costs without sacrificing the dream:

- Don’t wed during peak season. You’ll have more leverage in negotiating prices on everything from catering to the band if you can avoid getting married during the height of wedding season.

- Lower the guest count. A shorter guest list not only keeps costs down, it creates a more intimate and personal affair. Consider inviting only your immediate family and closest friends.

- Consider options for the reception. A brunch buffet usually is less expensive than a sit-down dinner or a served brunch. Serving midafternoon hors d’oeuvres instead of a full meal can also be a good money-saving option.

- Limit the number of attendants. Having many attendants will mean more plates at the rehearsal dinner as well as more bouquets and boutonnieres. And, gifts for the wedding party can be expensive. Allow those closest to you to participate another way.

Talk About Your Budget

It’s important to know what you can comfortably afford before making your plans. Sit down with your future spouse and your parents and create a budget. Determine ahead of time how much you can afford to spend and then stick to your plans. There are many online wedding budget planners to help you. Make sure to include miscellaneous expenses, like tips, the marriage license fee, attendant gifts, and thank you cards.

Here are additional tips to avoid post-wedding money troubles:

- Pay off credit cards as you use them. Using a credit card to pay for deposits can be smart, but make sure to pay your credit card bills each month. If you can’t pay them in full, then pay more than the minimum monthly payment.

- Don’t count on cash gifts to pay for your wedding. Spend only what you can afford to on your own and use any money you receive to help you with your important financial goals.

- Communicate with each other. Talk often and openly about the wedding budget, bills to be paid, and choices to be made.

You can keep your special day uniquely yours, but still within your budget. Start married life on a solid financial footing with as little debt as possible to help ensure you have many happy years together.