The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Information about 2021 Economic Impact Payment

With the new American Rescue Plan Act of 2021, you may have questions about the latest Economic Impact Payment. Mid Oregon Credit Union has assembled some information and resources to assist our members and the community.

The 2021 Economic Impact Payment differs slightly from the past two stimulus payments. Changes include:

- Eligible households should receive $1,400 for individuals or $2,800 for married couples, and $1,400 per eligible dependents.

- Higher earners receive smaller to no payments. If your Adjusted Gross Income (AGI) from your 2019 or 2020 tax returns is more than $75,000 per individual, or $150,000 for joint filers, your payment may be lower, or be phased out entirely.

- Dependents older than age 16 from eligible households will receive $1,400 payments.

To estimate your payment, you can use this quick calculator from Grow.

Where can you find information about your payment?

The IRS’s Get My Payment webpage is your best resource. It includes the Get My Payment tool, answers to frequently asked questions, and links to information about the first and second Economic Impact Payments and the 2020 Recovery Rebate Credit.

When will payments arrive?

Electronic payments started as early as March 12 and could continue for several weeks. Paper checks or debit cards mailed to households may take a bit longer to arrive.

How do I know when my payment has been received?

You may need to check your financial institution’s account over the next few weeks for a deposit. The most efficient way to use your institution’s online banking. If alerts are available with your online banking, set one to be notified any time a deposit is processed. Using online resources will save time and prevent potential phone or in-person wait times with your institution. During these periods, financial institutions typically experience a higher number of calls and visits to branches. For more information about Mid Oregon’s online (digital) banking, click here.

What if an address or account number has changed?

Payments should be issued to consumers in the same manner as their prior Economic Impact Payment. If you had difficulties with a previous round of payments or something has changed, you should visit the IRS’s Get My Payment webpage for answers to your questions and to update your information on file.

What if I received a payment by debit card?

To learn more about activating and using an Economic Impact Payment (EIP) card, visit the Federal Treasury website. The site also provides instructions on how to transfer debit card funds to your financial institution. To set up the transfer, you will need your financial institution’s routing number and account number.

For additional updates about the 2021 Economic Impact Payment, visit Mid Oregon’s COVID-19 information webpage.

The Case for Married Couples to File Joint Tax Returns or Separate Tax Returns

By Chris O’Shea* The annual tax season comes with a question for married couples: Do you file jointly or separately? While most married couples file together, there are some reasons you might want to consider filing separately.

Here’s the case for both methods.

Why You Should File Jointly

Lower tax rate. Typically, married couples who file jointly enjoy a lower tax rate than married couples who file separately.

Tax benefits. As US News reports, if you’re married, you need to file jointly to qualify for some tax breaks. If you file jointly, you’re eligible for the Earned Income Credit, the American Opportunity Credit, the Lifetime Learning Credit, student loan interest deduction and more.

Deducting retirement contributions. If you file jointly, you’ll have higher income cutoffs to make Roth IRA contributions. Married couples can contribute to a Roth IRA if their adjusted, joint-tax return lists a modified adjusted gross income of less than $208,000 in 2021. If you’re married and filing separately, the income cutoff drops all the way down to less than $10,000.

Why You Should File Separately

You and your spouse are high earners. If you and your spouse earn high incomes that are roughly the same, it might make more sense to file separately. Your tax rate might actually be lower if you take the separate returns route.

You have high medical costs. Another reason to file separately is if you have high medical bills. You can deduct unreimbursed medical expenses, but only if they exceed 7.5 percent of your adjusted gross income. If you have extensive medical bills, it might make sense to file by yourself so you can easily cross that 7.5 percent threshold.

You’re concerned about liability. If you’re concerned about tax liability, you might want to file separately. If you file your own forms, you won’t be tied to your partner’s potential tax or legal issues.

This guest article is from the “Your Money Blog” in ‘Mid Oregon’s Digital Banking Credit Savvy resource’. It is made possible by Savvy Money. “The Case for Married Couples to File Joint Tax Returns or Separate Tax Returns” was published in March 2021.

Credit Savvy free credit scores—now even better!

Credit Savvy, our free credit score and monitoring tool, is now even better! The updated feature includes some new and enhanced features, including some you just won’t see in other products of its kind. Here are some of the things that will look a little different when you open up the new and improved Credit Savvy tool:

- Score Analysis. Easily and quickly understand all of the factors that influence your credit score. You’ll see detailed explanations and some ideas for improving your score.

- Personalized Recommendations. We automatically look to see if we can lower your monthly payments on your current or future loans and credit cards.

- Credit Score Event Chart. Visualize the impact to your credit score over time and how key changes can impact it.

- Simulator—all new! Your choices can cause your score to move up or down. Simulate your credit score by selecting possible actions

and see how your score reacts. For instance, you can find out the potential impact to your credit score of such actions as paying off a debt, skipping a payment, increasing a credit limit, or applying for a new loan.

and see how your score reacts. For instance, you can find out the potential impact to your credit score of such actions as paying off a debt, skipping a payment, increasing a credit limit, or applying for a new loan.

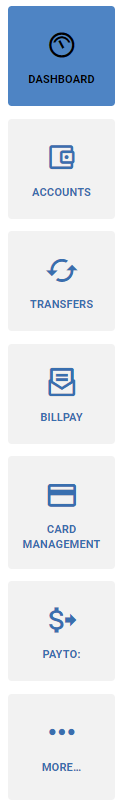

Easy access within Digital Banking

And the best thing about Credit Savvy is you don’t need to share your personal information or create a new login with another company—it’s all located securely inside Mid Oregon’s Digital Banking platform.

Just click the the More…. button on your Dashboard or Accounts view on your computer or mobile device to find the Credit Savvy widget. Answer a few questions to enroll, and you’re all set! You’ll have access to your updated credit score anytime, anyplace.

Take control of your credit score. Try Credit Savvy today!