The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Elder Fraud On the Rise-$3.5 Billion and Growing

There’s a segment of the U.S. population particularly vulnerable to online and other scams. The 60+ year old community is under attack, and the complaints are on the rise. The FBI’s Internet Crime Complaint Center (IC3) reports last year saw an 11% rise in complaints of elder fraud over the previous year. It’s now a nearly $3.5 billion criminal scheme to defraud this at-risk group — and it’s only getting worse.

Elder Fraud by The Numbers

The 2023 IC3 Elder Fraud Report takes a deep dive into the problem at hand including the statistics behind fraud victim complaints to the agency. Some of the leading complaint categories include tech support, confidence/romance, and investment. Cryptocurrency fraud also played a significant part with financial losses, including crypto investment scams.

Why 60+ = Target

Seniors present a tempting target because many have a financial nest egg that scammers love to crack, with some victims losing their entire savings to scams. Also, seniors tend to be trusting. Remember, it’s a generation that didn’t grow up with technology and that could help explain why tech support and cryptocurrency scams are so successful. The IC3 finds there were 17,696 tech scams and 12,284 crypto scams reported.

Avoiding Elder Fraud

Elder Americans can help keep scam opportunities at a minimum or avoid them altogether. It’s safe to assume there will always be attempts, but knowing ahead of time what a scam looks like and what to do about it is invaluable.

- Limit personal information on Facebook and other social media and never post birthdates, special events or family names. Scammer’s troll these websites for information they can use to pull you into a scam.

- If you don’t recognize a phone number, don’t answer. The same goes for unknown email senders, and never open their attachments.

- Don’t be pressured or scared into acting. Legitimate organizations never use pressure tactics, and the IRS and other agencies will only contact you by mail.

- If you have been scammed, report it immediately to the FBI or IC3, local law enforcement and your financial institution. Consider putting a freeze on your credit report since it can help limit your financial liability, and regularly check your banking statements and credit reports for unusual activity.

- Protect your financial and other accounts by using strong passwords that are a minimum of eight characters and a mix of letters, numbers, and symbols. If you suspect an account has been breached, change your password as soon as possible and enable multifactor authentication (MFA) whenever it’s available.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1.

Content provided by Stickley on Security.

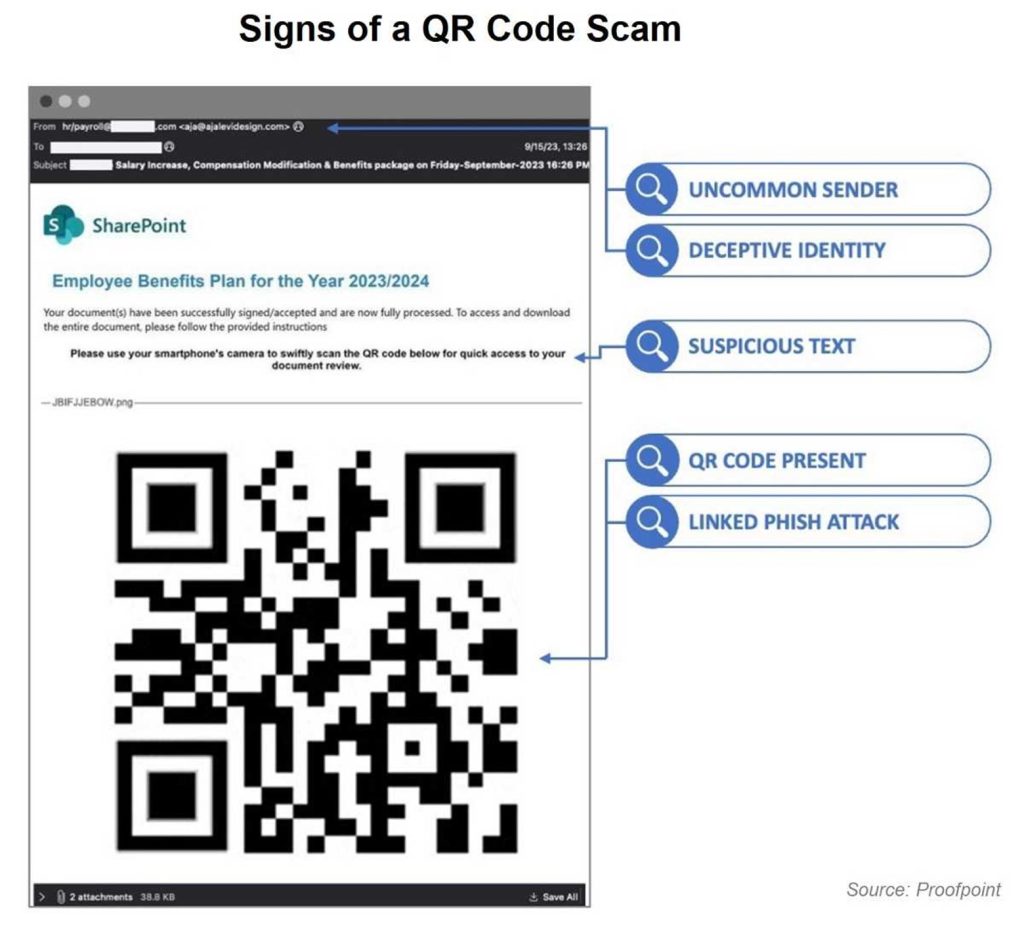

Tips for Safe QR Code Scanning

In our fast-paced digital world, QR (quick response) codes have gained immense popularity. These codes are now found everywhere, from TV screens to product packaging and websites. However, while we appreciate their convenience, cybercriminals are also taking advantage of them for malicious purposes.

To help you enjoy the benefits of QR codes safely, here are some essential security tips:

Be Skeptical

Approach QR codes with the same skepticism you apply to other tech tools. Just as you verify suspicious emails and texts, you need to scrutinize QR codes as well. A compromised QR code can lead you directly to a hacker’s website, where they may steal your personal information, passwords, and money or even infect your device with malware.

Examine Public QR Codes

Be cautious of QR codes found in public places. Cybercriminals may manipulate these codes by placing a malicious one over the original on posters, flyers, menus, and other materials. Check closely for any signs of tampering—look for codes that seem out of place, are oddly sized, or have unusual markings.

Check the URL

When scanning a QR code that redirects you to a webpage, carefully inspect the URL for any spelling errors. Cybercriminals often create fake URLs that closely resemble legitimate ones. These “spoofed” websites aim to steal your personal information. If you encounter a spoofed banking site, for example, any data you enter could fall into the hands of criminals.

Use Built-in Features When Possible

Before downloading a QR scanning app, first check if your device’s camera has a built-in QR scanning feature. If you do need a separate app, only download it from official sources like the Google Play Store or the Apple App Store. Avoid third-party app stores, as they are often less secure and may contain malicious software.

Consider Your Purpose for Scanning

Think carefully about why you’re scanning a QR code. While scanning for quick information is generally safe, use caution if the code is linked to financial transactions or personal information. Whenever possible, type the legitimate web address directly into your browser and bookmark it for future access.

Keep Your Device Updated

Regularly update your device’s software and use antivirus software. Software updates fix security vulnerabilities, and antivirus programs help protect against malware. Don’t delay keeping your device secure.

In a world where a simple QR code scan can expose you to risk, practicing a security-minded approach is essential for your safety.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1.

Content provided by Stickley on Security.

Boo! October is Financial Planning Month

Checking in with your finances doesn’t have to be scary. Mid Oregon has the resources to help you navigate those budgetary haunted houses.

Ah, October… the month when the leaves turn pretty colors, the kids are back in school and it’s time to choose your Halloween costume. October also happens to be Financial Planning Month, which means it’s the perfect time to review your financial goals.

No matter what your life stage is, this month isn’t just about crunching the numbers, it’s an opportunity to get back on track.

Some of us are already on top of our financial futures, and some of us are hoping for the best. Gaining control over your finances; bracing yourself for unforeseen expenses; setting and tracking savings goals; and making strides towards long-term financial security, are all important strategies made easier by taking advantage of the tools and services that Mid Oregon provides.

Budgets: Review, Refresh or Start from Scratch

Utilize this month as an opportunity to review and revitalize your financial plan—or start working on a plan for the first time. Mid Oregon’s Digital Banking has tools to help you review your current budget, savings, and investments to identify areas of opportunity.

Mid Oregon’s Financial Wellness widget in Digital Banking, efficiently categorizes your spending into various categories over time.

There are many ways to budget, you can read more about some of them in the Mid Oregon Blog.

Savings: Start Small and Watch it Grow

Are you new to saving money, or have you had a hard time getting started? Pick something small like a new outfit, a needed tool or something for your home and set aside a small amount each week. Set a time frame to achieve your goal and track your progress on a calendar, your refrigerator, in Digital Banking or whatever works for you. Set check in points, and when you are on track to your goal reward yourself with something small like a fancy coffee or rent a movie, you’ve been wanting to see.

Goals can be tracked easily in Mid Oregon’s Digital Banking App (under Financial Wellness/Savings Goals). Set a goal and start saving. Set up several goals and have the system divide each deposit or funnel money into a specific goal. You’ll get notifications when you reach a goal. Celebrate it!

Financial Health: Get a Free Financial Checkup

Mid Oregon members receive free access to a powerful resource for getting a handle on their finances. Financial Checkup takes you through an anonymous, questionnaire to organize your information on income, debt, and expenses. Simply answer a few questions and in just minutes, you will receive a thorough analysis of your financial situation. Additionally, you will receive tips by leading financial experts to help manage your debt and build a budget.

Know Your Most Important Score

Improving your credit score is another crucial aspect of financial wellness, and Mid Oregon can help you navigate this process. Many of us don’t keep track of our credit scores, but having a good score influences the type of financial options available to you—including interest rates on loans.

Mid Oregon has a free, secure option that can help you take charge of your credit. My Credit Score on our Digital Banking platform can help you improve your score, and monitor for potential fraud. When you enroll, you receive anytime, anywhere access to your credit score. Plus, you’ll receive simple, straightforward tips that you can use to improve your score.

Invest in Your Financial Education

Take the time this month to learn something new about personal finance. Whether through books, podcasts, or videos, expanding your knowledge on topics like investing, retirement savings, or debt management can have a significant impact. Enhancing your financial literacy is an investment in your future.

Mid Oregon holds free, in-person financial workshops on topics such as retirement, estate planning, social security, investments and more. We also have past workshops you can view on our YouTube channel. Additionally, our Financial Tips section on our homepage has a variety of articles on budgets, saving money, fraud prevention, and more. Ultimately, Financial Planning Month is about empowering you to take control of your financial future and make decisions that foster stability and growth. Your Mid Oregon team is here to help you every step of the way—please stop by, call, or visit us online at midoregon.com. We also encourage you to stay tuned to future member newsletters, blogs, and workshops for more financial fitness topics.