The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Ways To See If Your Data Has Been Stolen

With all the data breaches, whether by intrusion or accident lately, it’s likely your information was exposed somehow to someone you didn’t intend. After all, the marketing company Exactis, exposed hundreds of traits on us in 350 million records. Yahoo let out email addresses and passwords on billions of people, and of course who can forget the massive breach of Equifax just last year that resulted in sensitive data being let go on nearly half the population of this country. There is a lot of information that gets leaked on us and the more the bad actors have on us, the more targeted their phishing campaigns can be. So, it is a good idea to just check and find out if your credentials or online accounts have been found on the dark web as a result of these or any number of data breaches to stay a tiny step ahead of the hackers. See if your data has been stolen.

See If Your Data Has Been Stolen

While it normally isn’t recommended to use browser extensions or add-ons, there is one for Google Chrome that can check your passwords against the site HaveIBeenPwned. It’s called PassProtect. You can get it from the Chrome Web Store.

Firefox has something similar called Firefox Monitor, which should be available to all very soon. This is actually built into the browser, making it a bit more secure than Google’s version. It uses the same site to check for your credentials using various queries that keeps your information safe. Try updating your Firefox browser and it may already be included. If not, it will be soon.

You can also go directly to the website HaveIBeenPwned to see if your email address has been located as a result of various breaches.

Changing Your Email Password

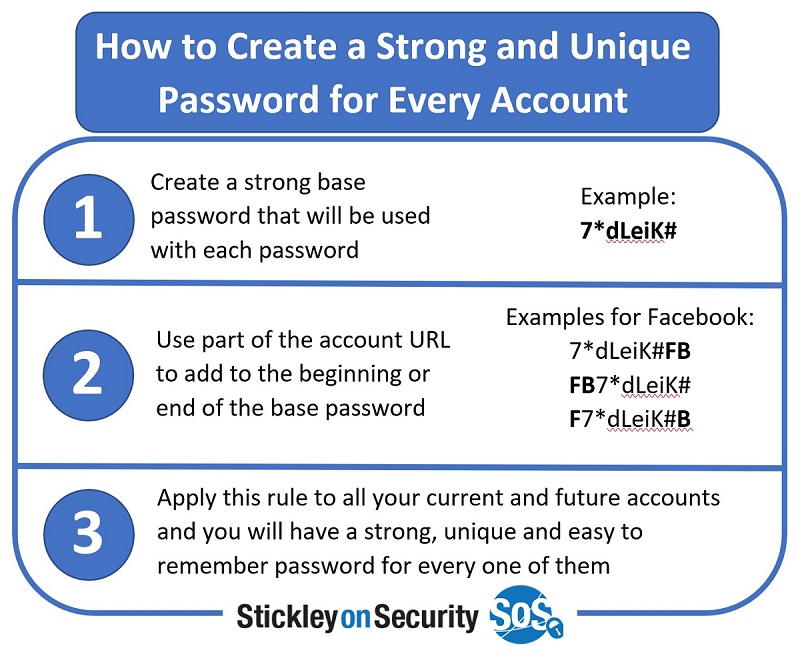

It’s always wise to change your email password from time to time. Make sure to use strong ones and include special characters, upper and lowercase letters, as well as a number or two. In fact, each online account needs its own unique password. And yes, it’s getting a little overwhelming to remember them all, but it is really needed these days. Think about how many you’d have to change if you used the same one as what you used for your Yahoo email and it got stolen. Whew! That may take a while.

It is important to change them periodically too. Cybercriminals use a technique called a brute force attack using automated tools to pound on websites using credential sets to find out which ones work. They are very successful doing this. If they get one and you use it elsewhere, they have it for those accounts too.

Remembering Your Passwords

There are ways to help you remember your passwords. You can keep a written list and tuck it away in a drawer that you keep locked when you’re not nearby. It’s pretty old-school, but it’s better than typing it and keeping it on your computer. You can type a list and use password clues rather than writing out your passwords. Still risky, but better than using the same password on multiple accounts.

You can use a password manager. However, heed cautionary advice with these. While they are getting better at protecting your passwords by strengthening their encryption and/or employing multi-factor authentication, there is still a risk that if a hacker gets into those companies’ networks, they can get all of your passwords.

Make changing your passwords a ritual, like switching out your smoke detector batteries on January 1 every year; only do it more often. That’s really a great way to protect your information and keep the hackers on their toes, especially if you see if your data has been stolen.

Keep up to date on your online safety through Stickley on Security on MidOregon.com.

BEFORE YOU BUY A NEW CAR: 3 Things You Need to Know

There are many things to consider before purchasing ANY car, but a NEW car might spark particular questions. There are pros and cons to buying new cars, just as there are pros and cons to buying used cars. You should figure out a few things before you buy a new car.

Ask Yourself Why Before You Buy A New Car

First off, when purchasing any vehicle, ask yourself “Why am I buying this car?” Is it for daily use, will you need a lot of storage space, seating space? Make sure the makes and models you narrow your search down to are practical reflections of how you will use the car.

You may love the look of a larger vehicle, but if you don’t have five children, you might not need that much space and that particular car may not be right for your daily commute and errands.

How Does It Fit For You

After you’ve considered the personal aspects of which car to buy, move on to the less subjective parts of the process:

1. Depreciation

Most cars depreciate at about 15% per year. With new cars, there is a 20% depreciation rate as soon as you drive off the lot. You want to consider this before you decide to buy a new car, especially if you can’t put much money down as a down payment. Chances are you’ll be upside down on your car loan almost immediately if you’re financing the entire cost.

2. Cost-to-own

Also, consider the true cost to own the car you’re eyeing. These costs include insurance, fuel, maintenance, and more. Maintenance costs vary by manufacturer and model. Do your research—some manufacturers have better reputations than others. Some new cars even come with “free” maintenance plans for the first couple of years or for a certain number of miles.

3. How much can you afford?

Don’t guide yourself solely by what the dealership is willing to lend you. And, don’t be blindsided by an attractive low monthly payment—oftentimes tied to a super-long loan term. Consider all aspects of financing—the total amount you are going to end up paying for that vehicle when it’s all said and done. Before you buy a new car, that’s what matters.

Options and Resources

Mid Oregon is presenting a free webinar on Tuesday, October 19, called “Get the Best Car Deal”. Register for the 7 p.m. webinar. Learn more about other Mid Oregon financial education webinars.

Are you in the market for a car? In today’s environment, is it more important than ever to make a good purchase decision.

Find out how to save money and remain in control of your car deal. Learn how to determine how much car you can afford, deal with dealers, negotiate the best car price, benefit from buying used and figure out finance options.

For more information on finding the right new car for you, researching options and available local inventory, take a look at our AutoSmart webpage today!

Read other articles about car buying and auto loans.

And then visit Mid Oregon Credit Union before you even step on the lot. As a not-for-profit financial cooperative, we can approve you for an auto loan that fits your circumstances—and your budget. We won’t put you into a loan you can’t afford, and we’re happy to explain everything to you away from the high-pressure of the dealership. If you have a trade-in, we can help you determine a value for that, too. Or, call us at (541) 382-1795 or email to beheard@midoregon.com.

Keeping Your First Credit in Good Standing

Credit is a very tempting risk. As soon as you have all that available money at your disposal, all kinds of impulses can take hold of you. Stories abound of people getting numerous credit cards and going on spending sprees. Do you really think about keeping your first credit in good standing?

The Credit Hangover

Only after the bills come to their mailboxes do they feel the hangover. If it’s bad enough, they can feel it for many, many years. If you are one of them, you can be denied credit in the future, and you can even lose employment opportunities. You can be denied other loans, such as car and home loans. Such are the costs of abusing credit. With this in mind, here are some simple tips for wise use of that little plastic card:

Simple Tips

- Never think of credit as free money. Credit is not free money. You have to pay it back, often with interest.

- Understand what your credit history is made of. Your credit history is made up of several factors. It is 35% payment history, 30% amount owed, 15% length of your credit history, 10% new credit, and 10% type of credit used. As you can see, payment history factors in the most. A detailed explanation of each of these factors can be found at Experian.com.

- Be patient. Building good credit takes years. It is a lifestyle made up of responsible money habits. Give it time.

- Use your card regularly. Using your credit card regularly helps build up your credit history.

- Pay your balance fully each month. As you use your card regularly, it is wise to charge small amounts and pay them off each month. That way, you build up a payment history, and you also avoid interest charges.

- Pay your bills on time. The largest component of your credit score is payment history.

- Don’t use too much credit. Avoid this temptation. If you can use cash instead, do that.

- Don’t use it frivolously. Again, charge only small amounts.

- Use it for things you already have money for. This will help ensure that you pay your balance in full each month. But more importantly, it is an easy way to help you build a credit record.

Looking at Credit Differently

To quote the great comedian Bob Hope, “A bank is a place that will lend you money if you can prove that you don’t need it.” This paradox is resolved when you see it from the bank’s point of view. It loans you money out of its vault so that it can earn money in return. It’s a business. Those who do not need credit are therefore the most likely to be able to pay the bank back.

Other Resources

- Mid Oregon has resources to help you manage your credit. Here are a few:

- Mid Oregon’s online banking tool, Credit Savvy.

- Mid Oregon’s recent “Managing Your Credit” webinar. Watch the video. View the presentation slides.

- Read Mid Oregon’s Blog articles about credit .

- Mid Oregon branch locations to talk to a loan officer about your credit.

- Order your credit report, free

Contact us today to learn more, and to get help keeping your first credit in good standing.