The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Pyramids and Promises. Don’t Get Burned by Fake Investments

The Allure of Easy Riches: Unmasking High Return Investment Scams

In the pursuit of financial growth, the promise of high returns with minimal risk can be incredibly enticing. Unfortunately, this enticing prospect is often a siren song leading to financial ruin, as it’s a hallmark of various insidious investment scams. From the classic Ponzi and pyramid schemes to the more modern “pump and dump” and fake cryptocurrency rackets, these frauds prey on optimism and a desire for quick wealth.

The core of these scams lies in a deceptive assurance: significant profits with little to no effort or danger. This directly contradicts the fundamental principle of legitimate investing, where higher returns inherently come with higher risk. Scammers, however, artfully craft narratives to make the impossible seem plausible.

Let’s break down some common forms of these deceptive schemes:

Ponzi Schemes

Named after notorious con artist Charles Ponzi, these schemes promise high returns to early investors, paying them with funds collected from later investors. There’s no actual legitimate business or underlying investment generating profits. The illusion of success is maintained as long as a continuous stream of new money flows in. When the recruitment of new investors slows or stops, or when too many existing investors try to cash out, the entire structure collapses, leaving the vast majority with nothing.

Pyramid Schemes

Similar to Ponzi schemes, pyramid schemes primarily focus on recruitment. Participants pay a fee to join and then earn money by recruiting new members who also pay fees. While some pyramid schemes may involve the sale of a product or service, the emphasis is overwhelmingly on recruitment, not genuine sales to end consumers. The vast majority of participants at the bottom of the pyramid are destined to lose their money, as the pool of potential recruits eventually dries up.

“Pump and Dump” Schemes

These scams typically involve manipulating the price of a thinly traded stock or, increasingly, a lesser known cryptocurrency. Scammers acquire a significant amount of the asset at a low price. They then “pump” its value by spreading false or misleading information, often through social media, online forums, or unsolicited emails, creating artificial demand and driving up the price. Once the price is sufficiently inflated, the scammers “dump” their holdings, selling off their shares at the inflated price, causing the asset’s value to crash and leaving other investors with worthless holdings.

Fake Cryptocurrency Investments

The unregulated and often complex nature of the cryptocurrency market makes it a fertile ground for scammers. These schemes can be variations of Ponzi or “pump and dump” schemes, where fraudsters create fake cryptocurrencies or platforms, promising astronomical returns. They might even allow small withdrawals initially to build trust before absconding with larger investments. The anonymity and difficulty in tracing crypto transactions make it particularly challenging for victims to recover their funds.

Warning Signs to Heed

Protecting yourself from these scams requires a healthy dose of skepticism. Be acutely wary of:

Unsolicited Investment Advice

If someone you don’t know or didn’t seek out offers you a “can’t miss” investment opportunity, especially through social media, email, or cold calls, it’s a major red flag.

Guaranteed High Returns with Little to No Risk

This is the ultimate oxymoron in the investment world. Every legitimate investment carries some degree of risk, and higher returns invariably mean higher risk. Any “guaranteed” high return should be immediately viewed as suspicious.

Pressure Tactics and Urgency

Scammers often try to rush you into making a decision, emphasizing that the opportunity is limited or exclusive. They don’t want you to have time to research or consult with trusted advisors.

Lack of Transparency

If the investment strategy is overly complicated, secretive, or the promoter can’t provide clear, concise answers to your questions, walk away.

Unlicensed Individuals or Unregistered Investments

Legitimate investment professionals and products are typically registered with regulatory bodies. Always verify licenses and registrations.

Focus on Recruitment over Product Sales

In schemes involving products, if the emphasis is on bringing in new investors rather than selling to actual customers, it’s likely a pyramid scheme.

Demands for Cryptocurrency or Wire Transfers

These methods of payment are often preferred by scammers because they are difficult to trace.

In the world of investing, if an offer sounds too good to be true, it almost certainly is. Thorough research, independent verification, and a healthy dose of skepticism are your best defenses against falling victim to these pervasive and financially devastating scams. Always consult with a licensed and reputable financial advisor before making any significant investment decisions.

Education is your best defense against fraud. To learn more about protecting your personal information and finances, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1.

Elder Fraud On the Rise-$3.5 Billion and Growing

There’s a segment of the U.S. population particularly vulnerable to online and other scams. The 60+ year old community is under attack, and the complaints are on the rise. The FBI’s Internet Crime Complaint Center (IC3) reports last year saw an 11% rise in complaints of elder fraud over the previous year. It’s now a nearly $3.5 billion criminal scheme to defraud this at-risk group — and it’s only getting worse.

Elder Fraud by The Numbers

The 2023 IC3 Elder Fraud Report takes a deep dive into the problem at hand including the statistics behind fraud victim complaints to the agency. Some of the leading complaint categories include tech support, confidence/romance, and investment. Cryptocurrency fraud also played a significant part with financial losses, including crypto investment scams.

Why 60+ = Target

Seniors present a tempting target because many have a financial nest egg that scammers love to crack, with some victims losing their entire savings to scams. Also, seniors tend to be trusting. Remember, it’s a generation that didn’t grow up with technology and that could help explain why tech support and cryptocurrency scams are so successful. The IC3 finds there were 17,696 tech scams and 12,284 crypto scams reported.

Avoiding Elder Fraud

Elder Americans can help keep scam opportunities at a minimum or avoid them altogether. It’s safe to assume there will always be attempts, but knowing ahead of time what a scam looks like and what to do about it is invaluable.

- Limit personal information on Facebook and other social media and never post birthdates, special events or family names. Scammer’s troll these websites for information they can use to pull you into a scam.

- If you don’t recognize a phone number, don’t answer. The same goes for unknown email senders, and never open their attachments.

- Don’t be pressured or scared into acting. Legitimate organizations never use pressure tactics, and the IRS and other agencies will only contact you by mail.

- If you have been scammed, report it immediately to the FBI or IC3, local law enforcement and your financial institution. Consider putting a freeze on your credit report since it can help limit your financial liability, and regularly check your banking statements and credit reports for unusual activity.

- Protect your financial and other accounts by using strong passwords that are a minimum of eight characters and a mix of letters, numbers, and symbols. If you suspect an account has been breached, change your password as soon as possible and enable multifactor authentication (MFA) whenever it’s available.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1.

Content provided by Stickley on Security.

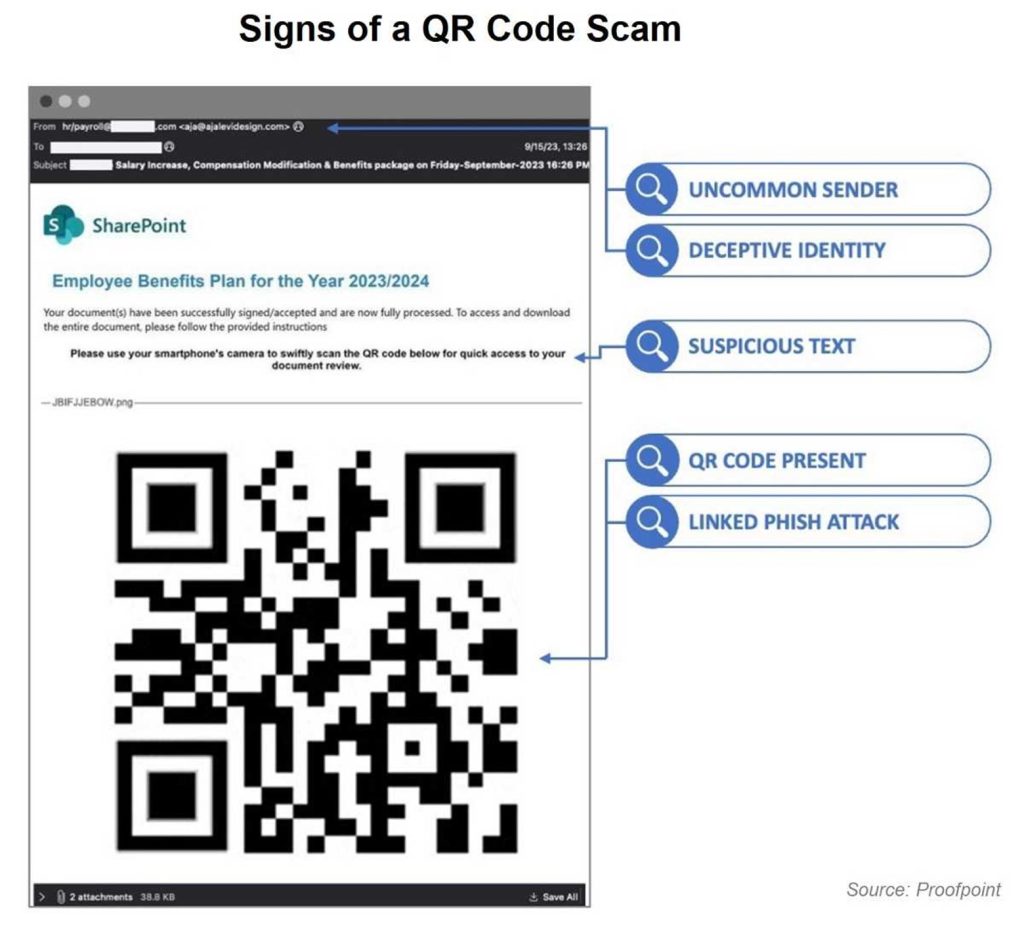

Tips for Safe QR Code Scanning

In our fast-paced digital world, QR (quick response) codes have gained immense popularity. These codes are now found everywhere, from TV screens to product packaging and websites. However, while we appreciate their convenience, cybercriminals are also taking advantage of them for malicious purposes.

To help you enjoy the benefits of QR codes safely, here are some essential security tips:

Be Skeptical

Approach QR codes with the same skepticism you apply to other tech tools. Just as you verify suspicious emails and texts, you need to scrutinize QR codes as well. A compromised QR code can lead you directly to a hacker’s website, where they may steal your personal information, passwords, and money or even infect your device with malware.

Examine Public QR Codes

Be cautious of QR codes found in public places. Cybercriminals may manipulate these codes by placing a malicious one over the original on posters, flyers, menus, and other materials. Check closely for any signs of tampering—look for codes that seem out of place, are oddly sized, or have unusual markings.

Check the URL

When scanning a QR code that redirects you to a webpage, carefully inspect the URL for any spelling errors. Cybercriminals often create fake URLs that closely resemble legitimate ones. These “spoofed” websites aim to steal your personal information. If you encounter a spoofed banking site, for example, any data you enter could fall into the hands of criminals.

Use Built-in Features When Possible

Before downloading a QR scanning app, first check if your device’s camera has a built-in QR scanning feature. If you do need a separate app, only download it from official sources like the Google Play Store or the Apple App Store. Avoid third-party app stores, as they are often less secure and may contain malicious software.

Consider Your Purpose for Scanning

Think carefully about why you’re scanning a QR code. While scanning for quick information is generally safe, use caution if the code is linked to financial transactions or personal information. Whenever possible, type the legitimate web address directly into your browser and bookmark it for future access.

Keep Your Device Updated

Regularly update your device’s software and use antivirus software. Software updates fix security vulnerabilities, and antivirus programs help protect against malware. Don’t delay keeping your device secure.

In a world where a simple QR code scan can expose you to risk, practicing a security-minded approach is essential for your safety.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1.

Content provided by Stickley on Security.