The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Start the New Year with a Financial Fitness Plan

With 2021 in the rearview mirror, you may be reflecting on the past year and looking for ways to improve your financial fitness standing. Whether you want to set a savings goal, reduce debt, or fund home improvement projects, Mid Oregon is here to help.

Have you considered refinancing your vehicle at a lower interest rate, or applying for a home equity line of credit (HELOC)? What about consolidating credit card debt with one of our low-interest VISA cards? Have you checked your credit score lately? Our Credit Savvy tool is a free, secure feature located in our Digital Banking platform. Find your credit standing and receive simple, straightforward tips you can use to improve your score.

Building your financial plan does not have to be complicated. Let’s start by finding new ways to make goals you can really achieve and tools that will help get you there faster. Here are some ideas:

Make a savings goal

If you see a tax refund in your future, use part of that money to give yourself a head start. Login to Digital Banking and visit the Savings Goals widget to set a goal.

Create a budget

Write it all down—every dollar you spend! From the daily coffee, to treats for our four-legged friends and monthly subscription costs, it all adds up. Writing down all your expenses, even those that seem insignificant, is a helpful way to track your spending patterns, identify necessary expenses and prioritize the rest. You can jumpstart your budget by applying the 50/20/30 rule. This simple rule consists of allocating 50% of your income toward essential expenses (rent, transportation, utilities), 20% toward personal financial goals (saving or paying off debt), and 30% toward flexible expenses (eating out, groceries, shopping, hobbies or entertainment).

Pass on unnecessary purchases

Get disciplined by identifying your needs vs wants. Do you need the newest smart phone or do you merely want it? Turning down something you want now may be difficult, but the reward will be greater savings later.

Become a fan of automation

- Digital Banking to ease financial tasks, saving you time and increasing your efficiency.

- Automatic overdraft protection. In a few easy steps, you can link your savings account to your checking to have a little added cushion in the event your expenses get a bit tight.

- Automatic loan payments. Your monthly loan payment will automatically be deducted from a linked checking or savings account.

- Setting up auto pay. This is a great way to save you time, hassle and offer peace of mind knowing your bills are paid promptly every month.

- Automate your savings: Direct deposit your paycheck into multiple accounts, including one for each of your savings goals.

Watch it grow

As your savings account balance begins to grow, you’ll feel more motivated to take it even further. We can help you make your money work smarter, not harder, for you.

Whatever your needs, Mid Oregon’s experienced team is a great place to start discussing your money-saving options. The year 2022 is a great time to start taking control of your finances and getting fiscally fit. Stop by a branch or visit us online at Mid Oregon Credit Union and start your Financial Fitness Plan today.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.

‘Tis The Season Of Fake Shopping Sites

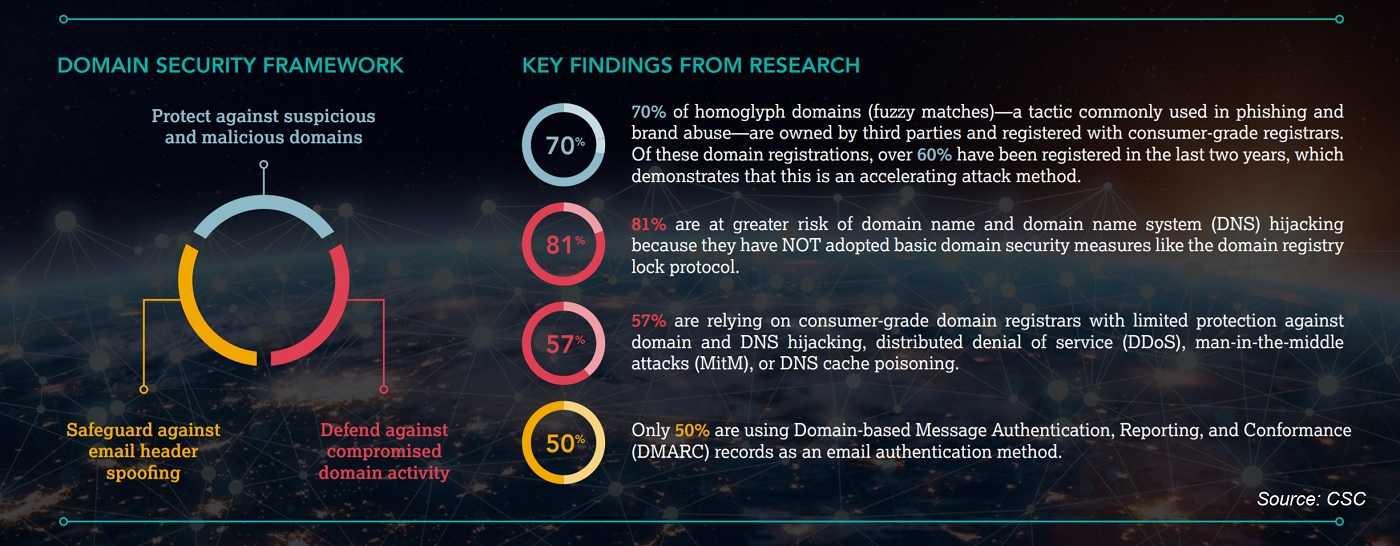

We’re all getting back into the holiday spirit after a somewhat glum 2020 season, Remember that the holiday shopping season doesn’t end on December 25. In fact, some retailers then put their marketing effort into overdrive. You will find after holidays sales, new year’s sales, and even “getting rid of all this stuff we didn’t sell at Christmas” sales advertised under some creative title. Retailers try to take advantage of the shopping spirit as far into the new year as they can. Criminals capitalize on this by creating phishing campaigns combined with fake shopping sites with lookalike domains (domain jacking) or taking advantage of typos (typosquatting): they are also upping their game.

Online Scams on the Rise

In a study by FairWinds Partners, 80% of the sites used for domain jacking see a significant increase in traffic during these after season times. Phishing scams, pay-per-click ads, and malvertising are on the rise.

Do-jacking and typosquatting happen when a cybercriminal uses a domain that is very close to a popular site for various scams. Often, the website collects information to use it for other nefarious purposes. Sometimes even just to sell on the underground markets. Additionally, it is used to get malware onto a visitor’s computer or device.

Mistakes Can Lead to Fake Shopping Sites

The way these attacks happens is simply by taking advantage of mistakes. Perhaps a letter is added to a site name as it for barnesandnobles.com (the real one being without the “s” on the end), for example. They take advantage of people making typographical mistakes. With a quick glance, the user likely won’t notice the subtle difference. This also occurs when a letter may be substituted with a number. One such way would be replacing a lower case “L” in a name with a number “1.”This is a very common problem with online banking sites or for sites where payment card data is entered. Cyberthieves know that the credentials associated with those sites are very valuable.

Remember, Mid Oregon Credit Union’s website is www.MidOregon.com. There are no dashes or other added letters.

Take Your Time and Review!

When preparing to do shopping online or enter any confidential, sensitive, or personally identifiable information into a website, take a little extra time to review the site name and make sure it’s correct first. Don’t click links that you find in email messages or that show up on the side of your web browser, for instance. Instead, type the name into your browser, but definitely use caution when doing so, because going to a site even for a second can cause malware to be downloaded onto your device. This is called a “drive-by download.”

Always make sure your devices are all equipped with anti-malware and anti-virus software or applications. Keep them updated at all times. This includes all mobile devices on any operating system.

If you are ever in doubt about a website’s authenticity, don’t put any data into it. Instead, do a little more investigating before doing anything further. There have been enough barriers to our joy lately. Don’t let do-jacking and typosquatting spoil the good times this year.

Read more Mid Oregon View articles about cybercrime and online fraud, to safeguard from cybercrime.

Yearly Check-up

By Chris O’Shea*

Year-end 401(k) moves to make

The end of 2021 is coming. That means it’s time to address your 401(k). You want to make sure you’re getting the most value out of this retirement account. Here are some moves to make before 2022 arrives.

Match Up

One of the best parts of a 401(k) is the employer match. Your employer will sometimes match 401(k) contributions, up to a certain point. It’s essentially free money. You want to make sure you’re taking advantage of this match. Set your contributions to the full matching amount before the year is over.

Max Out

For 2021, the max 401(k) contribution is $19,500 if you’re 50 or younger; $26,000 if you’re 50 or older. The time is now to get as close to that max as possible because it will take some time for payroll to change your contributions.

Review Things

Before the year ends, take some time to review your investment mix. As The Richmond Dispatch notes, you want to make sure you’re not paying too much in fees. If the fees don’t sit right with you, you might want to shift more of your portfolio to index funds. Index funds — unlike mutual funds — are passively managed, and that makes their fees lower.

Act Now

Your 401(k) can be a good investment tool. It can be a great tool if you are taking full advantage of it. Act now to make sure you’re getting the most value. Don’t sit around and just hope for the best. Time goes by faster than you think.

*This guest article is from the “Your Money Blog” in Mid Oregon’s Digital Banking Credit Savvy resource. It is made possible by SavvyMoney. “Yearly Check-up” by Chris O’Shea was published in December 2021.

View additional Mid Oregon View articles on retirement,