The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Access to Credit Is Critical

A recent poll emphasized that access to credit is a critical component of financial wellbeing and resilience. In borrowing, 86% of credit union members say that their institution makes it easy for them to get loans. Access to credit is part 1 of our 6-part series on the results from a recent national poll.

2022 National Voters Poll Results

A 2022 National Voters Poll conducted by CUNA* (Credit Union National Association) was shared in a recent white paper. The poll showed that credit union characteristics unambiguously translate to greater financial resilience. They also translated to higher levels of financial well-being for credit union members.

Credit union members fare better across the board on the four key components of financial health:. Those components are spending, saving, borrowing, and planning, according to the Financial Health Network.

Access to Credit Is Critical

In the area of borrowing, having access to credit is critical to financial well-being and resilience. Affordable credit can help consumers make key purchases. Affordable automobile loans, for example, help ensure access to reliable transportation to work. They also reduce the likelihood of income disruptions. Similarly, affordable home loans give many the opportunity to work toward financial security and to build intergenerational wealth.

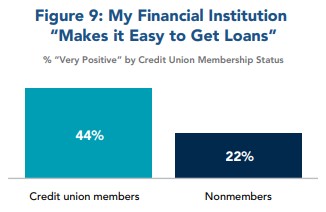

My Financial Institution “Makes it Easy to Get Loans”

In the survey, credit union members are two times more likely than nonmembers (by a 44% to 22% margin) to have strong feelings on this issue — responding “very positively” to the idea that their financial institution makes it easy to get loans. Credit union members who live in rural areas are nearly three times more likely than nonmembers in rural areas (by a 52% to 18% margin) to have strong feelings on this issue — responding “very positively” to the idea that their financial institution makes it easy to get loans.

Access to Credit at Mid Oregon

Mid Oregon has a lending focus built on providing accessible credit to members. In fact, we feel that it isn’t “can we do the loan”, but “how can we do the loan”. Our responsibility is to make good financing decisions for both the individual and for our collective membership. However, Mid Oregon loan officers will look for how best to make the situation work for the borrower.

Many of our loans are started online from our secure applications. Still, we receive many raving Google reviews about our branch loan officers and our lending results for members. Here are a few recent comments from 5-star reviews:

“Chandler at Mid Oregon was amazing! She got my auto loan refinanced within 4 hours and was beyond helpful and happy! Her and all of her team are just amazing at what they do, and I’d be lost without my mid oregon people!”

“I went to Mid Oregon to inquire on a RV loan. From beginning to end the loan process was smooth and fast. Natalie and Amanda did an amazing job communicating with me and the sellers. Next loan I get will be with Mid Oregon no doubt!!”

“Our experience with Dina, was very professional and efficient and we would recommend to anyone to seek out her expertise and energy for their next real estate transaction.“

Mid Oregon has financing for almost any want or need. Please take a moment to see how we can help. Start with our secure loan application, through email, by calling (541) 382-1795 or by visiting one of our seven conveniently located Central Oregon branches.

- Read additional articles about credit.

- View recorded webinar on “Managing Your Credit” from May 12, 2022.

Poll Information

*The online panel survey, conducted by FrederickPolls during January 2022. The survey is based on a nationally representative sample of 2,500 voters (with a margin of error equal to + 2%). Questions center on financial behaviors and outcomes, trustworthiness, and connections to the local community.

A Big Ratio

By Chris O’Shea*

The Ins and Outs of Credit Utilization Ratio

One of the biggest factors impacting your credit score is the credit utilization ratio. This is your total credit used divided by the total credit available to you. Your best strategy when dealing with this ratio is to keep it below 30 percent. If it goes above that number, you could be in trouble.

Ratio of Revolving Credit

Your credit utilization ratio is made up of revolving credit — so any lines of credit and credit cards. It does not include loans, like a mortgage or student loan debt. If you have three credit cards with a total of $32,000 credit available, and you have a $5,000 balance on one of the cards, your ratio is 20.83 percent. That’s pretty good. A low ratio indicates to lenders and credit bureaus that you are handling your credit wisely, and not overspending. It’s essential that you keep this percentage low. Here’s what TransUnion, VantageScore 3.0 considers when coming up with that magical three-digit number:

- Payment history (40%)

- Amounts owed (23%)*

- Length of credit history (21%)

- Credit mix (11%)

- New credit (5%)

“Amounts Owed” is where your ratio comes into play. Keep your credit utilization ratio below 30 percent and your credit score will be higher.

Credit Utilization Ratio Danger Zone

If your ratio goes above 30 or even 50 percent, your credit score could go down by double digit points. When your score goes down by that much, you’ll find it harder to secure loans, you’ll get higher interest rate offers on credit cards and much more.

Keep your credit utilization ratio in mind to maintain healthy finances. Try to make sure you can pay off your credit cards in full each month. If you have a heavy spending month that you know you will blow your ratio, consider paying your bill mid-month to bring it down. Keep cards open that you don’t use (if they don’t have an annual fee) anymore. You can even ask for a credit limit increase on your cards. Keep your ratio low and your finances will be easier to handle.

*This guest article is from the “Your Money Blog” in Mid Oregon’s Digital Banking Credit Savvy resource. It is made possible by SavvyMoney. “The Ins and Outs of Credit Utilization Ratio” by Chris O’Shea was published in May 2022.

Additional Information

See additional articles by Chris O’Shea in the Mid Oregon View.

Accounts Drained By Zelle Smishing Scam

From time to time, scammers come up with a new tactic using new technology, new events, or whatever they can to continue tricking us into giving up our personal or confidential information. Over the past few years and with the increasing use of texting and SMS messaging, a newer one in the bag of tricks has been coined as “smishing.” Because it’s text, it often catches people off guard and causes them to react quickly, which is exactly what you shouldn’t do. One of the latest is the Zelle smishing scam.

Often, various scams arrive via the data service on a smartphone. However, it can also be iMessage, which is the text messaging service that Apple uses over WiFi. But whatever the app is called, the term applies to any type of text messaging, including What’sApp, Facebook Messenger, and other chat programs.

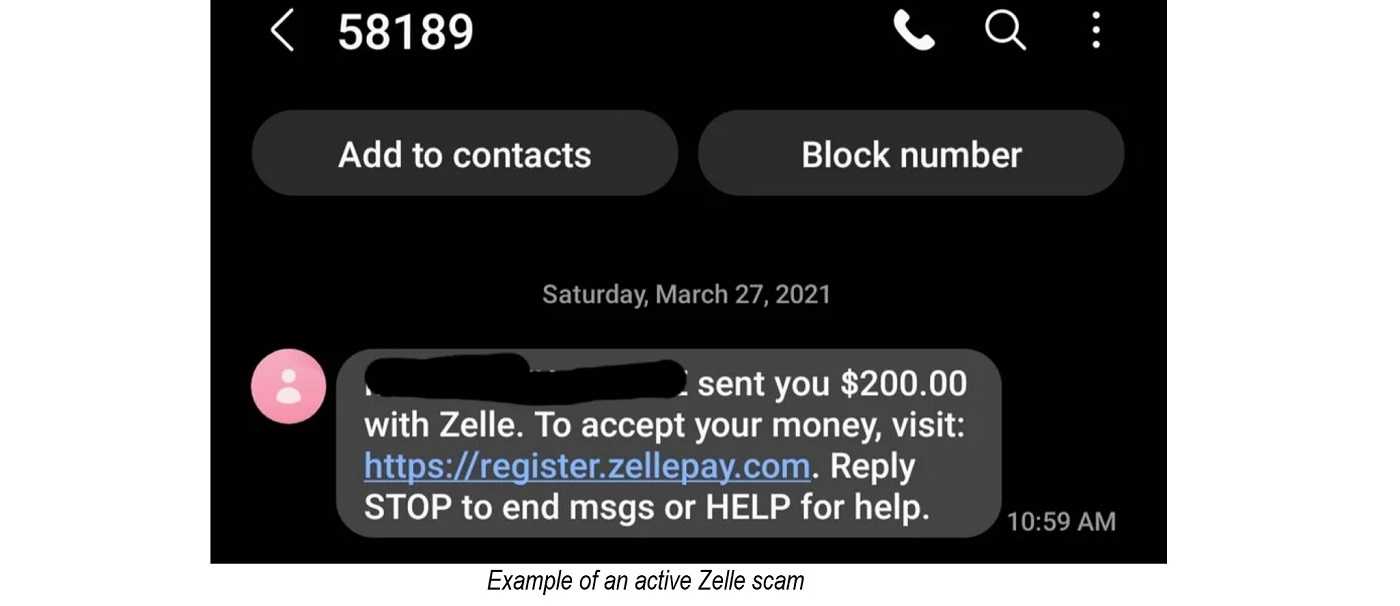

What is the Zelle Smishing Scam?

Phishing is a method cybercriminal used for decades to try to dupe people out of information, and if they are really successful, login credentials or payment card details. Often, phishing comes via email and includes a link or attachment that when clicked, leads someone to fill confidential information into a form or install malware that steals data off the device. Researchers at Experian found that adults from 18-24 send over 2,022 text messages per month from their mobile devices for an average of 67 per day! That’s valuable information for the cyberthief just waiting to cash in. In a recent scam, users are sent a text message that appears to be from their financial institution attempting to confirm a Zelle transaction. However, that phone number is spoofed by the cybercriminal. A message might say something like “Did you attempt a Zelle Payment of < some amount>? Reply YES or NO or 1 to stop alerts.” In other cases, the text may want the user to confirm identity by reading or sending back a supposed code. If the user replies, money is transferred directly out of their account to the scammers.

While phishing and even smishing have been around a while, there is a recent scam that intends to steal money using the newer digital payment services, such as Zelle.

Zelle, launched in 2017, is often embedded into banking apps and links to a user’s banking account. It allows members to send money to other people instantly. All it takes is an email address or phone number. In 2019, the company reported that users of the service transferred $119 Billion.

Avoiding These Scams Saves Everyone Money

Federal regulations require financial institutions to reimburse customers whose money is fraudulently stolen from an account. But that doesn’t mean it’s no risk or no cost. The financial institutions incur costs for every fraud that often gets passed onto the members and customers. Therefore, it’s to everyone’s benefit to avoid becoming a victim of these types of scams in the first place.

- If you don’t know the sender, aren’t expecting a message with a link or attachment, or just aren’t sure a link is safe to click, don’t click it. Instead, contact the sender independently of the received message and ask about it.

- Don’t react quickly to any message, whether text, voice, or email that threatens something bad may happen if you don’t. Take a breath. Go to your financial institution’s website or app and log in there. Never click links in messages for financial related details.

- If you don’t initiate the phone call to your financial institution, don’t send information. Instead, log in to your account using the app or the banks official website and check on your accounts. Making a quick phone call using a number you find or know also works. Don’t use information sent to you in unsolicited messages.

- Remember that financial institutions do not ask you to verify or update details via text or email. Go directly to the official app or website to do this.

- It’s not rude to just not reply to suspicious emails or texts. In fact, it is recommended you do just that.

- Report fraud, like the Zelle Smishing Scam, that happens via smishing to the FCC. There is a form on the agency’s website. This helps the FCC combat these types of crimes and potentially protect others.

Other Smishing Scams

A few other common smishing scams include the following:

- A text message arrives that appears to be from the target’s financial institution requesting that a link be clicked that will go to a website to address and resolve an issue with the account or payment card. If it’s clicked, malware is installed and email address, contact list information, and other data is stolen.

- A text message claims the user signed up for some sort of service and will be charged unless a link is clicked. The result is again malware getting installed and data stolen from the device.

- The user is sent a text claiming he or she has won a prize of some sort. Often, it’s a gift card. A link must be clicked to claim the prize. The link directs to a website where personal information is requested, but the victim never gets the prize, of course. Instead, the information is used for spamming or efforts to steal additional information such as financial account credentials.

Read more Fraud or Stickley on Security Articles

Register for Mid Oregon’s webinar upcoming on Preventing ID Theft. Presented by the Digital Forensics Team at the Deschutes County Sheriff’s Office on Thursday, April 28 at 10 a.m.

See Mid Oregon’s Security and Fraud Center

Visit the FTC’s Identity Theft Information Webpage