The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

New Year, New Financial You! Start 2026 Strong!

The start of a new year is the perfect time to give your finances a checkup. Just like we prioritize our physical health, investing time in your financial well-being can set the stage for a successful year ahead.

A strong financial plan provides clarity and helps you measure progress. Take a moment to review last year’s goals—what worked well, and what needs a tweak? Here are a few tips to jumpstart your financial health in 2026:

Set a Savings Goal

Define a clear savings target to keep yourself on track. Mid Oregon’s Saver’s Club is a great way to build toward your goals. Automate deposits and contribute regularly—even small amounts add up over time. With Digital Banking’s My Credit Score tool, you can set goals, track your progress and celebrate your milestones along the way.

Track Your Spending Habits

Understanding how you spend your money is the first step toward making smarter financial decisions. Mid Oregon’s Digital Banking offers helpful tools to guide you. With features like Financial Checkup, you can review your financial health, track your progress, and make informed choices with confidence.

Know Your Credit Score

Your credit score matters more than ever. With My Credit Score, you can access your score anytime, anywhere, along with key insights from your credit report. Working toward improving your score is easy with the Simulator tool and Recommended Actions. The DTI (Debt-to-Income) feature will help you better understand your financial health through the lens of your DTI ratio. This is a FREE service offered to Mid Oregon members that can help you achieve strong financial health in 2026.

Expand Your Financial Knowledge

Learn more about budgeting, investing, and managing debt wisely. Explore helpful articles on Mid Oregon’s blog and join our Financial Workshops throughout the year to boost your financial confidence.

By taking proactive steps now, you’ll enter 2026 feeling empowered and ready to achieve your goals. No matter where you are on your financial journey, your Mid Oregon team is here to help—stop by, call, or visit us at midoregon.com.

Simple Habits That Make You a Tougher Target for Cybercrooks

It’s already well into the new year and a fresh year usually brings fresh goals—exercise more, spend less, maybe try a new hobby. But one resolution that deserves a permanent spot on everyone’s list is tightening up your personal cybersecurity. And this isn’t one you should ever quit when February comes around.

Cyberthreats don’t take holidays, and scammers aren’t slowing down. In fact, they’re getting bolder, trickier, and faster at finding new ways to get into your accounts and steal your money or data. The good news? A few steady habits can make you far less appealing to cybercriminals.

Start With Your Passwords

Strong, unique passwords or passphrases are still your first line of defense. Mix letters, numbers, and symbols—and never recycle the same one across accounts. And while it may seem obvious, don’t share your passwords with anyone. Tech support, financial institutions, and reputable companies will never ask for them.

Stay Suspicious

Phishing emails remain one of the easiest ways for scammers to trick users. They may look polished these days, but old red flags still apply: Strange attachments, unexpected links, odd grammar, or messages from out-of-the-blue senders. Give anything suspicious a wide berth.

Keep an Eye on Your Financial Activity

Checking your banking and financial statements and credit reports regularly can help you catch fraud early. Freezing your credit reports is an added layer of protection if you don’t need frequent access. You can always unfreeze the reports, if needed.

Use Multi-factor Authentication

Turning on multi-factor authentication (MFA) wherever possible can stop attackers even if they get your password. And remember to use different login credentials for every account. Logging in with Facebook or Google might seem convenient, but it creates a single gateway to multiple accounts.

Passkeys

Don’t forget that passkeys are a great way to secure your accounts and not have to remember so many passwords. Keep in mind that passkeys and storing your passwords in your browser are NOT the same and storing them in the browser is not a recommended option.

Stay Up-To-Date

Finally, don’t let your devices fall behind. Keep anti-malware tools updated, install software patches promptly, and replace unsupported devices. Back up your data regularly, and stay aware of new scams circulating online and in your community.

Cybercriminals follow the money, and they’ll keep trying as long as it pays. Don’t make it easy for them.

Content provided by Stickley on Security.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1

“Wait, Did I Take a Toll Road?” What to Do When You Get the Text.

Have you taken a toll road recently? Well, even if you haven’t, this story is for you. There is a text message going around that anyone who drives on highways or freeways should be on the lookout for and it’s just annoying enough to drive anyone mad. As you can guess, it involves toll roads and the supposed accompanying fees related to them. It goes like this.

The Toll Text

A text message appears on your phone stating you owe a toll, and you need to pay it right away. What? You say. You haven’t taken a toll road recently, that you can recall anyway. So, why would you owe a toll? The answer is, you don’t. This scam tries to make you think you owe one and if you don’t pay up, right away, you’ll be assessed some phenomenal penalty.

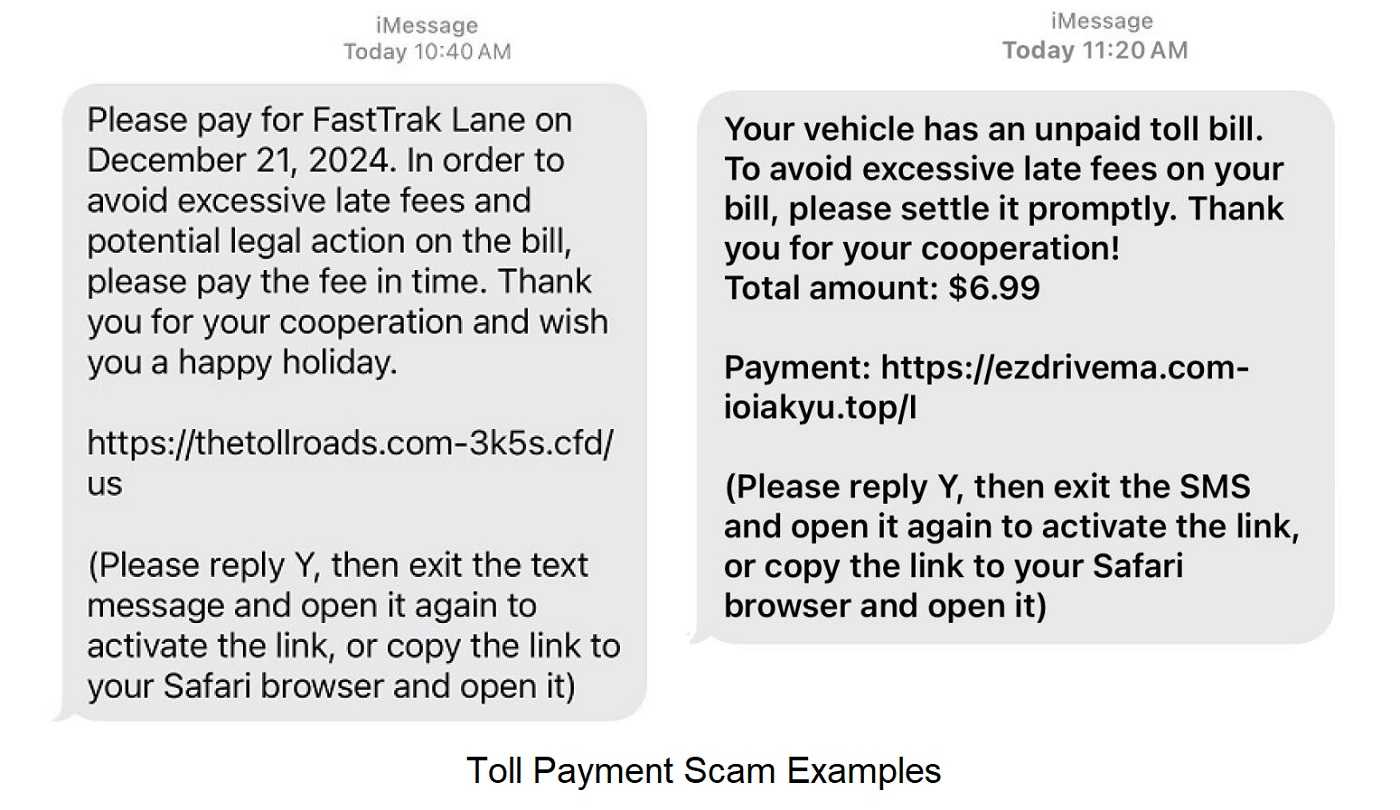

How to Spot the Scam

The first clue that this is a scam, if you haven’t taken a toll road of course, is that you haven’t taken a toll road. The second, is that there is that oh so familiar sense of urgency that phishing scams like to use so much. Yes, if you owe tolls, the time you have to pay matters to avoid penalties, but it’s not an immediate thing, unless there is a booth or you have one of those transponders. In California, you have five days to pay the tolls, for example. And toll agencies aren’t in the habit of sending unsolicited text messages. In fact, if you owe a toll and don’t have a toll road account for wherever you happen to be driving, they don’t even have your phone number. They’ll send you a bill in the regular mail.

The Kansas Turnpike warns, “Be aware of fake messages claiming you have outstanding tolls due on a Kansas toll facility. These messages include a link or URL instructing you to visit a fake website that mimics a KTA or DriveKS web site or a toll web site in another part of the country.” The New York Thruway website has a big warning on the front page of its website, alerting drivers that “E-ZPass or Tolls By Mail WILL NEVER send a text or email requesting sensitive personal information such as credit card, birthday, Social Security number, or other personally identifiable information.”

What To Do

If you do receive one of these, delete it off of your device so there is no chance you’ll accidently click the link. Keep your eyes open for other signs of phishing, such as texts being sent from international phone numbers. And remember to drive safely out there.

Content provided by Stickley on Security.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1