The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

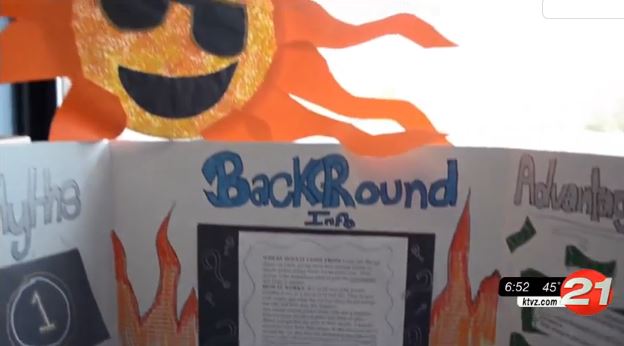

One Class at a Time at RPA

Redmond Proficiency Academy- One Class at a Time

Bob Shaw of KTVZ went to Redmond Proficiency Academy (RPA) this week to present Science Teacher Amy Herauf with a “One Class at a Time” award of $500. Nominated by fellow teacher Judd Wagner, Herauf and her student ‘Green Team” were recognized for the effort to qualify RPA as Central Oregon’s first green school, and the needs they face getting there. KTVZ and Mid Oregon Credit Union were excited to award One Class at a Time at RPA.

One Class at a Time is a joint effort between News Channel 21 and Mid Oregon Credit Union to help fulfill needs of area schools across Central Oregon. The campaign will award $5,000 in 2015 by identifying and funding applications for ten $500 classroom projects in the Central Oregon school districts in Deschutes, Jefferson and Crook Counties.

Visit the KTVZ One Class at a Time webpage for more details and contest rules.

10 Smart Money Moves for Your 20s

10 Smart Money Moves for Your 20s

If you’re in your 20s, you have a financial asset money can’t buy–time. And time makes your money grow. Making some smart money moves in your 20s pays off now and in the future. Here’s a list of 10 Smart Money Moves for Your 20s:

1. Set financial goals, say, to take a vacation, go back to school, get married, buy a house, or start saving for an early retirement. Put your goals in writing, then calculate how much you’ll need to save each month to reach them.

2. Make a spending plan, limit your debt, and concentrate on paying off existing bills. Limit debt to your ability to repay. Monthly credit payments, excluding a mortgage, shouldn’t exceed 20% of your monthly take-home (after-tax) pay.

Establish An Emergency Fund

3. Build an emergency fund equal to three to six months’ living expenses, even if it takes years to build. Use this fund only for true emergencies, such as unexpected car repairs, illness, or unemployment.

4. Save at least 10% of gross income for your emergency fund, future goals, and retirement. If you can’t manage 10%, start with 5% and increase it over time.

5. Take advantage of the services Mid Oregon Credit Union offers. You’ll earn more when you save and pay less when you borrow.

6. Make it a priority to get adequate insurance: health, disability, auto, personal liability, and tenants’ or homeowners’. If someone else depends on your income, you also need life insurance.

Save & Invest

7. Once you’ve implemented your spending plan, built your emergency fund, and obtained appropriate insurance, make the most of your money by starting to invest. The key to making the most of your money is investing small amounts gradually and sensibly over time.

8. Use tax-advantaged savings plans your employer or the government offers to save money for your retirement, such as company 401(k) retirement savings plans and individual retirement accounts at Mid Oregon Credit Union.

9. Keep job options open by keeping your job skills fresh. Get necessary training and education so your knowledge and skills stay up to date.

10. Maintain orderly financial files to keep track of your money and put your hands on important records when you need them.

Central Christian School- One Class at a Time Debuts!

Central Christian School- One Class at a Time Debuts!

Mid Oregon Credit Union and KTVZ kicked off a new community investment program called “One Class at a Time” this week, as Bob Shaw of KTVZ and Kyle Frick of Mid Oregon Credit Union visited Central Christian School in Redmond. Science teacher Karrie Johnson is the first One Class at a Time grant recipient, and was awarded the check in her classroom at the school. The grant will be used for purchase glassware and updated chemicals and to replace dilapidated chemistry textbooks. A new program kicks off in Central Oregon, as One Class at a Time debuts.

Funding Needs in Central Oregon Schools

One Class at a Time is a joint effort between News Channel 21 and Mid Oregon Credit Union to help fulfill needs of area schools across Central Oregon. The campaign will award $5,000 in 2015 by identifying and funding applications for ten $500 classroom projects in the Central Oregon school districts in Deschutes, Jefferson and Crook Counties.

Visit the KTVZ One Class at a Time webpage for more details and contest rules.