The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Students: Easy Ways to Cut Costs

College students are gaining confidence in personal finance management but unfortunately also have become less competent. A survey conducted by High One and Everfi recently found that in 2014, college students were more likely to use more than one credit card than they did in 2012, according to USA Today.

Considering that nearly two-thirds of undergrads take out student loans, and college seniors are graduating with an average loan balance close to $24,000, if students aren’t careful about spending, the first financial steps they take after college might send them in the wrong direction.

While college expenses may seem limitless, students can learn to manage them by avoiding these common money drains, according to CUNA’s member education department:

• Carrying a credit card balance. Many credit card companies lure borrowers with enticing offers, and then hit them with a hefty monthly interest charge on their accrued balance. According to Forbes, the average student graduates with $4,100 in credit card debt. Using a credit card is not a bad thing and actually can improve a credit score, but the key is to pay off the balance every month. If you don’t already have one, consider getting a Mid Oregon credit card, with low rates, no balance transfer and no cash advance fees.

• Going out to eat—a lot. Say you spend about $5 on a coffee and bagel for breakfast each morning and $8 on a sandwich or fast food for lunch and dinner. That means you’re spending more than $100 for five days of food—and these examples are modest. While it may take a few extra minutes each day, buying $100 worth of groceries and cooking at home will stretch your dollar, and can be healthier too;

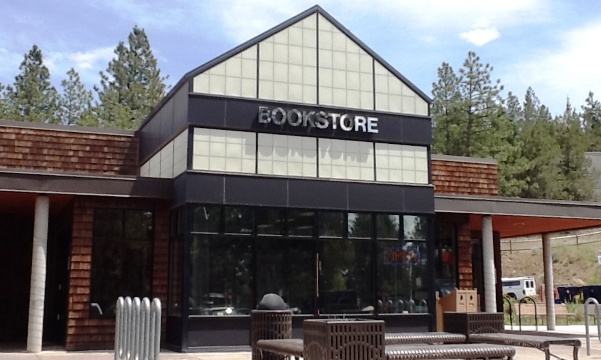

• Buying new textbooks. According to the College Board, the average student at a four-year public college spends $1,200 on books and supplies annually. You can’t eliminate the cost completely, but there are ways to trim your textbook budget. Consider purchasing used textbooks online. You also can resell your textbooks via sites like Amazon Marketplace or Half.com after classes end. Textbook rentals also have become popular. The COCC Bookstore, which serves both COCC and OSU Cascades students, has purchasing and rental options, as well as a buyback program; and

• Not using campus resources. Most colleges assess fees, which help provide a range of student services beyond those covered by tuition. Since you’re already paying for these services, don’t waste the money elsewhere. For example, use the campus gym instead of paying for an additional gym membership and use campus technology resources instead of paying an offsite repair shop. Make positive and sound decisions to reach their financial goals.

How to Throw a Barbecue on a Budget

The sun is shining, the birds are chirping, and a faint scent of sizzling meat carries on the afternoon breeze: It must be grilling season. Forget about opening day; Memorial Day is the unofficial start to America’s true favorite pastime—tossing heaps of beef, chicken, and pork over open flame. There is no reason to break the bank while dishing out some of the best barbecue your neighborhood’s ever tasted. The trick? Hunting down deals and asking friends to chip in (this is, after all, a community event). Here’s everything you need to know to master the art of throwing a barbecue on a budget

Read more at SmartAboutMoney.org*

* Smart About Money is one of the many programs of the National Endowment for Financial Education®. NEFE® is an independent, nonprofit foundation committed to educating Americans on a broad range of financial topics and empowering them to make positive and sound decisions to reach their financial goals.

Supplies 4 Schools Supports Back-to-School Success for Central Oregon Students

Supplies 4 Schools in Central Oregon Runs Through August

Mid Oregon Credit Union is collecting needed school supplies for students in Deschutes, Jefferson, and Crook Counties. The Supplies 4 Schools drive will run through the month of August. This year’s Supplies 4 Schools will assure that children who can’t afford needed and required school supplies will have a sense of belonging and readiness on their first day of school.

Supplies will stay in the same community in which they are collected. Community members may drop off donated school supplies at any Mid Oregon Credit Union location:

- Bend (Olney Ave and 2nd Street, across from Black Bear Diner)

- East Bend (On Cushing Drive, south of Neff, off 27th )

- Redmond (next to Bi-Mart)

- Madras (At Fifth and “F” Streets) and the Jefferson County Annex (66 SE D Street)

- Prineville (In front of Bi-Mart)

- La Pine Lending Center (Next to Bancorp Ins on Hwy 97)

Donations for Deschutes County will be distributed by the Family Access Network (FAN). In Crook and Jefferson Counties the supplies will be delivered directly to the school districts for distribution. For more information about Supplies 4 Schools call 541-382-1795.

Cash donations used to purchase school supplies may be made at any branch as well!

Needed school supplies include:

| Back packs | Colored markers thick & thin | Rulers |

| Calculators | Highlighters | Glue & glue sticks |

| College ruled paper | Compass/protractors | Pocket folders |

| 2, 3 &4 inch ring binders | Dry erase markers/pens | Notebook dividers 5-pack |

| Colored pencils | Tissue boxes | Spiral notebooks |

See school websites for more details on needed supplies.

Thanks to our media partner’s for helping us spread the word: