College students are gaining confidence in personal finance management but unfortunately also have become less competent. A survey conducted by High One and Everfi recently found that in 2014, college students were more likely to use more than one credit card than they did in 2012, according to USA Today.

Considering that nearly two-thirds of undergrads take out student loans, and college seniors are graduating with an average loan balance close to $24,000, if students aren’t careful about spending, the first financial steps they take after college might send them in the wrong direction.

While college expenses may seem limitless, students can learn to manage them by avoiding these common money drains, according to CUNA’s member education department:

• Carrying a credit card balance. Many credit card companies lure borrowers with enticing offers, and then hit them with a hefty monthly interest charge on their accrued balance. According to Forbes, the average student graduates with $4,100 in credit card debt. Using a credit card is not a bad thing and actually can improve a credit score, but the key is to pay off the balance every month. If you don’t already have one, consider getting a Mid Oregon credit card, with low rates, no balance transfer and no cash advance fees.

• Going out to eat—a lot. Say you spend about $5 on a coffee and bagel for breakfast each morning and $8 on a sandwich or fast food for lunch and dinner. That means you’re spending more than $100 for five days of food—and these examples are modest. While it may take a few extra minutes each day, buying $100 worth of groceries and cooking at home will stretch your dollar, and can be healthier too;

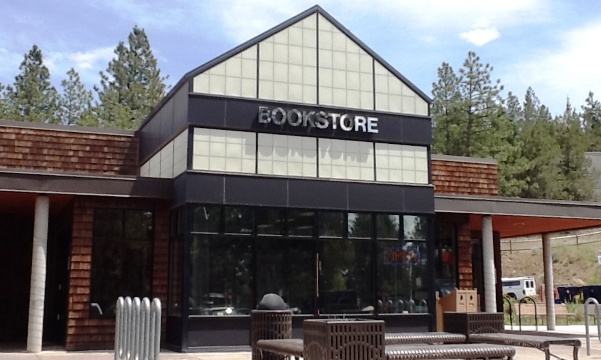

• Buying new textbooks. According to the College Board, the average student at a four-year public college spends $1,200 on books and supplies annually. You can’t eliminate the cost completely, but there are ways to trim your textbook budget. Consider purchasing used textbooks online. You also can resell your textbooks via sites like Amazon Marketplace or Half.com after classes end. Textbook rentals also have become popular. The COCC Bookstore, which serves both COCC and OSU Cascades students, has purchasing and rental options, as well as a buyback program; and

• Not using campus resources. Most colleges assess fees, which help provide a range of student services beyond those covered by tuition. Since you’re already paying for these services, don’t waste the money elsewhere. For example, use the campus gym instead of paying for an additional gym membership and use campus technology resources instead of paying an offsite repair shop. Make positive and sound decisions to reach their financial goals.