The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Mid Oregon Credit Union Receives Approval for Expansion

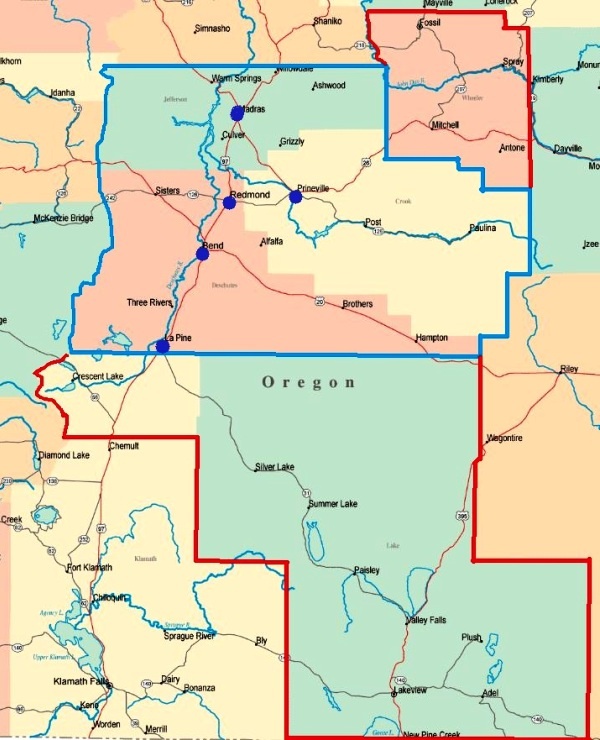

The member-owned, full-service financial institution headquartered in Bend announced today that the National Credit Union Administration (NCUA) has approved its application to expand its community charter boundaries. In addition to serving all of Deschutes, Crook, and Jefferson Counties, the new charter allows Mid Oregon Credit Union to serve people who live, worship, work, or attend school in Lake and Wheeler Counties, and in Northern Klamath County that is part of the COCC tax district.

“This approval opens up new areas of opportunity and also restores a historical relationship with Wheeler County, which was part of our charter from 1961 to 1998. We look forward to introducing ourselves in the new area and re-establishing our connections in Wheeler County” said Bill Anderson, President/CEO of Mid Oregon.

For clarity, the Klamath County zip codes included in the charter expansion are:

97733 – Crescent, Crescent Lake, Odell Lake

97737 – Gilchrist

97739 – Those portions of Klamath County taking mail delivery out of La Pine (e.g. Jackpine Village)

A new La Pine branch is under construction with an estimated completion date of June 2016. La Pine residents and the newly approved charter area will have access to the new full-service branch. The branch will offer a full service drive-up ATM, a 24 hour access walk-up ATM, and is designed to offer a full range of services. The Credit Union also offers its members convenient online and mobile banking services, including remote deposit and debit card security applications.

4 Reasons Credit Unions Are Good For Young Adults

Credit Unions Are Good For Young Adults

4 Reasons Millennials Should Open a Credit Union Account

Free Family Saturdays at the High Desert Museum-2016

“Free Family Saturday” complimentary admission program

Free admission to the High Desert Museum, courtesy of Mid Oregon Credit Union, is scheduled for January 23 and February 20, 2016. The “Free Family Saturday” complimentary admission program supports the community with the opportunity to explore wildlife and living history right in Central Oregon’s backyard. The museum is located five minutes south from Bend on Highway 97. The Museum is open from 10 a.m. to 4 p.m., including the Rimrock Café and Silver Sage Trading Store.

“Every year we meet and greet all the families who come out for the Free Family Saturdays at the High Desert Museum,” said Kyle Frick, Mid Oregon Credit Union VP of Marketing and Community Relations. “No matter what the weather, we see young and old alike who are smiling and excited to spend time enjoying this amazing Central Oregon resource!”

Details about the event

NOTE: Parking is limited – a free shuttle is offered from the Morning Star Christian School parking lot to the Museum and back all day. Children requiring car seats are not allowed to ride the shuttle. Thank you for your understanding.

For more information about exhibits, wildlife encounters, living history performances, music, and tours, visit the Museum’s website at www.highdesertmuseum.org

Share with others!

Please help us get the word out to everyone who can benefit from seeing this Central Oregon gem but may not be able to afford to take their whole family.

Share through Facebook– invite your friend, family member, co-worker or neighbor! January 23 event | February 20 event

HDM flyer 2016 2 per sheet– download the 2 per sheet reminder and hand to a friend, shows both event dates

Share by posting an 8.5″ x 11″ flyer in your workplace or public location- HDM 8×11 poster 2016 Jan | HDM 8×11 poster 2016 Feb