The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Mid Oregon Credit Union Celebrates 59 Years

Celebrates 59 Years

On November 22, 2016, Mid Oregon Credit Union, the only credit union headquartered in Bend, celebrates 59 years of continued growth and service to our members and communities. It was on November 22, 1957 that the official certificate of organization was signed by the National Credit Union Administration. This month Mid Oregon Credit Union celebrates 59 years of serving members.

Our roots go back to 1957 when a small group of educators in Crook County were inspired to improve the financial well-being of teachers, educators and their families. They saw the need to provide a safe haven for teachers to grow their savings and a source of credit that was both available and affordable.

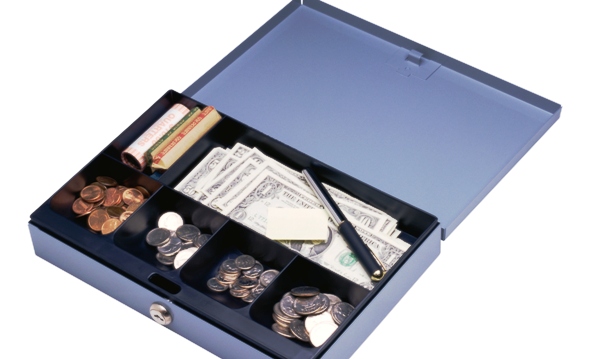

Cash Box in a Home Office

The Credit Union began business out of a single cash box in a home office and over the years, Mid Oregon has grown into a $248 million, not-for-profit financial service cooperative, with six branches throughout Central Oregon and the seventh in Sisters opening soon. With over 26,000 members, Mid Oregon continues to operate solely for our members’ benefit.

Mid Oregon is overseen by a volunteer, member-elected board of directors, and our growth is attributed to the credit union philosophy, “People Helping People.” We attributes our success to our membership relationships, capable employees and community involvement.

Dora Maxwell Award Winner

Mid Oregon Credit Union has a long history of community involvement and support, and we have been well-recognized for our efforts. For 18 years, Mid Oregon has been honored with the first place Northwest Credit Union Association’s Dora Maxwell award. The Dora Maxwell Social Responsibility Community Service Award is given to a credit union for its social responsibility projects within the community. Mid Oregon members and employees regularly raise funds for various community causes including Supplies 4 Schools, Holiday Dough and Healthy Beginnings Adopt a Bear. Our involvement embraces the community by supporting countless organizations, services and events, including Pay it Forward, One Class at a Time, Free Family Saturdays at the High Desert Museum, Teachers’ Night Out, Ski 4 Schools, COCC, and OSU Cascades, just to name a few.

Credit-Debit Card Security Tips for Consumers

With “Black Friday” and “Cyber Monday” happening, the holiday shopping frenzy gets its traditional jumpstart in November…However, some data suggests that consumers are more at risk right before Christmas from having their cards compromised. According to the National Retail Federation’s annual spending survey, consumers will spend an average of $1,047.83 this holiday season, much of it using their plastic. We want our members and others in Central Oregon to have credit-debit card security tips.

Millions of shoppers will use their credit or debit cards for convenience. They can shop with confidence by following these simple security safety tips offered by Mid Oregon Credit Union:

In-store purchases:

• EMV chip cards provide an extra layer of security when you buy on site (not online). Not all merchants have caught up with this technology trend. If the merchant’s chip reader is not functional, you must swipe your card. This underscores the need for you to monitor your spending transactions.

• Take advantage of your credit union’s online account monitoring services. Report any suspicious activity to your credit union immediately.

• Be sure your card is returned following each purchase and that it is indeed your card.

• Wait for the card receipt. Never leave it at the checkout counter; and keep receipts with you, not in your shopping bags.

• Check your statements and watch for multiple or incorrect charges. Compare receipts to your account statements, and then destroy your receipts.

• Report unauthorized transactions to your credit union immediately.

• Keep a list of your card account numbers and telephone numbers to call if your cards are lost or stolen. Keep that list in a secure place.

• Make sure you have signed your credit and debit cards. Do not write your PIN on the card!

• When entering your PIN, block the keypad from the view of the cashier or other customers.

• Know that your PIN can be stolen in other ways. There is a heat signature left on non-metal keypads for several minutes after you use it. Infrared cameras installed on Smartphones can be used to measure this heat signature and obtain your PIN. Stop this fraud by resting your fingers on other keys while typing in your PIN.

• Running your card as credit rather than debit is another way of protecting your PIN.

Online Shopping: Use a Secure Internet Connection:

• Do not use public wireless networks for online purchases.

• Shop on sites with https:// in the URL, and be sure that an icon with a lock appears to the left. The “s” stands for “secure” and indicates communication with that site is encrypted.

• Type the merchant’s address directly into your browser; avoid links.

• Use complicated passwords with at least eight characters. Include numbers, special characters and upper and lower case numbers.

• Keep the antivirus and security software updated on your computers and mobile devices.

• We recommend that you don’t store your payment information. Many websites or apps let you store your credit and debit card information for convenience, but this might also be too convenient for thieves.

• Do not respond to pop ups, and do not share card information via email or texts.

• Set up payment and purchase alerts via text and email. If you notice suspicious activity, notify your credit union immediately. Mid Oregon members who have CardNav on their smart phone should review their settings for debit card use and alerts.

Fraudsters are always looking for new ways to access your account information; always be aware of how and where you are making purchases with debit and credit cards to protect yourself from potential threats. By diligently following credit-debit card security tips, you can shop with confidence and enjoy a happy holiday season free from fraud and identity theft. If you suspect your account has been compromised, contact your credit union immediately for assistance. For additional up-to-date information, visit Mid Oregon’s Security and Fraud Center.