The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Credit Blues? Things To Improve (Part 2)

For the first 4 of ten things you can do avoid the credit blues. To improve your credit score, read this prior post, Credit Blues? Things You Can Do To Improve! (Part 1).

What can you do to improve your score?

The Federal Trade Commission (FTC), on their Consumer Information webpage on “Credit Scores”, provides this informative recap:

Credit scoring systems are complex and vary among creditors or insurance companies and for different types of credit or insurance. If one factor changes, your score may change — but improvement generally depends on how that factor relates to others the system considers. Only the business using the system knows what might improve your score under the particular model they use to evaluate your application.

FTC Credit Report & Credit Score Information

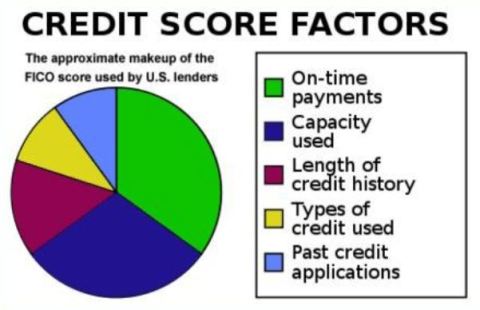

Nevertheless, scoring models usually consider the following types of information in your credit report to help compute your credit score:

-

- Have you paid your bills on time?You can count on payment history to be a significant factor. If your credit report indicates that you have paid bills late, had an account referred to collections, or declared bankruptcy, it is likely to affect your score negatively.

- Are you maxed out?Many scoring systems evaluate the amount of debt you have compared to your credit limits. If the amount you owe is close to your credit limit, it’s likely to have a negative effect on your score.

- How long have you had credit?Generally, scoring systems consider your credit track record. An insufficient credit history may affect your score negatively, but factors like timely payments and low balances can offset that.

- Have you applied for new credit lately?Many scoring systems consider whether you have applied for credit recently by looking at “inquiries” on your credit report. If you have applied for too many new accounts recently, it could have a negative effect on your score. Every inquiry isn’t counted: for example, inquiries by creditors who are monitoring your account or looking at credit reports to make “prescreened” credit offers are not considered liabilities.

- How many credit accounts do you have and what kinds of accounts are they?Although it is generally considered a plus to have established credit accounts, too many credit card accounts may have a negative effect on your score. In addition, many scoring systems consider the type of credit accounts you have. For example, under some scoring models, loans from finance companies may have a negative effect on your credit score.

Scoring models may be based on more than the information in your credit report. When you are applying for a mortgage loan, for example, the system may consider the amount of your down payment, your total debt, and your income, among other things.

-

Here are the last 6 of 10 things you can do to improve your credit score:

- 5. Use credit cards—but manage them responsibly. In general, having credit cards and installment loans that you pay on time will raise your score. Someone who has no credit cards tends to have a lower score than someone who has already proven that he can manage credit cards responsibly. Mid Oregon has low cost credit cards with no cash advance fees and no balance transfer fees.

- 6. Don’t open multiple accounts too quickly, especially if you have a short credit history. This can look risky because you are taking on a lot of possible debt. New accounts will also lower the average age of your existing accounts which is something that your credit score also considers.

- 7. Don’t close an account to remove it from your record. A closed account will still show up on your credit report. In fact, closing accounts can sometimes hurt your score unless you also pay down your debt at the same time.8. Shop for a loan within a focused period of time. Credit scores distinguish between a search for a single loan and a search for many new credit lines, based in part on the length of time over which recent requests for credit occur.

9. Don’t open new credit card accounts you don’t need. This approach could backfire and actually lower your score.

10. Contact your creditors or see a legitimate credit counselor if you’re having financial difficulties. This won’t improve your score immediately, but the sooner you begin managing your credit well and making timely payments, the sooner your score will get better.These ideas won’t create a dramatic improvement in your credit score overnight, but over time, they will. Remember, it takes time to develop a strong profile. Once you’ve done it, you’ll find it easier to apply for credit and favorable interest rates.Talk to us to find potential tips and solutions. We are only a short trip (visit one of our 7 Central Oregon branches), a quick email or a short phone call away.((541) 382-1795).

Strong Growth and Performance for First Half of 2017!

Strong Growth and Performance for First Half of 2017!

Our fast start in 2017 has been sustained through the first half of the year as we continue to improve our performance and achieve our goals to increase service to the membership.

As our organization grows, we are actively working to operate more efficiently and effectively by improving our accountability, systems and structure. Some of the changes are clearly evident to our members while others are working behind the scenes to ensure that we continue to provide great service and valued financial products. You may have noticed some new faces in the branches; we have been hiring to back fill for staff who have been promoted to help us keep moving forward as we grow. We are fortunate to be able to attract and retain great people who value our culture and reflect our brand.

Simply Free Checking

Our Simply Free Checking is having a significant impact on our growth, we are seeing record numbers of new members who are finding value in having a relationship with Mid Oregon. We are also seeing changes at other financial institutions that are nudging lots of people to make a switch, and very thankful for our members who are taking advantage of our “Tell a Friend” referral rewards to encourage their friends to give Mid Oregon a try.

The increased levels of activity are pushing us to exercise our skills and build our stamina to higher levels, we are just plain getting better at what we do and working to find ways to focus on quality as well. We will be releasing our new Mid Oregon App soon, it is in beta testing by staff right now to get it ready for our members.

Information About the Eclipse

We are diligently preparing for the Eclipse on August 21 and have carefully considered both member convenience and security. We will be closing our Madras and Prineville branches for the day while the rest of our branches will be operating as normal.

August and September are very busy months for us, supporting the community with Supplies 4 Schools, free concerts, back to school events and the Duck Race!

Thanks always for your membership and engagement with Mid Oregon Credit Union, we appreciate that you chose us to help you with your financial needs and dreams.

You Can Make a Difference with School Supplies

You Can Make a Difference with School Supplies and help local kids off to a great start!

Mid Oregon Credit Union knows our members, and you, want every Central Oregon kid to get the start he or she needs to succeed in school. As a homegrown credit union founded right here in Central Oregon by local educators, we’re once again partnering with the Family Access Network and Central Oregon public school districts to collect and distribute school supplies with the Supplies 4 Schools program.

See a video about the Family Access Network (FAN) and Mid Oregon School Supply collaboration

Supplies 4 Schools Provides a Way for You to Help

Many kids in our community show up for school without the basic tools and supplies to be successful in class. To respond to that need, Mid Oregon created Supplies 4 Schools where collected supplies reach students through the Family Access Network and schools. For the past many years our members have always come through with overwhelming support for the program! In fact, the Family Access Network was able to provide more than 3,200 children with school supplies in 2015 as a result of Supplies 4 Schools and other community efforts.

Donation bins will be at your local Mid Oregon Credit Union branch anytime during the month of August. Just bring new, packaged school supplies, or you can also make a cash donation, which will be used to its fullest potential to make sure those backpacks are full come September!

Donations Stay in Your Community

When you support Supplies 4 Schools, your donations go to help the kids in your area. The Family Access Network works in schools in Deschutes and Crook County, in Jefferson County the donations go straight to your local schools for distribution. Supplies collected in our newer La Pine and Sisters branches will stay in those areas, too.

What’s Needed?

Here’s a quick list of the items that are most needed. When you’re out shopping at local retailers, be sure to grab a couple of these items on sale. Thanks for your support of this wonderful effort to help local kids!

High school back packs

Elementary school back packs

Ear buds

Basic & scientific calculators

Composition books

2″ and 3″ binders

Five-tab dividers

Other needed supplies:

College ruled paper

Calculators

1” and 2” three ring binders

Pocket folders

Colored pencils

Color markers (thick and thin)

Highlighters

Alarm clocks

Dry erase markers/pens

Compasses and protractors

Rulers

Glue and glue sticks

Tissue boxes

Remember, your cash donations are appreciated and will be applied to the supplies needed most. For more information about Supplies 4 Schools, please call 541-382-1795, or send an email to beheard@midoregon.com.