Seven Ways to Use Your Tax Refund

If you’re expecting a tax refund this year, now is a best time to start planning how you’ll use that extra money. The best uses are to pare down debt and bulk up your savings. Here are seven ways to use your tax refund. For instance, you can:

- Open an emergency fund or add to your existing one. Aim to save enough to cover three to six months of expenses for those unexpected emergencies, like your car breaks down, your refrigerator dies, or you lose your job. Put your tax refund into a savings account opened specifically for these emergencies. Three to six months is a big hurdle if you are just beginning. Aim for at least $1,000 if that is all you can do.

- Fund your IRA. You can make up to a $5,500 contribution ($6,500 if you’re 50 or older) to a Roth or a traditional individual retirement account (IRA) for tax year 2018. Mid Oregon has both kinds of IRA accounts- learn more by visiting our Deposit Account webpage, and click on the IRA/HSA tab.

- Open a 529 plan. If you save for your child’s college education in a 529 plan, you may get a tax deduction for your efforts. Visit SavingforCollege to find out more. Mid Oregon Financial Services has 529 options for you, visit their webpage for more details.

- HSA Accounts. If you are have a high-deductable health plan, starting or building your Health Savings Account (HSA) is a great option. HSA accounts let you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in an (HSA) to pay for deductibles, copayments, coinsurance, and some other expenses, you can lower your overall health care costs. HSA funds roll over year to year if you don’t spend them. An HSA may earn interest, which is not taxable. Mid Oregon has a great HSA Account, with a debit card and no monthly fees. To learn more about HSAs, visit HealthCare.gov, and to learn about Mid Oregon’s account, visit our Deposit Account webpage, and click on the IRA/HSA tab.

- Take a class to improve your career prospects. If you think you lack certain skills to get ahead in your career, use the refund to purchase classes to learn those skills. You may be able to deduct those expenses from your taxes using the Lifetime Learning Credit. Central Oregon Community College (COCC) is a great place to start for adult career development.

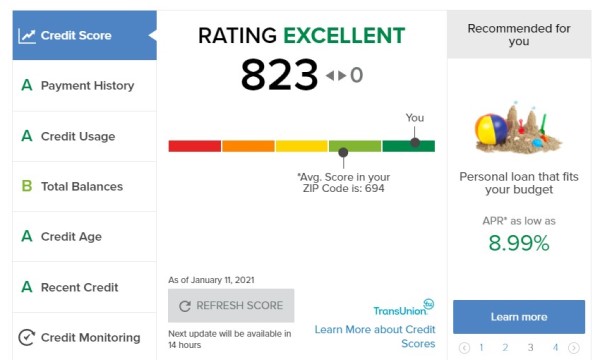

- Pay off debt. Use your refund to pay off any high-interest-rate credit card debt you may have. Try to pay off the debt in full so you can stop getting interest charges added to your balance every month.

- Start a Savers Club account. This account lets you save for holiday spending year-round so you don’t have to rely on credit cards in December. It is also flexible enough to use for vacation savings, property taxes, and many more expenses. If your employer offers direct deposit, make saving even easier by having a set amount automatically deposited to this account. To learn about Mid Oregon’s Savers Club account, visit our Deposit Account web page, and click on the Certificates tab.