The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

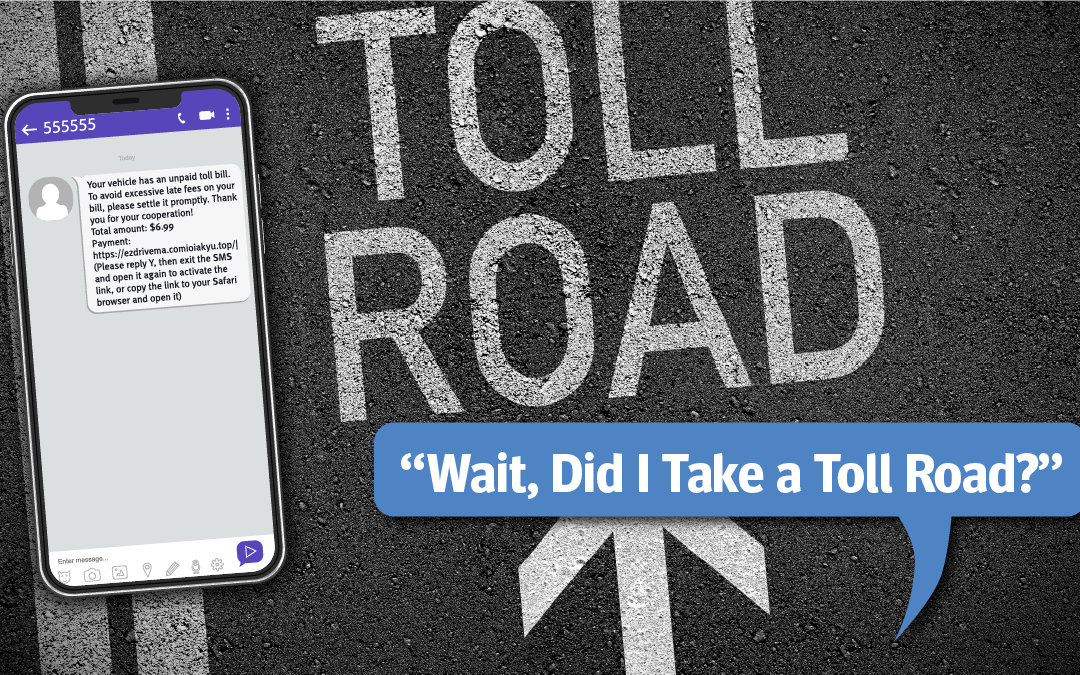

“Wait, Did I Take a Toll Road?” What to Do When You Get the Text.

Have you taken a toll road recently? Well, even if you haven’t, this story is for you. There is a text message going around that anyone who drives on highways or freeways should be on the lookout for and it’s just annoying enough to drive anyone mad. As you can guess, it involves toll roads and the supposed accompanying fees related to them. It goes like this.

The Toll Text

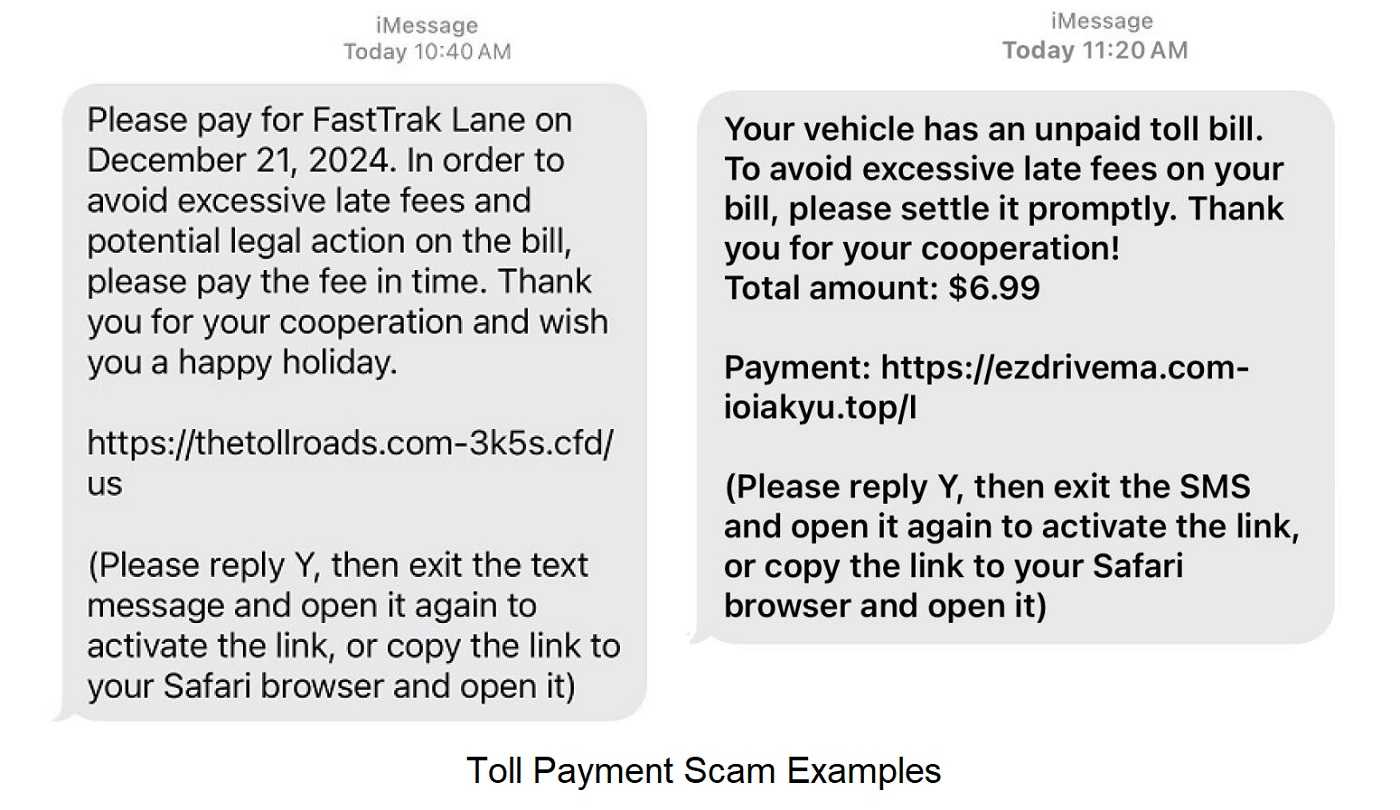

A text message appears on your phone stating you owe a toll, and you need to pay it right away. What? You say. You haven’t taken a toll road recently, that you can recall anyway. So, why would you owe a toll? The answer is, you don’t. This scam tries to make you think you owe one and if you don’t pay up, right away, you’ll be assessed some phenomenal penalty.

How to Spot the Scam

The first clue that this is a scam, if you haven’t taken a toll road of course, is that you haven’t taken a toll road. The second, is that there is that oh so familiar sense of urgency that phishing scams like to use so much. Yes, if you owe tolls, the time you have to pay matters to avoid penalties, but it’s not an immediate thing, unless there is a booth or you have one of those transponders. In California, you have five days to pay the tolls, for example. And toll agencies aren’t in the habit of sending unsolicited text messages. In fact, if you owe a toll and don’t have a toll road account for wherever you happen to be driving, they don’t even have your phone number. They’ll send you a bill in the regular mail.

The Kansas Turnpike warns, “Be aware of fake messages claiming you have outstanding tolls due on a Kansas toll facility. These messages include a link or URL instructing you to visit a fake website that mimics a KTA or DriveKS web site or a toll web site in another part of the country.” The New York Thruway website has a big warning on the front page of its website, alerting drivers that “E-ZPass or Tolls By Mail WILL NEVER send a text or email requesting sensitive personal information such as credit card, birthday, Social Security number, or other personally identifiable information.”

What To Do

If you do receive one of these, delete it off of your device so there is no chance you’ll accidently click the link. Keep your eyes open for other signs of phishing, such as texts being sent from international phone numbers. And remember to drive safely out there.

Content provided by Stickley on Security.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1

From Ledger Sheets to Digital Banking: 5 Tips for Financial Wellness

From Ledger Sheets to Digital Banking: Five Smart Moves for Financial Wellness

When I was a child, I watched my father balance his checkbook once a month like clockwork. He’d retreat to the little room off the garage he called his “office,” armed with an ancient mechanical adding machine. I can still hear the rhythmic tap-tap-tap and the roll-chunk as the machine printed each calculation on a narrow strip of paper. It went on for hours, but at the end of the day, his account book balanced perfectly.

Those memories taught me something important: financial wellness takes discipline and attention. Back then, it was all about ledgers, calculators, and patience. Today, we have tools that make managing money easier and faster than ever—but the principles remain the same. As we head into a new year, Mid Oregon would like to share five strategic moves that can help you take control of your finances and feel confident about your future.

1. Audit Your Accounts

Back in the day, auditing meant flipping through pages of handwritten entries and reconciling every penny. Today, it’s much simpler—but just as important.

Start by reviewing all your accounts:

- Checking and savings

- Retirement accounts

- Old accounts you might have forgotten about

Ask yourself:

- Does each account have a clear purpose?

- Are you contributing to retirement?

- Do you have an emergency fund?

Pro Tip: Consolidating accounts can reduce fees and give you a clearer picture of your finances. Mid Oregon’s Digital banking tool make this easy—you can see everything in one place, even accounts from other institutions.

2. Set Money Goals

When I was younger, goals were simple: save enough for a family vacation or a new appliance. We didn’t have apps or dashboards—just envelopes and handwritten notes.

Today, goal-setting is more structured and powerful. Start by listing what went well last year, then identify what you’d like to improve. Break big goals—like paying off debt or saving for a home—into smaller steps.

Tips for Success:

- Be specific and realistic

- Start small—two or three goals are plenty

- Stay flexible. Life happens!

Pro Tip: Use the savings goal tool under the Financial Wellness tab in the Mid Oregon Digital Banking to track your progress and stay accountable.

3. Optimize Investment Accounts

Investing used to feel intimidating without easy access to information. Now, you can review and adjust your accounts with just a few clicks.

Action Steps:

- Check your retirement contributions and make sure you’re taking advantage of employer matches

- If you have old 401(k) accounts, consider rolling them into an IRA for better control

- Explore IRA certificates for competitive rates and long-term growth

4. Enlist Professional Help

Years ago, financial advice often came from family or friends. Today, you have access to experts—and many services are free.

Our institution offers:

- Financial consultations visit any branch to review your goals and accounts

- Book a Retirement & Investment planning session with Mid Oregon Wealth Management to help you prepare for the future

- Attend one of the Financial Workshops offered by Mid Oregon to make everyday money management and future planning easier

Don’t hesitate to ask for help. Professional guidance can simplify complex decisions and give you peace of mind.

5. Plan for Tax Season

I remember when tax season meant paper forms spread across the kitchen table and hours of calculations. Now, you can prepare with far less stress.

Start early:

- Organize your documents now

- Use digital tools to track deductions and income throughout the year

- Seek professional help if needed—did you know that just being a member at Mid Oregon you can get discounts for your tax prep? Click here for more information.

Closing Thoughts

Financial wellness isn’t about perfection—it’s about progress. The tools have changed since my father’s days with his mechanical calculator, but the goal remains the same: clarity, confidence, and control.

If he could balance the books with nothing but paper and patience, imagine what you can do with today’s technology. Start now, take small steps, and make this the year you thrive.

Don’t Get Grinched! Top Holiday Scams You Need to Know.

Safely past Thanksgiving, they’re out there waiting. Right now, the scammers are looking to ruin this holiday season of gifting for their own benefit. Whether online or in person, these greedy grinches are after what they can grab using tried and tested methods. AI is also helping scammers appear more legitimate. Some of the top scams are listed below to help you have a scam-free holiday season.

Phony Shipping Notices

Whether you’re expecting a delivery or not, scammers will alert you via phone, email, or text there’s a package on the way or you missed a delivery. They’ll claim to be from FedEx, the post office, or other package delivery service sending you a link to track the fake delivery. The links lead to a spoofed website or they can download malware. Some ask for a credit card number or other PII for the bogus delivery.

TIPS: Don’t click on any links and go to the true delivery service or merchant website to see if there’s really a package delivery needing your help. Don’t provide your PII or payment information when asked, it’s a sign something isn’t quite right.

Missing Packages

Porch Pirates are out in full force looking for package deliveries left on doorsteps and other obvious places. They love driving around neighborhoods looking for unattended deliveries. It’s free stuff for these grinch-pirates but it’s a headache for you when you’re not at home. Getting stolen merchandise replaced or refunded can take time you don’t have for the gift-giving season.

TIPS: Instruct deliveries to a side or back door when possible or send to a friend or neighbor you know will be home. Home security cameras catch Porch Pirates in the act for law enforcement. Package tracking using the legitimate delivery service website can help with delivery days and times to be on the lookout. Use delivery options like Amazon’s Key or Hub Lockers or pick up the item from the merchant when possible.

Fake Order Notices

Emails arrive about a purchase you’ve made from a retailer or third-party payment like PayPal, to verify your order. The purchase amount is enough to make you panic, and you’ll want to resolve the matter quickly. The email includes a link or phone number to dispute the order, and scammers know you’ll likely follow it. The link can go to a spoofed website to steal your PII, or it will outright ask for your payment card and login information so the scammer can go a shopping spree.

TIPS: Don’t follow links or provide sensitive information. Instead, go directly to the merchant’s true website and make inquiries from there. Check your payment card for unauthorized charges. If there isn’t anything in either of those locations, it’s likely a scam.

Sob-sters & Fake Relatives

Appeals for donations including with GoFundMe can be bogus, so if you’re giving this holiday season, stick with well-known or local charities. Calls from a family member asking for a money wire to get out of jail, for instance, call a family member to confirm it’s legit. Emails with similar scenarios, especially asking for money via gift cards, is the sign of a true scam.

TIPS: Call and verify! Contact the recipient of the donation. For family—call another family member to verify the story before sending a dime.

Content provided by Stickley on Security.

For more tips on protecting your personal information, visit Mid Oregon’s Security and Fraud Page: https://ow.ly/hjHm50V9XE1