Upon graduation, many high-schoolers are ready (or think they are ready) for college. They’re emotionally ready to spend time away from home, they’re prepared for the workload of classes, etc. But what many of them lack is financial know-how.

According to DailyFinance, within five years of leaving home, most teens are faced with the decision of taking out student loans, buying a car, signing up for credit cards, or even taking out a mortgage. And it’s up to parents to instill some wisdom in those bright-eyed, bushy-tailed youths before they learn it the hard way.

Your teens shouldn’t be burdened with your financial stress, and they definitely don’t need to know all of your misdeeds. But they should know the basics of the common financial situations they’re soon to encounter. Whether you’ve done right with your money, made a boatload of financial snafus, or a little bit of both, here are some worthwhile discussions to have with your kids:

Student Loans: While student loans are often times a necessary debt, they’re still money owed to someone else….

Read more at ASmarterChoice.org* Blog

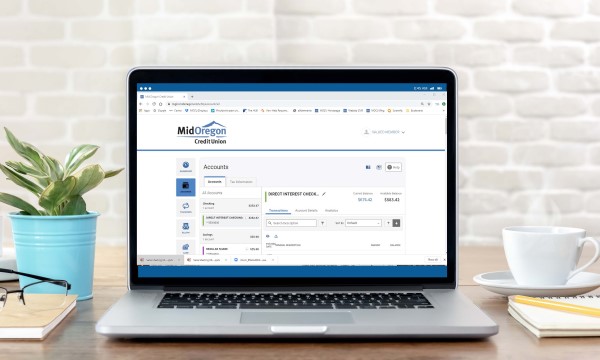

*About A Smarter Choice: Credit unions make a difference for their members and the communities they serve. ASmarterChoice.org, a project of the nation’s credit unions, was developed to help everyone understand that credit unions are the best option for consumers for conducting their financial business.