We’ve all been through it. Having your private personal data compromised is frightening.

That’s why at Mid Oregon Credit Union, we believe protecting the privacy and security of our members’ accounts is our most important responsibility.

Acting Quickly

When we discover a data breach, we act immediately to change account numbers and issue new credit and debit cards for affected members. Additionally, we pursue cyber criminals through available legal channels. But, under current regulations, we are not allowed to tell you which organization is responsible for the breach.

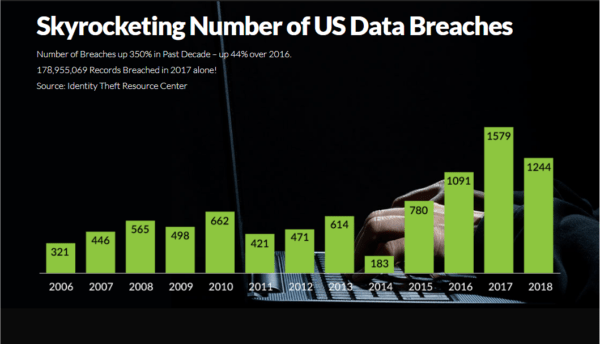

Having your personal financial data stolen is enough of a burden. You shouldn’t have to worry about who is going to clean up the mess and pay the bills for the fraud. The problem keeps getting worse.

2018 Data Breaches

More than 1,200 data breaches occurred in 2018, exposing more than 197 million data records—a 126% increase over 2017. The number of records breached in 2018 is likely higher since only half of the breaches reported included the number of records exposed. Read more about the problem here.

Most of us assume the organization responsible for the breach pays the costs since their security failures caused the theft of your data. Sadly, that’s not how it works.

Credit unions like Mid Oregon bear the brunt of the expenses after a data breach, even though we (and members like you) had nothing to do with it.

Credit Unions Pay the Price

To give you one example, after the Target breach, credit unions were left on the hook for $30.6 million and credit unions reissued 4.6 million credit and debit cards.

Right now, organizations responsible for these breaches can shift most of the costs of their data breaches to others. Because we are not-for-profit cooperatives owned by our members, you ultimately foot the bill to clean up their mess. There is no incentive for the organizations that allowed the breaches to spend the time and money to increase their data security. That’s wrong for consumers and bad for our economy.

Calling on Congress!

That’s why Mid Oregon and other credit unions across the country are working together to improve protections for credit union members who are victims of data breaches.

We’re calling on Congress to step up and protect credit union members.

I hope you’ll consider lending your voice to this important effort. Please click on this link to learn more about the problem and send an e-mail to your U.S. Representative and U.S. Senators.

Thank you for making your voice heard on this important subject on behalf of your fellow consumers.

Sincerely,

Bill Anderson

CEO, Mid Oregon Credit Union

PS—Data breaches are scary and inconvenient, but Congress can protect consumers like you. To find out more, visit StoptheDataBreaches.com.