Bust the Mid-Winter Blues and Keep Financial Resolutions This Year.

I always spend part of the last day of the year trying to come up with a great New Year’s resolution. While I know most of them won’t be kept for a full 12 months, I like to state some kind of goal for myself. If nothing else, it makes me sit and think about my life for a few minutes. But making them doesn’t necessarily mean I will keep financial resolutions this year.

One of my favorite resolutions was one I made a few years ago to get in touch with old friends. This was a fun one and I probably contacted about five close friends I hadn’t talked to in years. It made me feel good and it was great hearing about their lives, jobs, kids, etc… I can’t say I’m still in touch, but I did what I set out to.

Changed Last Year

Last year, I decided, after a few financial hiccups, to really and truly get my finances in order. I started by laying out a budget for myself and signing up with Mint. This is a great, free online tool that tracks all your spending automatically so you can see exactly where your money goes. It was a real eye-opener and very helpful.

I learned a lot about better ways to manage my money, which had far-reaching effects: less stress, fewer calories consumed (I didn’t eat out as much), a great vacation, bigger savings and retirement accounts, and a less cluttered closet. All items in the WIN column.

Tips For a Great Next Year

I’d like to share a few valuable tips with you to help make 2015 a great financial year for you.

Get started:

- Write down everything you spend during a 1-week time period – everything. This will let you see exactly where your money is going.

- Cut the frequency at which you dine out in half – stay home and enjoy a simple home-cooked meal.

- Put your credit cards on ice in the freezer – it will force you to use cash to pay for things meaning you can only buy what you can afford.

Get serious:

- Transfer all your credit card balances to one card with the lowest interest rate.

- Stop going to the ATM every day – small withdrawals can add up fast.

- Shop around for the best home and car insurance deals – your plans should be reviewed every 6 – 12 months. Consider raising your deductibles to reduce your annual payment.

- Refinance your mortgage if there’s a lower interest rate available. Consider a 15- year instead of a 30. This can save you thousands over the life of your loan.

Get physical:

- Ride your bike or walk to save gas money.

- Cut your own grass and wash and iron your own shirts.

- Exercise at home or outside to save money on a gym membership.

Get creative:

- Plan meals ahead of time so you can shop once and use what you buy more efficiently.

- Clip coupons and use them! This is serious business and can save you hundreds of dollars each year.

- Stop buying donuts or coffee on the way to work, a candy bar at 2:00, drinks after work. Bring breakfast bars, make coffee at home or carry snacks with you to prevent unnecessary spending.

These are lots of ways to cut corners, trim budgets, shave interest rates and pinch pennies. Look for things that you can really live with so you’ll stick with them for 12 months, not just 12 days.

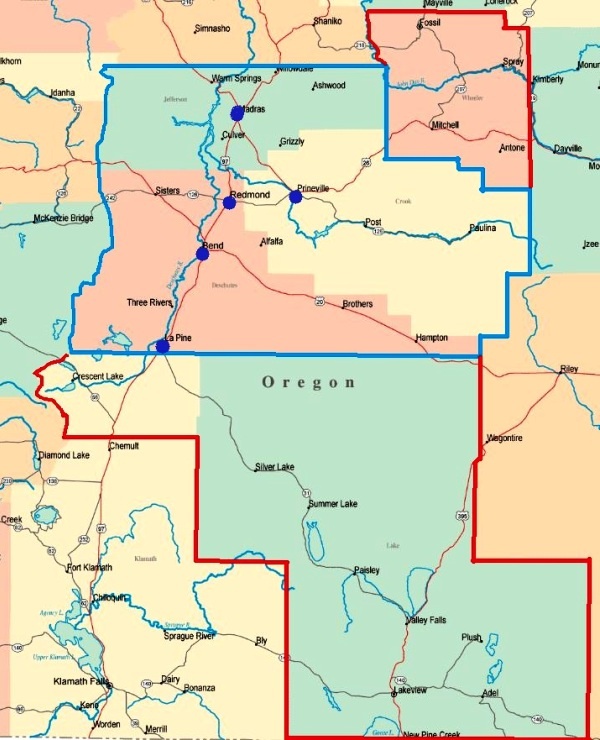

Need some help getting started? Check with Mid Oregon Credit Union for free financial workshops on the topics you need. Mid Oregon’s Financial Services Representatives can also offer suggestions to members on ways to trim your financial costs. Mid Oregon has affordable options on credit cards, mortgages and other financial products you use, including in-house insurance options from Cascade Insurance Center. Check midoregon.com or visit a branch for more details.