The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

The Friendlier Skies

Why now is the time to use airline miles

By Chris O’Shea*

The recent pandemic lull has seemingly come at an opportune moment: Right in time for summer vacations. If you’re considering flying to your summer destination and you’re sitting on airline miles, you’re in luck — now is the time to strike. Here’s why.

The Refund

As The New York Times notes, one of the best aspects of booking a flight with airline points is that they are fully refundable. That means if the pandemic somehow (ugh, fingers crossed) takes a turn for the worse between now and your summer vacation, you can change or cancel your flight without any fees or penalties. If you buy an airline ticket with cash, you’ll likely only get an airline credit if you need to cancel. And yes, you can buy a refundable ticket, but they’re usually more expensive than regular tickets.

The Value

Airline points are like currency for airlines, and that means they can change their value how they see fit. That’s why now is the time to use your miles. It’s plausible that your points’ value is at an all-time high. However, as flying demand increases, there’s a good chance that airlines will reduce their buying power.

The Options

In general, you have more options when flying right now. There are less travel restrictions from countries than since the pandemic began two years ago. That means you have more options to pick a great summer vacation spot. You also have more airline seating options now, as travel demand has just started revving up.

*This guest article is from the “Your Money Blog” in Mid Oregon’s Digital Banking Credit Savvy resource. It is made possible by SavvyMoney. “The Friendlier Skies” by Chris O’Shea was published in March 2022.

See additional articles by Chris O’Shea in the Mid Oregon View.

View additional Mid Oregon View articles on travel and vacation.

Support Health Screening For Preschoolers

Fun Mid Oregon Fundraiser Helps Preschoolers Receive Free Health Screenings

Mid Oregon is gearing up for its 18th Annual “Adopt-A-Bear” fundraiser April 1 through April 17 in support of Healthy Beginnings. They provide free health screening for preschoolers. We want to share how anyone can support health screening for preschoolers.

Over $35K raised for Healthy Beginnings since 2004

Since 2004, Mid Oregon’s Adopt-A-Bear annual fundraiser has raised more than $35,000 to help support Healthy Beginnings. Community donations keep their screenings free for all families who use their services. The screenings are performed by local medical, dental, nutritional, and behavioral specialists, The screenings providing parents with a thorough assessment of their child’s physical and developmental health.

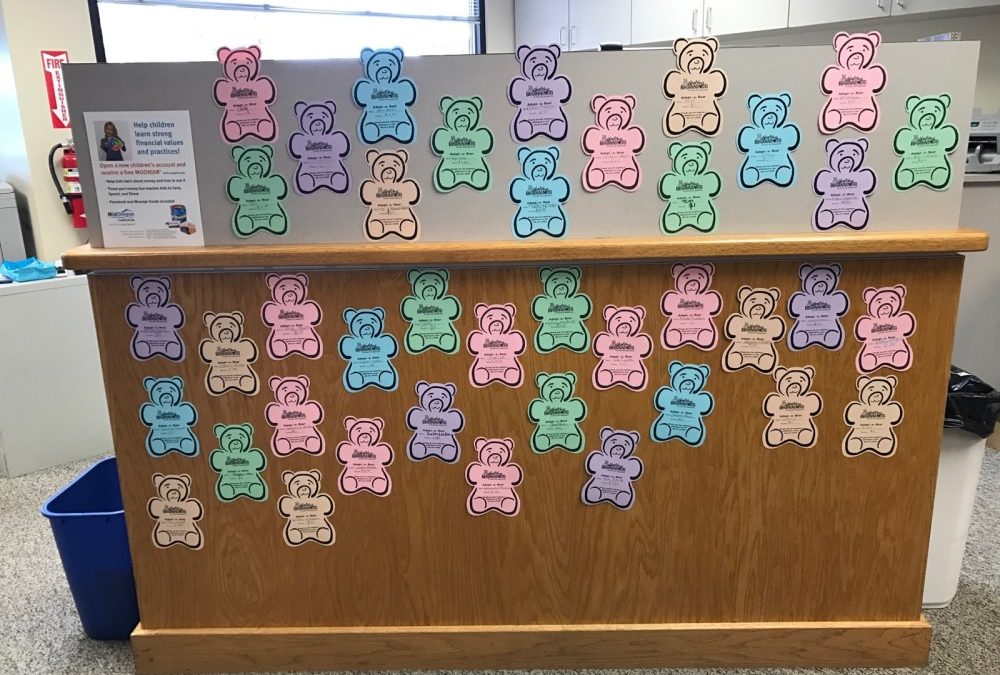

That year, Mid Oregon’s CEO, Bill Anderson, and the Healthy Beginnings Executive Director at that time, Holly Remer provided a perfect solution to a fundraising dilemma with a creative campaign called “Adopt-a-Bear”. The colorful “teddy bear” became the vehicle to expand community awareness and provide needed revenue. Mid Oregon Credit Union staff and members “adopt” bears with their donations to Healthy Beginnings. As a result, the die-cut bears become the “wallpaper” at all their branches.

First Five Years Significant to Development

“So many critical developmental milestones happen in those first five years,” says Kathleen Cody, Healthy Beginnings current Executive Director. “Children suffering from unidentified medical or developmental issues can act out in various, unhealthy ways. Our assessments help catch these issues before school starts, giving parents an additional resource and peace of mind if they have questions about their child’s development.”

From April 1-17, we encourages Central Oregon communities to “Adopt-A-Bear” at any of Mid Oregon’s seven branches, by calling 541-382-1795, or going to our secure, online donation form. Donations will help ensure that every preschooler in Central Oregon is healthy and prepared to enter kindergarten ready to learn. This gives the opportunity to support health screening for preschoolers to virtually anyone in our region.

About Healthy Beginnings

Healthy Beginnings is a registered 503(c) non-profit organization located in Bend, Oregon. They are dedicated to ensuring that all local children enter their school life ready to learn, contribute, and thrive. Healthy Beginnings conducts free, comprehensive health and developmental assessments for children under the age of five. They use state-of-the-art screening tools and performed by certified volunteer health and behavioral specialists. These free health screenings are available to every child in Deschutes, Crook, and Jefferson Counties.

You can learn more about Healthy Beginnings at www.myhb.org.

Read past articles about Healthy Beginnings and Adopt-A-Bear.

Why Auto Loan Pre-Approvals are Critical Today

Are you seeing the need to get yourself a new set of wheels? Maybe you have been waiting until the pandemic restrictions were reduced? Perhaps your current vehicle is becoming less reliable? Generally, more people make vehicle purchases in the spring. Mid Oregon wants you to know why auto loan pre-approvals are critical today..

Mid Oregon Credit Union has many thousands of vehicle loans, and each year we help Central Oregon’s purchase thousands of cars, trucks, RVs and “toys”. We strongly suggest you get pre-approved for any vehicle purchase, especially today. While always a good idea, currently it may make the difference in getting what you want, when you want it.

Why Get Pre-Approved For Your Loan?

- Verifies you can afford the car you want. You will want to focus on the vehicles that fit in your price range. There are many brands, makes and models theoretically available. You should concentrate your efforts where prices, whether new or used, are affordable to you.

- Reduces pressure while buying. There can be a lot of stress just finding, test driving and negotiating your purchase. Having your loan settled is one less thing to worry about. You will want to be focused on the vehicle and price to make a better decision.

- Lender will have more of your interest in mind. If you finance through a credit union or bank directly, they want to be sure the loan works for your circumstances. That lending relationship will continue long after you drive off the dealer’s lot. Both you and your lender want that to work long term.

- Choose better loan terms. When you are at the credit union looking at a pre-approval, you will have knowledgeable input on what you can afford. You can easily see how interest rate, monthly payments, duration of the loan and overall costs will look for you. You aren’t pressured or rushed in order to get your vehicle purchased.

- Learn about additional insurance or service coverage at better cost. Mid Oregon, and likely other financial institutions, will have lower cost additional products and services you can set up with your financing. Guaranteed Asset Protection (GAP), Mechanical Breakdown Protection and Life, Disability and Unemployment protection are the most common. These can help provide peace of mind with your major purchase.

- Get trade-in valuation information. Mid Oregon will look up current values on your potential trade-in. Sometimes it is easier to handle that at the dealer, but normally you can get more value in selling it yourself. You will have more time to consider the choice.

Why Auto Loan Pre-Approvals are Critical Today

- Low Inventory. New vehicles have been in short supply due to supply chain issues. Chip availability for new auto electronics are the major reason, but there are others. As a result you will have fewer vehicles on the lots to see, and if you find one, having your pre-approved loan and amount allows you to make a fast decision. Even if you order your vehicle, having your loan in-hand can mean getting delivery sooner. While the used car market has its differences, being able to make quicker decisions is still important.

- Rising Prices. Prices on new cars increased over 12% from January 2021 to January 2022. And 82% of buyers paid over sticker price, compared to 3% in January 2021. If you are pre-approved, you can better determine current affordability in the moment.

- Higher gas prices and operating expenses. Often vehicle buyers only focus on the monthly payments for their purchase. While we know that the total cost is equally important, the monthly maintenance expenses can make a big difference to affordability. Fuel prices have risen dramatically in recent weeks, and even motor oil costs have increased. Coupled with lower supply of some parts and even difficulty getting in for services, the expenses for operating a vehicle need to be strongly considered with your purchase and loan payments.

Getting Pre-Approved is Time Well Spent

Talking to a vehicle lender like Mid Oregon Credit Union before you start shopping can be a great decision. You will use your time better by concentrating on what you can afford, not wasting your time. It’s easier to be more responsive when shopping, and have less stress in doing so. You stand a better chance of getting the vehicle you need, when you need it. And you will have more peace of mind knowing the financing will be better for you, without the pressure of a quick decision.

Mid Oregon would love to help you with your pre-approval. Many purchasers start online with our easy application. You can also visit one of our Central Oregon branches, or reach out to us through email info@midoregon.com or by phone (541) 382-1795. Let us help you get the vehicle you want, when you want it!

Want to know more about getting your best car deal? Join us Thursday 3/24 at 7 p.m. for our free online webinar- register here!

Read more about vehicle buying, and vehicle financing.