The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Start 2023 with a Financial Fitness Plan

Amazingly, it’s that time—the new year has arrived and right on schedule. Now is when we reflect on the past twelve months, and make resolutions to change certain areas in our lives—like our financial well-being. Whether you are trying to save money, reduce debt, improve your credit score, or fund a home improvement project, Mid Oregon can help.

Saving sufficiently for the future—whether that’s tomorrow or years from now—is crucial. Perhaps 2023 is the time to focus on building your nest egg for emergencies, retirement, or simply peace of mind. Mid Oregon offers a variety of savings account options that pay competitive dividend:

- Share Certificates—You can enjoy higher returns on your investments and keep your money safe and local. Take advantage of our latest 7-month and 11-month dividend offers.

- Saver’s Club Certificate—Set your goal and the amount you want to save every month. It’s ideal for saving for something special or not being caught short during the holidays.

- High Yield Savings Accounts—Savings account with a variable dividend rate that increases as the balance increases (minimum balance $1,000).

Minimizing debt is equally important. Consider applying for a home equity line of credit (HELOC) to consolidate debt or to build an ADU for extra income. How about transferring your high-interest rate credit card balance and take advantage of our no balance transfer fees?

Have you checked your credit score lately? Keep in mind that your credit score influences the type of financial options available to you—including interest rates on loans. Our CreditSavvy tool is a free, secure feature on our Digital Banking platform that you can use to improve your score, and monitor for potential fraud.

Building your financial plan does not have to be complicated. You can start by finding effective ways to make goals you can realistically achieve, and tools that will help get you there faster.

MAKE A SAVINGS GOAL

Set up a specific but realistic goal. It may be ‘paying off my credit card faster” or “saving $2,500 for an emergency fund.” If you see a tax refund in your future, use part of that money to give yourself a head start. Use a savings goal calculator, such as Mid Oregon’s Savings Goals widget in Digital Banking, to see how much you’d have to save each month. Or, as mentioned above, visit the variety of savings options Mid Oregon offers. Whatever you want to save for, set a goal and then work toward reaching it.

CREATE A BUDGET

A budget can feel daunting, especially if you have never done one or it has been a long time. But having a budget allows you to better control your money, instead of it controlling you. You will also feel more confident if faced with a financial setback. Begin by writing it all down—every dollar you spend. From the daily coffee, to treats for our four-legged friends and monthly subscription costs, it all adds up. Writing down all your expenses, even those that seem insignificant, is a helpful way to track your spending patterns, identify necessary expenses and prioritize the rest. You can jumpstart your budget by applying basic percentage rules:

- The 80/20 rule is one of the more simplistic rule where you use 80% of your budget for needs and wants, then save the other 20%. Rather than having a variety of categories, you simply divide your expenses and savings into these two buckets.

- The 70-20-10 rule spends 70% on your wants and needs, save 20%, and 10% for gifting. If you have debt, you can replace the 10% for giving and allocate it towards your debt payoff plan.

- 50/20/30 rule allocates 50% of your income toward essential expenses (rent, transportation, utilities), 20% toward personal financial goals (saving or paying off debt), and 30% toward flexible expenses (eating out, groceries, shopping, hobbies or entertainment).

- 30-30-30-10 rule is another popular method you can try. This budget breaks down into 30% housing, 30% expenses, 30% debt/savings, and 10% for entertainment/fun.

Figure out the best budget for you and get started.

PASS ON UNNECESSARY PURCHASES

It’s easy to lose track of how much money you spend on items you do not need. It might be on sale or “fit perfectly on the table corner.” Keep in mind that these unnecessary purchases can affect your bottom line. Get disciplined by identifying your needs vs wants. Do you need the newest smartphone or do you merely want it? Think about giving yourself a 24-hour cooling-off period between the time you see an item and when you make the purchase. If you’re shopping online, consider putting the item in your shopping cart and then walking away until you’ve had more time to think it over. In some cases, you might even get a coupon code when the retailer notices you abandoned the items in your cart. Turning down something you want now may be difficult, but the reward will be greater savings later.

BECOME A FAN OF AUTOMATION

- Digital Banking to ease financial tasks, saving you time and increasing your efficiency.

- Automatic overdraft protection. In a few easy steps, you can link your savings account to your checking to have a little added cushion in the event your expenses get a bit tight.

- Automatic loan payments. Your monthly loan payment will automatically be deducted from a linked checking or savings account.

- Setting up auto pay. This is a great way to save you time, hassle and offer peace of mind knowing your bills are paid promptly every month.

- Automate your savings: Direct deposit your paycheck into multiple accounts, including one for each of your savings goals.

TALK WITH YOUR CREDIT UNION

If you are feeling overwhelmed with your finances, reach out to your credit union and schedule an appointment . Sometimes it helps to have a personal conversation related to your specific needs, and Mid Oregon can offer helpful wisdom and insights.

The above strategies can help you to stick to a budget and save for your goals all while allowing for some budgeted fun. Remember, a goal without a plan is just a wish. Write it down, create the time and opportunity, and make it happen. Whatever your needs, Mid Oregon’s experienced team is a great place to start discussing your money-saving options. The year 2023 is a great time to start taking control of your finances and getting fiscally fit. Stop by a branch or visit us online at Mid Oregon Credit Union and start your Financial Fitness Plan today.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.

Need more help? View Mid Oregon’s recent webinar recording of “Reaching Your 2023 Financial Goals“, and access the handouts at https://www.midoregon.com/education/workshop-handouts.shtml.

Give—and Receive—Holiday Dough

Sometimes putting food on the table is a daily challenge. This time of year can be especially difficult for some families. Rising food and fuel costs are putting an added strain on many local households. For more than a decade, Mid Oregon Credit Union has partnered with our members and other community members to bring holiday cheer to local families through Holiday Dough. We are asking you to join us and Give—and Receive—Holiday Dough.

How You Can Help

We invite the community to participate in our annual Holiday Dough fundraiser. It supports local charities to provide food, clothing, and shelter to individuals and families in need during the holiday season. From November 14 to December 16, We are collecting donations at each of our seven branches. In addition, you may make donations online at midoregon.com/dough or by calling our Contact Center at 541-382-1795. One hundred percent of the contributions will stay in the communities where collected and will benefit these local nonprofits:

2022 -Nonprofits

- The Giving Plate (Bend) – Coordinating the Monthly Food Box program, Grow & Give Garden, Kid’s Korner food bank, and Backpacks for Bend.

- La Pine Christmas Basket Association Providing Christmas food baskets to low-income families, singles, and seniors in southern Deschutes County area.

- Redmond Jericho Road – Providing hot meals, backpacks of food, emergency and housing assistance to those in need in the Redmond area.

- Jefferson County Food Bank (Madras) – Supplying food to families and individuals.

- Crook County Holiday Partnership (Prineville) – Providing holiday support to seniors, children, veterans, people with disabilities, and families who are less fortunate in Crook County. Funds are used for food, gifts, and related items.

- Sisters Kiwanis Food Bank – The food bank’s Christmas program provides holiday meals to approximately 175 families. The food bank relies on cash donations to help buy items that are not normally donated, such as meat and dairy products.

Making a Difference in the Community is a Mid Oregon Core Value

Giving back to the community is a core value of Mid Oregon. Giving back also aligns with our credit union philosophy of “people helping people.”

“When putting food on the table is a daily struggle, planning a festive holiday meal can be almost impossible,” says Kyle Frick, VP of Marketing for Mid Oregon Credit Union. “We are humbled by the community’s generosity and honored to facilitate this effort that supports those who are less fortunate.”

Since 2011, Mid Oregon members and the community have donated nearly $29,000 to local food banks through Holiday Dough—helping to bring holiday cheer to local families. This year, we have ways to both give-and receive-holiday dough.

How You Can Receive Your Holiday Dough

Plus, this year we’re sharing some “dough” with you! Visit our Holiday Dough Page. Be sure to view and download the winning recipes from our Mid Oregon Team Cookie Contest. We invite you to share them with family and friends this season–let us know your favorites!

Investing for the Future

For years, you’ve diligently invested in your retirement portfolio, accumulating wealth that you hope will sustain you throughout your Golden Years, investing for the future. To help see that your assets are sufficient to help you support your lifestyle standards, there are important steps that you can take:

Perform regular assessments

While you may have performed calculations about your anticipated retirement needs years ago, it’s helpful to re-crunch those numbers regularly, to guard against changes in your expectations as well as financial markets.

Calculate

It is important to calculate your Social Security income, any pension moneys, accumulated savings, and personal investments. Determine whether collectively they can cover your estimated living expenses, which should incorporate swings in the financial markets. If you find that your assets are lacking, it may be helpful to consult a financial professional to help reconfigure your portfolio

Guard against the big “I”

Most people approaching retirement will want to protect their portfolio from market swings and the dreaded I: inflation. That doesn’t mean replacing all of your investments with less risky assets; rather, that means considering a gradual move of some stock investments into bonds and cash while retaining sufficient growth-oriented investments that help manage inflation risk.

Preserving your assets for future generations

Integral to a strong financial plan is a well-constructed estate plan that preserves your assets for your heirs. In this regard, you may benefit from consulting with an attorney who can help you draft trust and various types of insurance tools to help protect your assets from estate taxes. Additionally, revisit your financial plan and goals with a financial professional regularly, addressing any potential problems before they impact your savings.

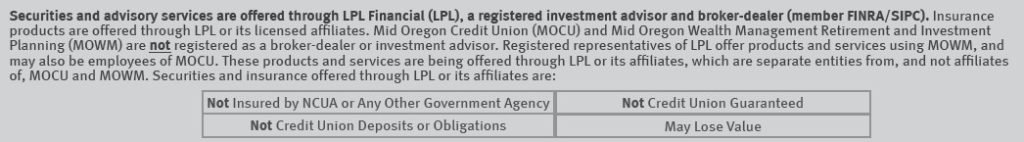

Investing for the future is a key component to a secure retirement. If you are interested in learning more about our services, please contact Marc Cabanilla, Mid Oregon Wealth Management at 541-322-5745 or m.cabanilla@lpl.com—his door is always open.

Content provided by Marc Cabanilla, Mid Oregon Wealth Management