The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

These Top Scams Are Heading Your Way

This year’s top scams are bigger and better than ever. Phishing scams hit new heights during the pandemic and show no signs of slowing down. The FBI’s Internet Crime Complaint Center (IC3) received over 2.1 million complaints from scam victims last year. The most common reports were about imposter scams, but that’s just the tip of the iceberg. The FTC finds that last year, the financial cost of these fraudulent scams was more than $3.3 billion. Most scams are preventable, and awareness is the first step to stopping them. Below are some of the top scam attacks to look out for.

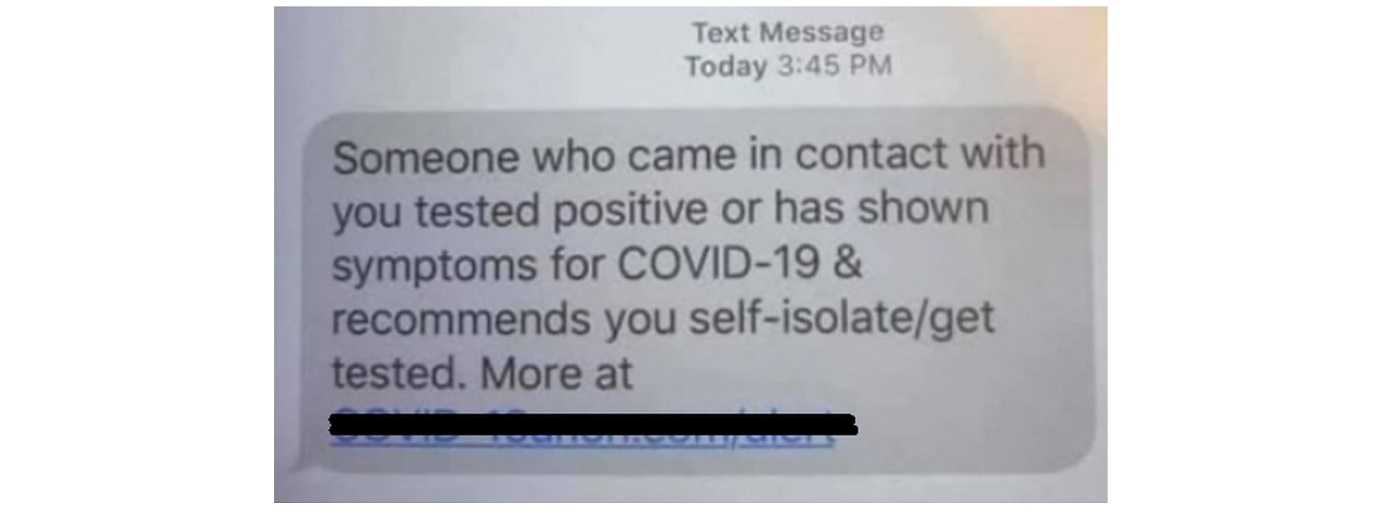

- Coronavirus scams. Still very active, fraud is the top star here. Scammers are pedaling everything from coronavirus cures to selling non-existent PPE supplies. There are bogus healthcare workers that need your personal information, Medicare and unemployment scams, and a host of other pandemic-related fraud.

- Elder Americans. Social Security and Medicare scams are leading the way. Phone calls (vishing) and actual door-to-door scammers are used to do their bidding. Top ruses have to do with alleged problems with a victim’s Social Security account or fines they need to pay or else… They demand payments through wire transfers, sending cash, gift cards, and pre-paid debit cards and other quick payments.

- Investment Scams. The lure of big returns on investments can be difficult to avoid, with scammers happy to provide new investment opportunities, especially involving cryptocurrency. Doing your homework before handing over any financial assets is key to avoiding these scams.

- Romance Scams. Affairs of the heart can be costly, including financially. The FTC shows just how costly these scams can be, with over $300 million lost last year, nearly a 50% increase over the prior year. The median broken heart cost $2,500 and maybe a lot of tears. Approach potential heart throbs with an abundance of caution no matter how convincing they are.

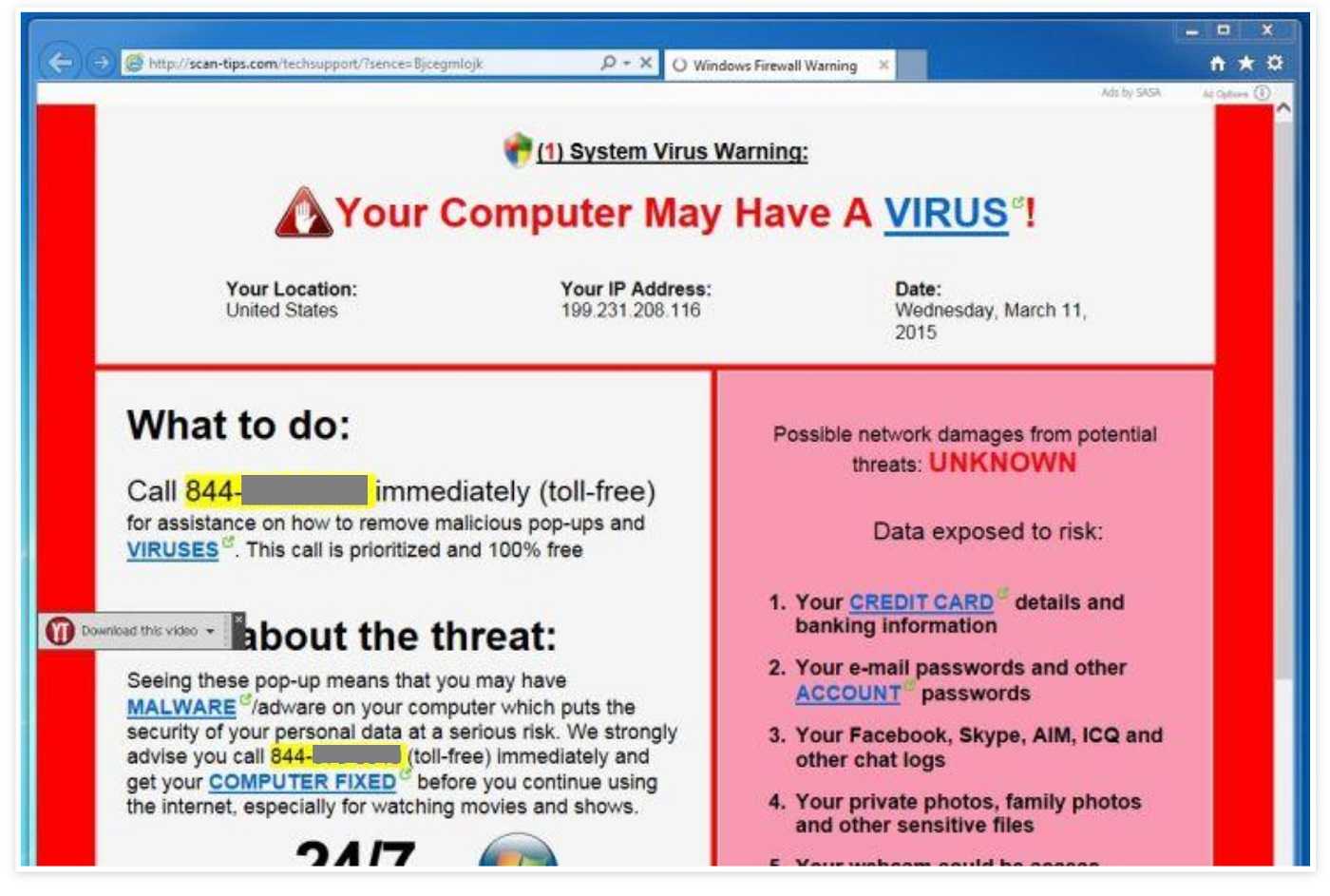

- Tech Support Scams. Beware any email phishing messages, pop-ups or phone calls warning your device is compromised or not working properly. Of course, it’s scammers behind all of them, offering their services to fix the problem. Legitimate tech support companies won’t contact you directly about device problems. What they want is access to your device and/or payment information for their so-called help.

- Delivery Scams. Americans continue to be victims of package delivery scams. Scammers use texts, phishing emails, and phone calls warning a package can’t be delivered until more information is provided. They impersonate known delivery services or retailers, all to get you to divulge personal information they can use for future scams.

- Travel Scams. Being cooped-up during the pandemic has led to an avalanche of travelers this year, as TripAdvisor confirms. Travel scams abound, from great deals on vacation destinations including plane tickets, hotel stays, and car rentals. Scammers want your personal information and payment data for vacation plans that don’t exist, but the scam is for real.

- Fake Job Openings. The FTC finds 70% more job scams in Q1 of 2020 were reported than in all of 2019. Fake job opportunities abound. Scammers tell you the job is yours, but you need to provide a host of personal information to seal the deal. Happy job winners gladly provide what scammers want, including copies of their driver’s license, banking data (for depositing your paycheck), and even passport information.

- Phishing and Smishing Impersonation Scams. Scammers find the name of an employee of well-known companies like Netflix or Amazon and pose as them. Using email phishing and texts (smishing), they target company customers with messages containing malicious links or malware-filled attachments. Acting on them gives scammers what they’re after: access to personal data, messages, contacts, and more. The FBI’s IC3 reports victims lost $57 million to phishing scams in one year.

Scam Prevention Tips

- “If it sounds too good to be true, it probably is.” These are words to live by when scammers present scenarios that seem too good to be true, like saying you’ve won a contest or gift card.

- Know the red flags of email phishing. Never respond to emails with generic greetings, misspelling, or bad grammar as they’re sure signs of a scammer. Don’t open attachments or follow links, especially if you don’t know the sender. If an email seems strange in any way, delete it and move on.

- Never give personal information, including banking data, in an email, text or unsolicited phone call. If you want to check what you’re being told is needed, type in the true company website or phone number yourself and check your account. Consider bookmarking websites for those accounts you use most often.

The Duck Race Raised Over $96,000!

19,500 ducks race down the river in Drake Park

The 2023 Great Drake Park Duck Race raised almost $100K for Central Oregon non-profits CASA, Education Foundation for Bend-La Pine Schools, Furnish Hope, MountainStar Family Relief Nursery, Neighbor Impact, Saving Grace, and Sleep in Heavenly Peace. This year marks the 34th consecutive year of local Rotary clubs, businesses and community members raising much-needed funds for local nonprofit organizations. As the Duck Race raised over $96,000, over $2 million has been raised since it began in the late 1980s.

On Sunday, September 10, thousands of the colorful ducks were excited to hit the water and show off their racing skills. Spectators eagerly awaited and cheered at the Galveston Bridge “starting line” as 19,500 plastic ducks splashed into the river, competing to be first to cross the finish line.

$5,000 cash was top prize of 21 offered

In the end, the winning bright pink duck outpaced the pack for first place earning their ticket holder the Grand Prize of $5,000 cash! The other 2023 Great Drake Park Duck prizes won included 4 Adult ’23/24 season ski passes to Hoodoo, 4 rounds of golf at Widgi Creek, 2 8-punch pickleball cards, Milwaukee 4-tool combo, Signature 1/2 carat diamond earrings, a Wanderlust tour, a TV, sound equipment, dinner with local celebrity Gary Lewis, a pizza over, and several gift cards for local businesses valued from $250 to $500.

Sponsors key as the Duck Race raised over $96,000

The Great Drake Park Duck Race is presented by local Rotary clubs and sponsored by Credit Unions Working Together (First Community, Mid Oregon, OnPoint, Oregon Community and SELCO). Because of the generosity of the title and prize sponsors, the Duck Raised raised over $96,000 that will be provided to the seven non-profit beneficiaries.

2023 prize sponsors include Bella Nuova Day Spa, Cascade Insurance Group, Century Insurance, Lewis Outdoors, Hoodoo Ski Area, Hutch’s Bicycles, Johnson Brothers Appliance, Les Schwab, Loud & Clear A/V Systems, Miller Lumber, PacificSource Medicare, PayneWest Insurance, The Pennbrook Company, RBC Wealth Management. Saxon’s Fine Jewelers, Stereo Planet, and Zivney Financial Group. Media and other sponsors include Bend Radio Group (Mix 100.7, KSJJ 102.9, Power 94, 92.9FM), The Bulletin, Cascades Business News, Central Oregon Daily, Combined Communications (99.7 The Bull, KBND, 101.7, 107.7 Gold, 98.3 The Twins, 101.7), News Channel 21, and Source Weekly. In-kind support includes Carlson Sign, Humore.us, and Sign Pro.

Keeping your children safe online

on·line safe·ty | noun

- The act of staying safe online. It encompasses all technological devices, from PCs and laptops to smartphones and tablets, which have access to the internet.

My five-year-old nephew visited me last week and I was amazed at how savvy he was at navigating my computer to watch his favorite shows. Although I found him to be very clever, it made me wonder what else he had access to and what parental controls, if any, were in place for someone so young.

How risky is it for kids to be online?

Risks to kids vary from age, gender, online exposure and other factors. This could range anywhere from online bullying to accessing inappropriate websites to sharing too much personal information. Due to the COVID restrictions in the last few years, more kids are accessing the internet for schooling, social interaction and self-entertainment. Unfortunately, this also opened a window for scammers to actively target kids online to capture their personal information for nefarious reasons. Scammers also found that kids can be a gateway to obtaining your personal information too.

Tips For Keeping your children safe online

However, there are simple ways to make them aware of the risks of online scammers. Help them build skills to avoid becoming a victim. Keep them from opening a gateway to your family’s financial security and privacy.

1. Talk openly with your child about their online activity

As soon as your child starts accessing the internet, talk to them about what they are reading, watching and who they are communicating with online. Keep the conversation going as they grow older. Ask your child what sites they visit or apps they use, write a list, and look at them together. Talk to your child about what you think is appropriate. Remind them that this may be different for other parents and their children.

Listen to your child and reach an agreement about what is right for your family. Remember the time will come when they will access the internet outside the safety of home and you want them to be prepared for that.

It’s vital to teach them about their online reputation, too, and how they must be careful about how they behave, interact with people and represent themselves in such a public forum. They must always remember that the internet isn’t private.

2. Keep screens and devices where you can see them

Always monitor your child’s time online, particularly younger children. Keep the computer in a central spot in the home. Put it where it’s easy to keep an eye on what your child is doing and viewing online. For mobile devices, you can set them to forget Wi-Fi passcodes so your children cannot go online without you knowing. You can also try to make an agreement that there are no tablets, laptops or gaming in bedrooms.

For younger children, you might also consider checking browser histories after your child has been online to see what sites they are visiting. This approach obviously gets harder as children grow older and work out how to clear histories. This is even more reason to open the lines of communication about internet use at an early age.

Use Parental Controls

3. Know your parental controls

Innocent searches online can lead to not-so-innocent results. So it’s wise to know how to use the parental controls/search restrictions offered by web browsers, internet service provider and devices. For example, the SafeSearch Filters feature on Google will block sites with explicit sexual material. To turn it on, go to Settings/SafeSearch Filters. Although not 100 per cent accurate, parental controls can help prevent your child from seeing and accessing most violent or sexual material. See https://www.internetmatters.org/parental-controls/. Paid for security tools and features will offer extra protection and control.

4. Know your children’s online friends

As adults, we know that some people online aren’t who they say they are. But children and teens can be alarming naïve about who they are chatting with. Especially if they are not taught to be cyber wise from an early age.

Make sure you become friends with contacts within your child’s social media circles and ensure you monitor posts. Your children may resist but tell them that is one of the conditions for you to allow them access.

5. Be ‘share aware’ to protect your privacy

If your child is a regular user of social networks, they must be aware of the risk of personal information or images being made public once they post it. While they won’t fully understand the consequences of revealing personal information online, you should teach them to be cautious and thoughtful about what they post and share. Encourage your children to ask themselves before posting anything if the information (i.e. name, phone number, home address, email, name of school) or photo is something they would give a stranger. If the answer is no, don’t post it.

If your child is sharing photos or posts online ask your child to let you see what they are sharing or ask an older sibling to check any photos before they’re shared.

6. Keep control of your family’s digital footprint

Every picture and personal detail that is posted and shared on social media and the internet contributes to someone’s digital footprint. The big risk with this is that once information is shared publicly, it can be used in ways you may not expect and cannot control. You should also assume that anything that is put online is permanent (it can sometimes be deleted but not always before others have seen it and saved it). For this reason, children and teens need to be smart about protecting their images and information. The same goes for parents who regularly post pictures of their children’s online.

Teach your child to stay in control of their digital footprint, by only sharing with people who they know and trust. Rather than posting to all their friends on social media, encourage them to be selective and use the privacy settings on the social media platforms they use.

Don’t Disclose Locations

7. Teach your children to keep their location private

Most apps, networks and devices have geo-tagging features which make your whereabouts public and can lead someone directly to you. These features should be turned off for obvious privacy and safety reasons. Digital photos also contain metadata (information about the time, date and GPS coordinates) which may reveal more then you want to. Some social media platforms automatically hide or remove this data, but not all, so do your homework and know how much info you’re sharing.

8. Keep track of online time

Set a time limit for daily screen time. It’s important to monitor your child’s online time, particularly younger children, to ensure they do not develop bad habits. Get your children to agree on a period of time, say 30 minutes per session, and set a timer to go off—don’t forget to make this a non-negotiable finish time. You could also switch off the home Wi-Fi at a set time each night (ideally before bedtime) so everyone has some ‘time-out’ from the internet. A good practice is to try making some days ‘screen-free’ in your home to encourage everyone to pursue other more active and/or less technology-driven ways to entertain themselves.

9. Be #SocialNetworkSavvy

Educate yourself on ways to be safe on social networks so that you can give the best advice to your children. Sign up to the social networks and apps your children are using and find out how to use the privacy settings and reporting mechanisms. Talk about how they can stay safe on social networks, including talking to a trusted person when they are worried, and being aware of what constitutes online bullying – both as a perpetrator and a victim.

If your child uses social networks, be sure they know how to:

- Report inappropriate and/or offensive posts

- Block someone

- Keep information private.

Be the Model for Your Kids

10. Lead by example

Lead by example and always model the kind of positive online behavior you would like your children to use. If they see you being cautious and respectable when you are online, they are more likely to follow in your footsteps. And, yes, this includes limiting your own screen time.

Finally, you don’t want to instill fear in your child or prevent them from experiencing the many educational, entertainment, social and other benefits of the internet, but rather to assist them in maximizing its benefits and avoid its dangers. You can accomplish this while still keeping your children safe online.

Content provided by By Laura Easterbrook, Child Protection and Forensic Medical Service