The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Let’s embrace 2024 with financial health!

Can you believe it—we are already one month into 2024! It feels like we were ringing in the New Year just yesterday, full of hope and excitement for what the next 12 months had in store for us.

Now that you have jumped into the new year with both feet firmly planted, it’s time to check on the financial plan you (hopefully) started in January.

Why is a financial plan important

A financial plan is a way to improve your financial well-being, set goals, and create a road map for a better financial future. Whether it’s saving money, paying off debt, starting an emergency fund, or investing—having a clear financial plan can give you a sense of direction and purpose.

Review your 2024 goals

Take a moment to review your financial goals. Are they relevant and achievable? If not, don’t be afraid to make adjustments. Having realistic goals in your financial plan is better than setting yourself up for failure. Tips to reach your financial objectives:

Make a savings goal

If you see a tax refund or Oregon kicker in the future, use part of that money to give yourself a head start. You can also log into Digital Banking and use the Savings Goals tool to set a goal and track your progress.

Track your spending

This may seem obvious, but it’s amazing what you discover when you start writing down all your expenses. From major purchases to treats for your four-legged pal—it’s important to write it all down.

Get a free Financial Checkup.

Mid Oregon recently introduced a powerful resource for getting a handle on your finances—Financial Checkup in Digital Banking—an empowering new addition to our My Credit Score family.

Expand your financial know-how

Take advantage of our upcoming free financial literacy workshops. We also have past workshops you can view on our YouTube channel. Additionally, our Financial Tips section on our homepage has a variety of articles on budgets, saving money, fraud prevention, and more.

Watch it grow, grow, grow

As your savings account balance grows, you’ll feel more motivated to take it even further. We have various savings products to fit your goals. Make your money work smarter, not harder.

Whatever your goals, Mid Oregon’s experienced team is here to help. 2024 is a great time to start taking control of your finances and getting fiscally fit. Stop by a branch or visit us online at midoregon.com and begin your journey to financial health.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.

Travel Smart – Your Boarding Pass And Social Media Don’t Mix

Exciting, fun, and fabulous! Those words only begin to describe the joys of an upcoming trip. Getting caught up in the whirlwind is easy and so is sharing a snapshot of your boarding pass online. Cybercriminals love finding boarding passes and itineraries posted on public platforms like social media, and what they can do with that information is, well, criminal. Nothing puts a damper on a vacation like finding your identity stolen and even worse, that you may have helped.

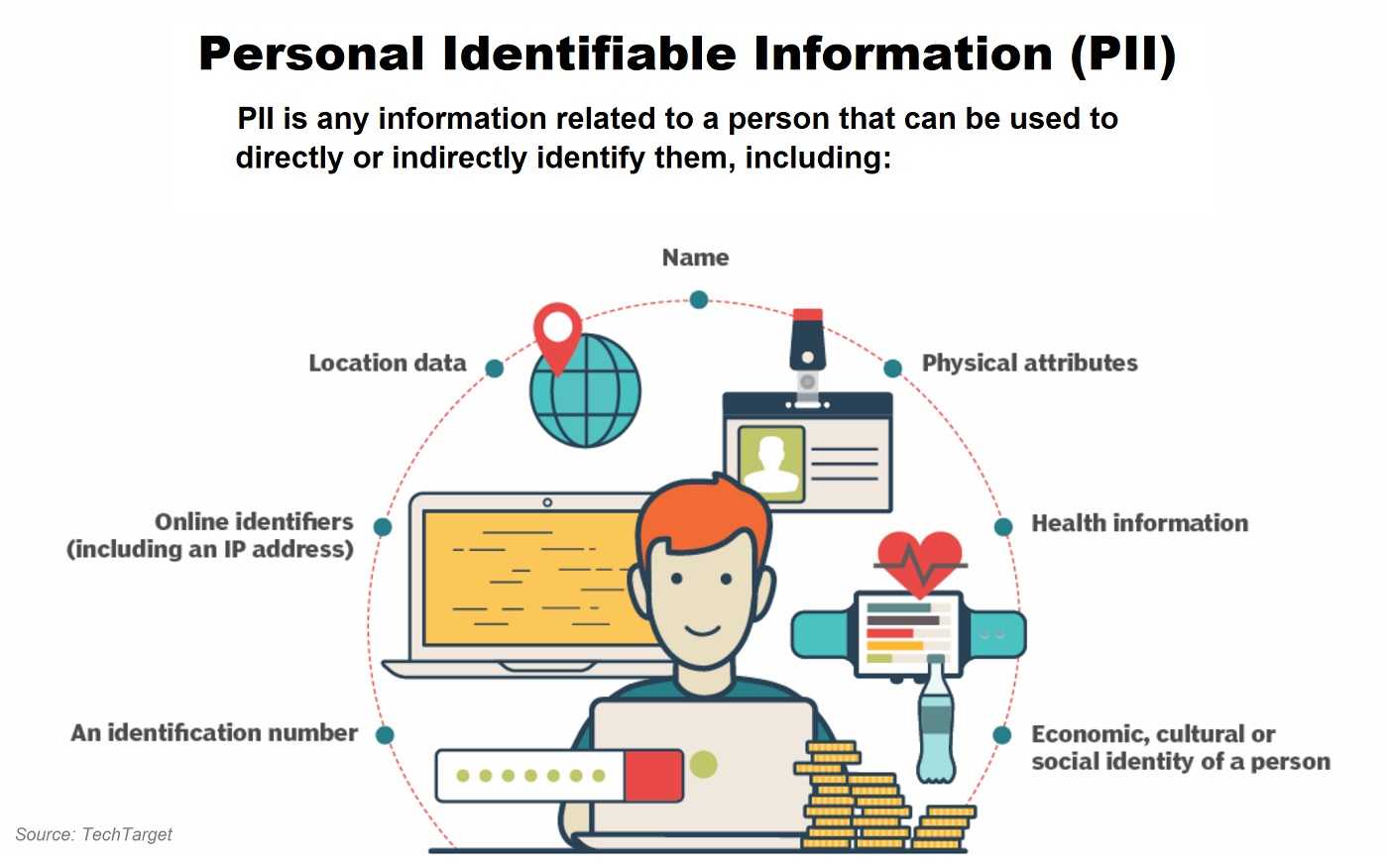

Boarding pass details enable several cybercrimes that can target you before, during, and after a trip. Your Personal Identifiable Information (PII) like legal name, address, and ticket number are all displayed and so is your passenger name record (PNR). A PNR is a six-digit numerical code representing an extensive digital file on the traveler. That file is available to a hacker who knows how to get it.

The personal data in a PNR includes all contact info (name, address, phone, email), frequent flyer and bonus miles info, travel itinerary, credit card numbers, and billing data. It’s all in a hacker’s possession thanks to posting an innocent picture of your boarding pass.

Identity Theft and Data Dynamite

Having your PNR number posted online can upend the best of travel plans. Identity theft allows a hacker to open credit and other accounts in your name, get a mortgage, or buy a new car. They can cancel or change your airline and hotel reservations and steal your travel miles and points. This happened to Hilton Honors members several years ago.

Even an email address in the wrong hands, especially when partnered with social engineering tactics, is like data dynamite. With a hacker pretending to be someone else, socially engineered phishing emails can lead to your job and employer. That connection can lead to financial fraud crimes and malware attacks like ransomware. Unfortunately, it’s not a stretch for these things to happen.

Smart Travel, Smart Vacation

Data theft is a crime with limitless opportunities and many social media posts inadvertently enable it. For travel, consider an electronic boarding pass rather than a printed one. That way leaving it in an airplane seat pocket or on the floor of the terminal won’t happen. Keep your travel itinerary off social media and other public internet spaces. It leaves a timeline of when your home will be empty and vulnerable to break-ins and a time when you may not be able to so diligently log in to check your accounts. Do your best to monitor your bank and credit accounts for unusual activity, even when traveling.

No one wants a cybercriminal going with them on vacation, so keep your travel PII where it belongs – with you.

Want to know more? Read additional Mid Oregon blog articles about online security and fraud protection.

As a reminder, Mid Oregon will never initiate a call asking for personal or account information via phone, text, or email.

Content based on an article by Stickley on Security

Ready to take control of your finances in 2024?

Amazingly, the calendar has once again turned its page, and we find ourselves standing at the threshold of a brand new year.

As 2024 begins, many of us will set resolutions to change certain aspects of our financial lives, such as saving money, reducing debt, improving our credit scores, or even funding a long-awaited home improvement project.

Fortunately, if you find yourself in need of some guidance and assistance in achieving these goals, Mid Oregon is here to help. And what better way to start taking control of your finances than by creating a financial fitness plan.

MAKE A SAVINGS GOAL

Set up a specific but realistic goal. Perhaps 2024 is the time to focus on building your nest egg for emergencies, retirement, or simply peace of mind. If you see a tax refund in your future, use part of that money to give yourself a head start. Use a savings goal calculator, such as Mid Oregon’s Savings Goals tool in Digital Banking, to see how much you’d have to save each month. Or, explore the variety of savings options Mid Oregon offers (see below). Whatever you want to save for, set a goal and then work toward reaching it.

MAKE SAVINGS A PRIORITY

Saving sufficiently for the future—whether that’s tomorrow or years from now—is crucial. From regular savings and high-yield savings accounts to share certificates, Mid Oregon offers a variety of savings options and strategies to cater to your unique needs:

- Share Certificates—Enjoy higher returns on your investments and keep your money safe and local. We have amazing rates right now so take advantage of our latest special.

- High Yield Savings Accounts—Savings account with a variable dividend rate that increases as the balance increases (minimum balance $1,000).

- IRA Accounts—Build your future and your nest egg faster with attractive rates of return and choices to fit every budget and savings goal.

- Saver’s Club Certificate—Set your goal and the amount you want to save every month. It’s ideal for saving for something special or not being caught short during the holidays.

MINIMIZING DEBT

If reducing debt is on your agenda for the year, Mid Oregon can also assist you in navigating this challenging journey. We offer a variety of loan options designed to help you consolidate your debts and manage them more efficiently. Consider applying for a home equity line of credit (HELOC) to consolidate debt or build an ADU for extra income. How about transferring your high-interest rate credit card balance and take advantage of our no balance transfer fees? By working with our knowledgeable loan officers, you can develop a customized plan to tackle your debts strategically, potentially saving you money and reducing your financial stress.

CREATE A BUDGET

A budget can feel daunting, especially if you have never done one or it has been a long time. But having a budget allows you to better control your money, instead of it controlling you. You will also feel more confident if faced with a financial setback. Begin by writing it all down—every dollar you spend. From the daily coffee, to treats for our four-legged friends and monthly subscription costs, it all adds up. Writing down all your expenses, even those that seem insignificant, is a helpful way to track your spending patterns, identify necessary expenses and prioritize the rest. You can jumpstart your budget by applying basic percentage rules:

- The 80/20 rule is one of the more simplistic rule where you use 80% of your budget for needs and wants, then save the other 20%. Rather than having a variety of categories, you simply divide your expenses and savings into these two buckets.

- The 70/20/10 rule allocates 70% monthly bills and daily spending, 20% for savings and 10% for debt payments.

- The 50/30/20 rule allocates 50% of your income toward needs (housing, transportation, utilities, groceries), 30% toward wants (eating out, streaming services, hobbies or entertainment), and 20% towards savings (emergency fund, extra debt payments)

- The 30/30/30/10 rule is another popular method you can try. This budget breaks down into 30% housing, 30% expenses, 30% debt/savings, and 10% for entertainment/fun.

MY CREDIT SCORE—YOUR MOST IMPORTANT NUMBER

Improving your credit score is another crucial aspect of financial wellness, and Mid Oregon can help you navigate this process. Many of us don’t keep track of our credit scores, but having a good score influences the type of financial options available to you—including interest rates on loans.

Mid Oregon has a free, secure option that can help you take charge of your credit. CreditSavvy (My Credit Score) on our Digital Banking platform can help you improve your score, and monitor for potential fraud. When you enroll, you receive anytime, anywhere access to your credit score. Plus, you’ll receive simple, straightforward tips that you can use to improve your score. In addition, you’ll enjoy these other features:

- Articles on ways to improve your score.

- Information on how your score compares to other consumers in your area.

- Credit Simulator Tool. Try different what-if scenarios to see how they’ll affect your score—before you make a change!

- Free credit monitoring. Sign up to receive alerts on new accounts or inquiries on your credit report.

- Special offers tailored to your good credit that can reduce your interest rates and save you money!

For those who are interested in building or repairing their credit, we off resources such as secured credit cards and credit builder loans, designed to assist in creating a positive credit profile and boosting your creditworthiness.

GET A FREE FINANCIAL CHECKUP

Mid Oregon recently introduced a powerful resource for getting a handle on your finances—Financial Checkup in Digital Banking—an empowering new addition to our My Credit Score family.

Financial Checkup takes you through an anonymous, 15-minute questionnaire to organize your information on income, debt, and expenses. Simply answer a few questions about your income and current debts. In just minutes, you will receive a thorough analysis of your financial situation, including tips by leading financial experts to help manage your debt and build a budget.

PASS ON UNNECESSARY PURCHASES

It’s easy to lose track of how much money you spend on items you do not need. It might be on sale or “fit perfectly on the table corner.” Keep in mind that these unnecessary purchases can affect your bottom line. Get disciplined by identifying your needs vs wants. Do you need the newest smartphone or do you merely want it? Think about giving yourself a 24-hour cooling-off period between the time you see an item and when you make the purchase. If you’re shopping online, consider putting the item in your shopping cart and then walking away until you’ve had more time to think it over. In some cases, you might even get a coupon code when the retailer notices you abandoned the items in your cart. Turning down something you want now may be difficult, but the reward will be greater savings later.

BECOME A FAN OF AUTOMATION

- Digital Banking to ease financial tasks, saving you time and increasing your efficiency.

- Automatic overdraft protection. In a few easy steps, you can link your savings account to your checking to have a little added cushion in the event your expenses get a bit tight.

- Automatic loan payments. Your monthly loan payment will automatically be deducted from a linked checking or savings account.

- Setting up auto pay. This is a great way to save you time, hassle and offer peace of mind knowing your bills are paid promptly every month.

- Automate your savings: Direct deposit your paycheck into multiple accounts, including one for each of your savings goals.

As we embark on another new year, it’s essential to remember that achieving your financial goals requires dedication, discipline, and sometimes, a helping hand. Mid Oregon is committed to being that helping hand for you, providing the resources, expertise, and support needed to make positive changes in your financial well-being. So, take advantage of our offerings, and let this year be the one where you turn your financial resolutions into accomplishments.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.