The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Expect more sophisticated cyberattacks in 2024

The cyberattack landscape predictions for this coming year are coming in. This time, cybercriminals are expected to up the ante making attacks like ransomware more sophisticated and effective—with AI making all attacks real wild cards.

Organizations are preparing for this year’s crop of escalated cyberattacks, and new regulations will also present a challenge for their systems. But criminals won’t stop their attacks, so keeping on top of the risks is your best bet.

CIRCIA Upfront

There’s a new law affecting all organizations who are victims of cybercrime in the U.S. Due to take effect soon is a law known as CIRCIA, or the Cyber Incident Reporting for Critical Infrastructure Act of 2022. Through required reporting, CIRCIA promotes transparency and accountability for businesses when cybercrimes occur. It also allows CISA (Cybersecurity and Infrastructure Security Agency) to identify attack trends and share that information with those benefiting from it. CISA can also use CIRCIA information to quickly help victims of attacks.

Generative AI, or GenAI (think ChatGPT)

AI continues to grow. In particular, social engineering attacks benefit from its use. With a few key words, cybercriminals can plot pointed phishing attacks on a massive scale without displaying the usual red flags of phishing like poor spelling and grammar. Deepfakes and voice cloning are other GenAI areas ripe for the picking. Overall, GenAI will make phishing and other social engineering attacks more convincing.

Ransomware

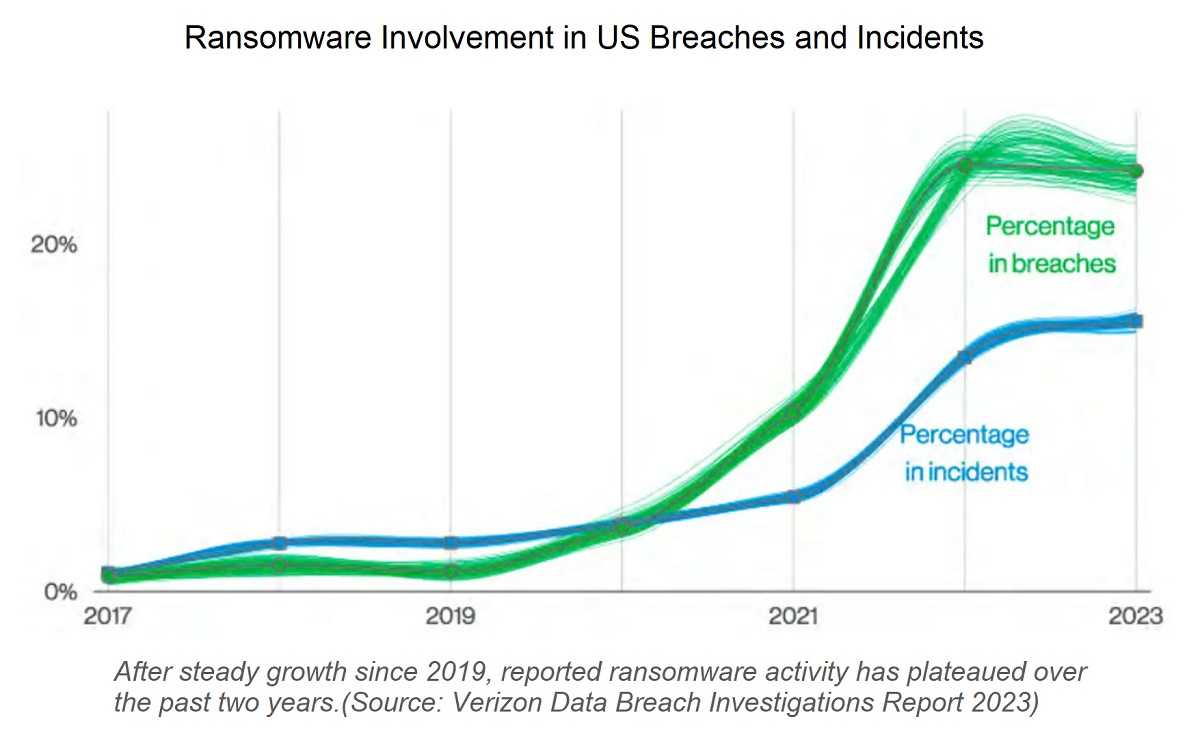

This is considered the scourge of healthcare, education, businesses, and state and city services (to name a few). Ransomware is all about cybercriminals getting ransom payments for critical data they’ve encrypted. Adding to this attack is double extortion against ransomware victims using their hijacked sensitive data. According to Verizon, ransomware was involved in 24% of all data breaches last year.

Hacking as a business is booming

With Malware as a Service (MaaS) available to rent or buy on the dark web, hackers have all they need for their cyberattack goals. Attacks by aspiring hackers and their rented malware of choice have it easy with tutorials and step-by-step instructions. Also, “hired guns” are available to do your hacking for you. It’s believed more threat groups will offer hacking as a service for the right price.

Cyber-education and Zero Trust

These are two practices businesses need more of this year. With 96% of malware delivered via email, employees of every level from bottom to top benefit from recurring cybersecurity awareness training. Zero trust for organizations means no one is trusted by default. Whether inside or outside an organization’s network, as with employees and vendors, verification is required every step of the way with system interaction.

What you can do

Always have your guard up for various attacks. Consider a zero-trust policy for yourself when it comes to providing sensitive information to anyone. Make sure the person on the other end of the phone is really who they claim to be and hold that information close until you’re sure. Pay attention to email and text messages, as well as visual voice messages. If you cannot be sure, double check. Keep all of your systems updated and install anti-virus/anti-malware software on every one of them.

Want to know more? Read additional Mid Oregon blog articles about online security and fraud protection.

As a reminder, Mid Oregon will never initiate a call asking for personal or account information via phone, text, or email.

Content based on an article by Stickley on Security

Celebrate Valentines Day without the financial stress

Valentine’s Day is a special occasion that many couples look forward to. However, it can also be a stressful time for those on a tight budget. Fortunately, there are many ways to celebrate this day without the financial headache. With a little creativity and thoughtfulness, you can plan a budget-friendly Valentine’s Day celebration that will be just as romantic and memorable as an expensive one.

Homecooked dinner

One idea to consider is cooking a romantic dinner at home. Instead of going out to an expensive restaurant, prepare a delicious meal together in the comfort of your own home. You can even set the mood by lighting candles or a fire, playing their favorite music, and dressing up for the occasion. Not only will you save money, but you’ll also have fun cooking together and enjoying each other’s company.

Romantic hike or walk

If cooking isn’t your thing, consider taking advantage of nature and going for a romantic hike or walk. Not only will you get some exercise, but you’ll also enjoy the fresh air while spending quality time with your partner. Central Oregon weather can be unpredictable, but that’s why hats and gloves were invented so don’t hesitate to venture outside.

Movie night

Another budget-friendly idea is to plan a romantic movie night at home. You can rent a favorite movie or choose one from a streaming service. This is a great way to snuggle up and spend quality time together. Pop some popcorn, grab some blankets, and enjoy a night of movie magic. You can even make it a themed night by choosing movies that reflect your relationship or your favorite memories.

Make your own gift

Lastly, you can consider making DIY gifts for your loved one. Instead of buying expensive gifts, consider making something special that comes from the heart. Whether it’s a handmade card, a personalized photo album, or a heartfelt love letter, the effort and thoughtfulness behind a DIY gift will be appreciated.

Remember, Valentine’s Day is not about how much you spend, but about sharing quality time with your significant other and showing them how much you care. So go ahead and start planning your budget-friendly Valentine’s Day celebration today!

Let’s embrace 2024 with financial health!

Can you believe it—we are already one month into 2024! It feels like we were ringing in the New Year just yesterday, full of hope and excitement for what the next 12 months had in store for us.

Now that you have jumped into the new year with both feet firmly planted, it’s time to check on the financial plan you (hopefully) started in January.

Why is a financial plan important

A financial plan is a way to improve your financial well-being, set goals, and create a road map for a better financial future. Whether it’s saving money, paying off debt, starting an emergency fund, or investing—having a clear financial plan can give you a sense of direction and purpose.

Review your 2024 goals

Take a moment to review your financial goals. Are they relevant and achievable? If not, don’t be afraid to make adjustments. Having realistic goals in your financial plan is better than setting yourself up for failure. Tips to reach your financial objectives:

Make a savings goal

If you see a tax refund or Oregon kicker in the future, use part of that money to give yourself a head start. You can also log into Digital Banking and use the Savings Goals tool to set a goal and track your progress.

Track your spending

This may seem obvious, but it’s amazing what you discover when you start writing down all your expenses. From major purchases to treats for your four-legged pal—it’s important to write it all down.

Get a free Financial Checkup.

Mid Oregon recently introduced a powerful resource for getting a handle on your finances—Financial Checkup in Digital Banking—an empowering new addition to our My Credit Score family.

Expand your financial know-how

Take advantage of our upcoming free financial literacy workshops. We also have past workshops you can view on our YouTube channel. Additionally, our Financial Tips section on our homepage has a variety of articles on budgets, saving money, fraud prevention, and more.

Watch it grow, grow, grow

As your savings account balance grows, you’ll feel more motivated to take it even further. We have various savings products to fit your goals. Make your money work smarter, not harder.

Whatever your goals, Mid Oregon’s experienced team is here to help. 2024 is a great time to start taking control of your finances and getting fiscally fit. Stop by a branch or visit us online at midoregon.com and begin your journey to financial health.

Want to know more? Read additional Mid Oregon blog articles about goals, budgeting, and debt consolidation.