The Bottom Line

Small business is important to Central Oregon, and to Mid Oregon. Find tips and resources for business, and information about Mid Oregon’s commercial services and business members.

Improving Your Financial Health 2025

Don’t blink! Another year has come and gone. Now might be the perfect time to review your financial goals with an eye on improving your financial health for 2025. Many of us will set resolutions around our financial lives, such as saving money, reducing debt, improving credit scores, or funding a large purchase. At Mid Oregon you have access to all the tools you need to manage your finances no matter your situation.

Creating a Budget

Having a budget allows you to better control your money. But many feel daunted by the idea of creating a budget for themselves. Writing down your expenses not only helps you to track your spending patterns, it can identify ways for you to avoid unnecessary spending. For most, once you’ve created a budget, you begin to feel more in control of your financial future.

Begin by writing it all down; your daily coffee, subscriptions, utilities, etc… Even those expenses that seem insignificant to you. Identify the necessary expenses, then prioritize the rest. Try applying the following basic percentage rules:

- The 80/20: One of the simpler rules your can use starts with using 80% of your budget for needs and wants, then save the other 20%. Rather than having a variety of categories, you simply divide you expenses and savings into these two buckets.

- The 70/20/10: This rule starts out by allocating 70% of your monthly bills and daily spending, 20% for saving and 10% for debt payments.

- The 50/30/20: This rule divides your income, allocating 50% to needs (housing, transportation, utilities, groceries), 30% toward wants (eating out, streaming services, hobbies or entertainment), and 20% toward savings.

- The 30/30/30/10: This rule is another popular method that breaks your budget down into 30% for housing, 30% for expenses, 30% debt/savings, and 10% for entertainment/fun.

Using the Financial Checkup feature with Mid Oregon’s digital banking takes about 10-15 minutes and gives you a 360-degree view of your spending. You can continue to monitor your spending throughout the year. With the charts and graphs that show you where you are spending money month to month you can track how you are doing with your budget.

Make Savings a Priority

Perhaps 2025 is the time to focus on building your nest egg for emergencies, retirement, or simply peace of mind. Use a savings goal calculator, such as Mid Oregon’s Savings Goals tool in Digital Banking, to see how much you’d have to save each month. If you see a tax refund in your future, use part of that money to give yourself a head start. You’ve heard it before, “pay yourself first”. It may sound cliché but it’s true. Setting aside 20% of your paycheck before you even see it is a great way to begin. In addition to adding automatic transfers to savings, Mid Oregon offers a variety of savings options and strategies to cater to your unique needs:

- Share Certificates—Enjoy higher returns on your investments and keep your money safe and local. We have amazing rates right now so take advantage of our latest special.

- High Yield Savings Accounts—Savings account with a variable dividend rate that increases as the balance increases (minimum balance $1,000).

- IRA Accounts—Build your future and your nest egg faster with attractive rates of return and choices to fit every budget and savings goal.

- Saver’s Club Certificate—Set your goal and the amount you want to save every month. It’s ideal for saving for something special or not being caught short during the holidays.

Work on Minimizing Debt

If reducing debt is on your agenda for the year, Mid Oregon can also assist you in navigating this challenging journey. We offer a variety of loan options designed to help you consolidate your debts and manage them more efficiently. Consider applying for a home equity line of credit (HELOC) to consolidate debt or build an ADU for extra income. How about transferring your high-interest rate credit card balance and take advantage of our no balance transfer fees?

The Most Important Number, Your Credit Score

Improving your credit score is another crucial aspect of financial wellness, and Mid Oregon can help you navigate this process. Many of us don’t keep track of our credit scores, but having a good score influences the type of financial options available to you—including interest rates on loans.

Mid Oregon has a free, secure option that can help you take charge of your credit. Credit Savvy (My Credit Score) on our Digital Banking platform can help you improve your score, and monitor for potential fraud. When you enroll, you receive anytime, anywhere access to your credit score. Plus, you’ll receive simple, straightforward tips that you can use to improve your score. In addition, you’ll enjoy these other features:

- Articles on ways to improve your score.

- Information on how your score compares to other consumers in your area.

- Credit Simulator Tool. Try different what-if scenarios to see how they’ll affect your score—before you make a change!

- Free credit monitoring. Sign up to receive alerts on new accounts or inquiries on your credit report.

- Special offers tailored to your good credit that can reduce your interest rates and save you money!

For those who are interested in building or repairing their credit, we off resources such as secured credit cards and credit builder loans, designed to assist in creating a positive credit profile and boosting your creditworthiness.

Do You Really Need It?!

It’s easy to lose track of how much money you spend on items you do not need. It might be on sale or “fit perfectly on the table corner.” Keep in mind that these unnecessary purchases can affect your bottom line. Get disciplined by identifying your needs vs wants. Do you need the newest smartphone or do you merely want it? Think about giving yourself a 24-hour cooling-off period between the time you see an item and when you make the purchase. If you’re shopping online, consider putting the item in your shopping cart and then walking away until you’ve had more time to think it over. In some cases, you might even get a coupon code when the retailer notices you abandoned the items in your cart. Turning down something you want now may be difficult, but the reward will be greater savings later.

Automating Routine Banking Tasks

- Digital Banking to ease financial tasks, saving you time and increasing your efficiency.

- Automatic overdraft protection. In a few easy steps, you can link your savings account to your checking to have a little added cushion in the event your expenses get a bit tight.

- Automatic loan payments. Your monthly loan payment will automatically be deducted from a linked checking or savings account.

- Setting up auto pay. This is a great way to save you time, hassle and offer peace of mind knowing your bills are paid promptly every month.

- Automate your savings: Direct deposit your paycheck into multiple accounts, including one for each of your savings goals.

As we embark on another new year, it’s essential to remember that achieving your financial goals requires dedication, discipline, and sometimes, a helping hand. Mid Oregon is committed to being that helping hand for you, providing the resources, expertise, and support needed to make positive changes in your financial well-being. So, take advantage of our offerings, and let this year be the one where you turn your financial resolutions into accomplishments.

Regardless of your financial situation, your Mid Oregon team is here to help you every step of the way—please stop by, call, or visit us online at midoregon.com. We also encourage you to stay tuned to future member newsletters, blogs, and workshops for more financial fitness topics.

We hope you find the above tips helpful as you wrap up 2025 and move forward with your financial future.

And remember, it’s progress not perfection.

How to Stay Safe and Avoid Password Fatigue

Most of us know that password fatigue can lead to security mishaps and that creating a safe and secure entrance into our personal or work accounts can be a real challenge. Fortunately, security experts also know that safe password use has long been a problem, one that can lead to epic malware infections like ransomware, banking trojans, and more.

RedLine Stealer Malware

Popular browsers like Chrome, Firefox, Safari, and Opera offer the option to store passwords for you, but hackers using the malware RedLine Stealer can hijack those stored passwords in a heartbeat.

Looking deeper into RedLine Stealer shows that the malware is capable of stealing more than passwords from browsers. Even though browsers encrypt what they store, RedLine can decrypt it. This info-stealing trojan takes more data such as usernames, credit cards, cookies, FTP credentials, and files if they also are stored in the browser. RedLine Stealer also downloads and runs other malware, takes screenshots of active Windows’ screens, and executes additional commands. In short, RedLine hijacks every bit of data stored in a browser.

Security experts note RedLine also sneaks past anti-virus solutions, making it nearly impossible to prevent infections. It doesn’t help that this malware is readily available on hacker websites like 2easy and others. Apparently, half the stolen data sold on 2easy is there thanks to Redline Stealer’s, well…stealing. Experts also saw evidence of spam campaigns using website contact forms and discussion forums and a host of other lures that download and install RedLine.

Adding to RedLine’s success is that it exploits a substantial security gap for password-storing browsers that is yet to be acknowledged and fixed. And since that day isn’t today, browser password storage remains a convenient but very risky road to take.

How to Avoid RedLine and other Password Stealing Malware

Rather than store your passwords in the browser, consider another solution to remember them. Writing them down with the old-fashioned pen and paper and storing them securely is one option. Another is using clues to trigger your memory. But if you want to use a password manager, use caution.

Password managers are an alternative to having a browser store them. They keep usernames, passwords and other guarded data like credit card info that is encrypted and in theory is safe. But most also have a master password that if stolen, gives up all the usernames and passwords they store. Think “keeping all your eggs in one basket.” Be sure to shop around, as password manager providers offer different services at differing prices. Use MFA (multi-factor authentication) to secure your password manager. Even if a hacker gets hold of the password, they won’t have the required MFA to abuse it.

Alternative Password Storage

Alternative methods to password managers are giving users a way to authenticate their identity without relying on passwords at all. They include using alternate options like a smartphone, hardware token, one-time passwords (OTP), or a biometric measure like a fingerprint. Many mobile devices use this already. However, those are coming our way in the future for our laptops and desktops. For now, it’s best to find another option besides storing them in browsers.

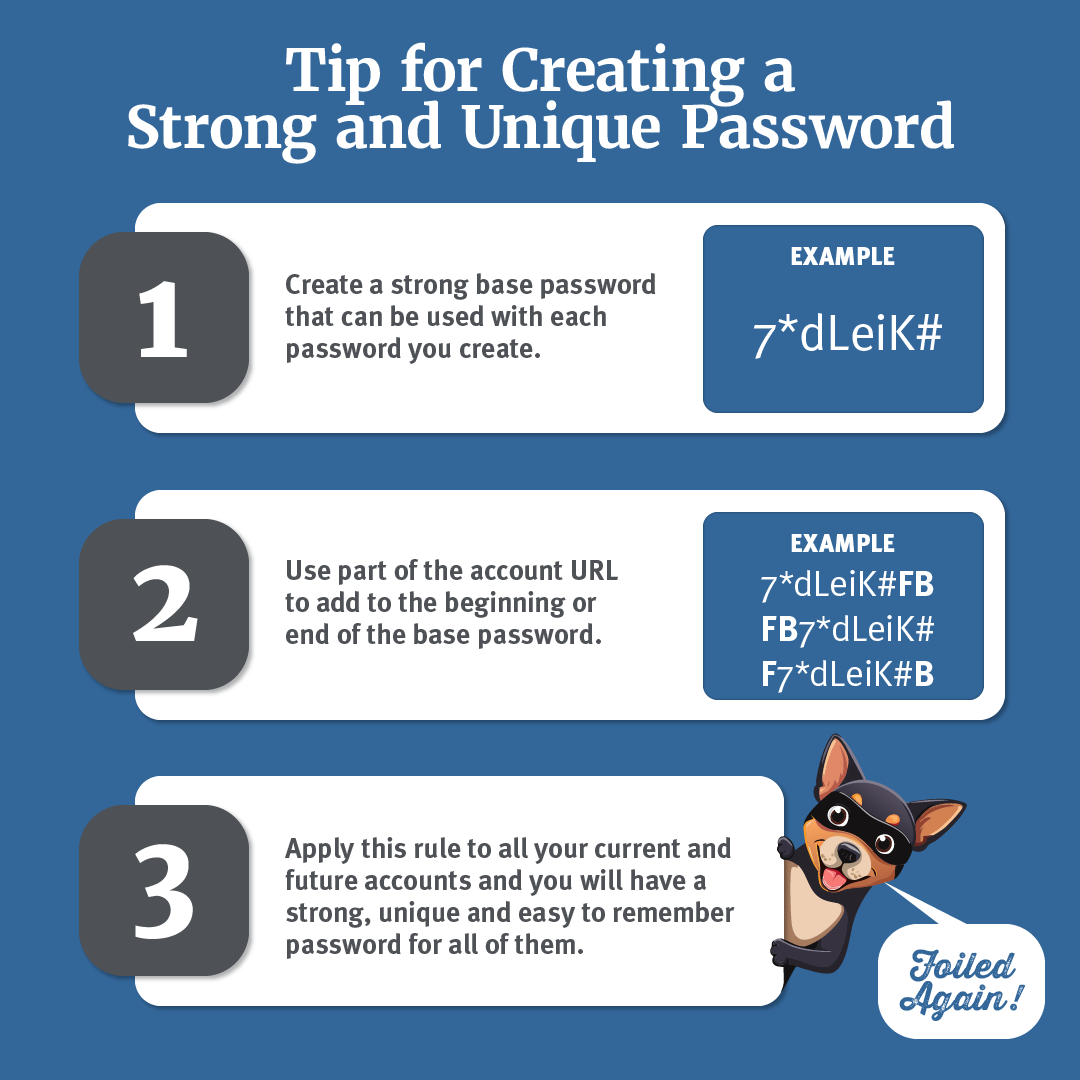

A Simple Way to Create Unique and Easy To Remember Passwords

The folks at Stickley Security suggest a quick and easy way to create a secure password to help avoid password fatigue. First create a strong base password. Use a number, lower case and uppercase letters and a special character (!#$%*;). For example: 89!ApikT. This ‘core’ or base password can be used in combination with a part of the URL for the account you are creating a password for.

Combine the URL with the base password and create a secure, unique combination that will be easy for you to remember. For example a password for facebook could be: fb89!ApikT or 89!ApikTfb. Anyway you combine it, you’ll be able to remember it.

Mid Oregon provides a valuable resource for enhancing your online security. We invite you to explore our Stickley on Security section within the Security and Fraud Center. This platform offers timely articles covering a range of digital security topics, along with informative videos. Additionally, you can subscribe to receive news and alerts via email, ensuring you stay informed with the latest updates to keep your financial accounts secure in the digital landscape.

Read additional blog articles on cyber security and fraud.

As a reminder, Mid Oregon will never initiate a call asking for personal or account information via phone, text, or email.

Visa Gift Cards Convenience!

Convenient & Flexible

We are almost at the last minute, when we can’t find the right gift, don’t have time to shop or when we don’t know what a person wants. Visa Gift cards remain an extremely popular gift choice. Mid Oregon Visa Gift Cards convenience can help you give that perfect gift without stressing out trying to find it.

A Mid Oregon Visa Gift Card can also be the tool that allows you to hold to your spending plan. By loading our Visa Gift Cards with your budget amount(s), you can limit your spending, and still have a great gift.

Shopping Flexibility

Mid Oregon Visa Cards can be used almost everywhere Visa cards are accepted in Central Oregon, and at millions of places around the world-including retail and online merchants as well as mail and phone orders. The only exclusions are gas stations, ATMs, hotels, car rentals and airline reservations. It has all the protection and security features you expect from a Visa Card.

Gift Visa Card recipients can go on-line to view transactions or update personal information. Lost or stolen cards are replaceable with the unused money still available, unlike cash. There is no disruption with your debit card and checking account, or hassle with your credit cards.

Great For Children, Too!

Mid Oregon Visa Gift Cards can also help young people with their Christmas giving. You can get each child a card with their Holiday gift giving money loaded and help them learn about sticking to a plan, how to use a card and have the safety of not losing cash.

Even those teenagers with whom your are helping learn money management with their own Mid Oregon Simply Free Checking account and debit card can benefit. Removing overspending temptations and reducing the risk are values for all of us.

How the Mid Oregon Visa Gift Card Works

Members can visit any Mid Oregon branch and buy Visa Gift Cards from one of our tellers. Activation of your cards happen within 24 hours, There is a one time cost of $3 per card, and the card will not expire for up to five years. There are no monthly maintenance fees unless the card is unused for 12 months. There is a minimum amount of $10 loaded onto the card, and a maximum of $1,000. Replacement cards are handled through the convenient Visa customer service center, and there is a modest fee to replace the card. More details are available at any Mid Oregon branch.

To purchase Mid Oregon Visa Cards a non Mid Oregon member would need to join the credit union. Details on joining are available on our website or by contacting us as per above.